Question: A company wants to build a new 800 MW natural gas power plant. The capital cost of the plant is $2 billion. The project

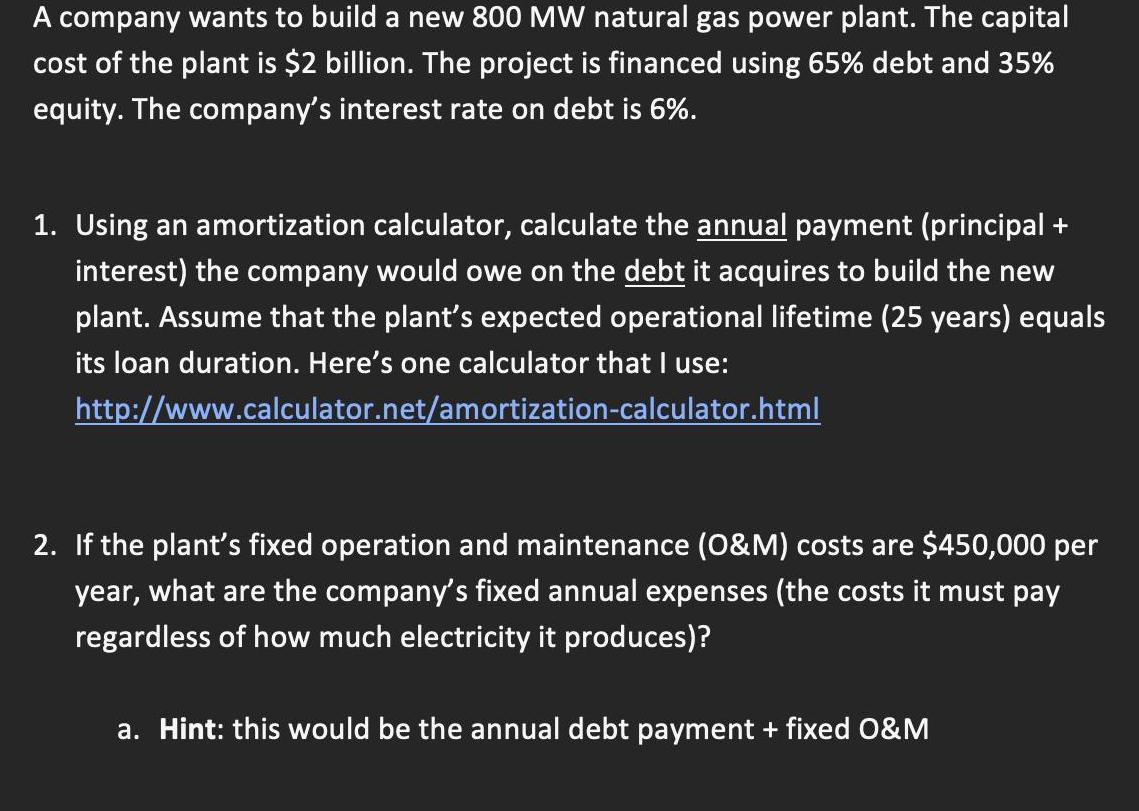

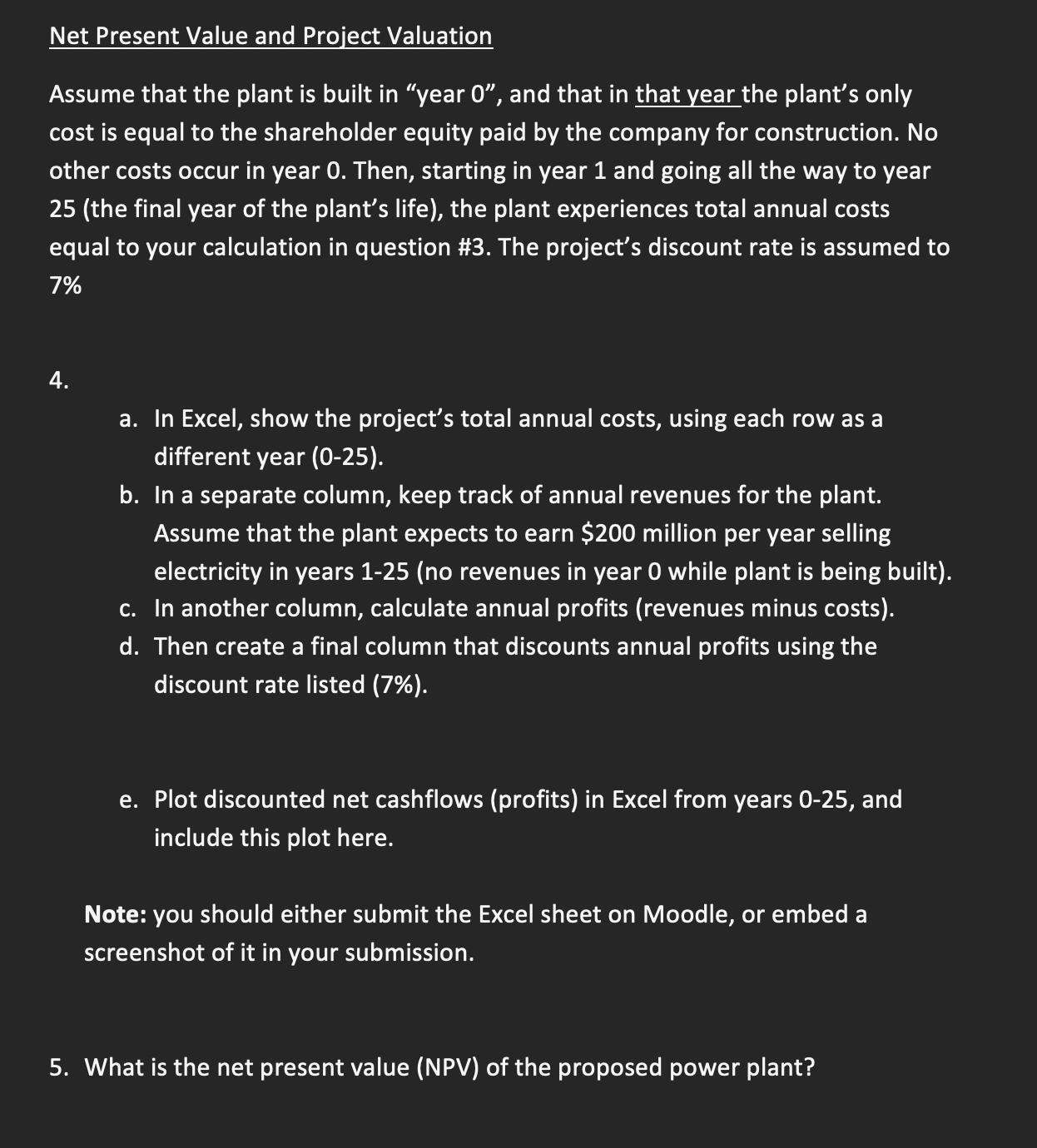

A company wants to build a new 800 MW natural gas power plant. The capital cost of the plant is $2 billion. The project is financed using 65% debt and 35% equity. The company's interest rate on debt is 6%. 1. Using an amortization calculator, calculate the annual payment (principal + interest) the company would owe on the debt it acquires to build the new plant. Assume that the plant's expected operational lifetime (25 years) equals its loan duration. Here's one calculator that I use: http://www.calculator.net/amortization-calculator.html 2. If the plant's fixed operation and maintenance (O&M) costs are $450,000 per year, what are the company's fixed annual expenses (the costs it must pay regardless of how much electricity it produces)? a. Hint: this would be the annual debt payment + fixed O&M Net Present Value and Project Valuation Assume that the plant is built in "year 0", and that in that year the plant's only cost is equal to the shareholder equity paid by the company for construction. No other costs occur in year O. Then, starting in year 1 and going all the way to year 25 (the final year of the plant's life), the plant experiences total annual costs equal to your calculation in question #3. The project's discount rate is assumed to 7% 4. a. In Excel, show the project's total annual costs, using each row as a different year (0-25). b. In a separate column, keep track of annual revenues for the plant. Assume that the plant expects to earn $200 million per year selling electricity in years 1-25 (no revenues in year 0 while plant is being built). c. In another column, calculate annual profits (revenues minus costs). d. Then create a final column that discounts annual profits using the discount rate listed (7%). e. Plot discounted net cashflows (profits) in Excel from years 0-25, and include this plot here. Note: you should either submit the Excel sheet on Moodle, or embed a screenshot of it in your submission. 5. What is the net present value (NPV) of the proposed power plant? 6. Based on its NPV, should the plant be built?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts