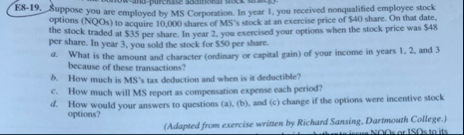

Question: ES - 1 9 . Suppose you are employed by MS Corporation. In year 1 . you received nonqualified employee stock options ( NQO s

ES Suppose you are employed by MS Corporation. In year you received nonqualified employee stock options NQO s to acquire shares of MS ss stock at an exercise price of $ share. On that date, the stock traded at $ per share. In year yoe exercised your options when the stock price was $ per share. In year you sold the stock for $ per share.

a What is the amount and character ordinary or capital gain of your income in years and because of these transactions?

b How much is MSs tax deduction and when is it deductible?

c How much will MS report as compensation expense each period?

d How would your answers to questions ab and c change if the options were incentive stock options?

Adapted from exercise written by Richand Sansing, Dartmouth College.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock