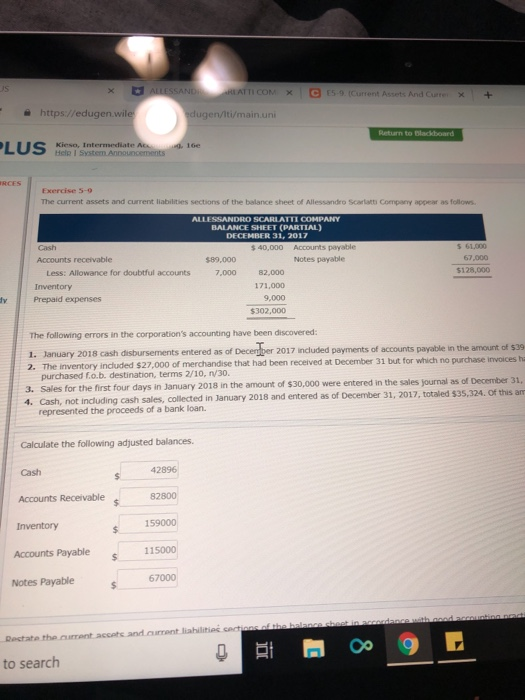

Question: ES-9 (Curront Assets Ard Curre - + https://edugen wile dugen/iti/main.uni Kieso, Intermediate lGe The current assets and current liabilities sections of the balance sheet of

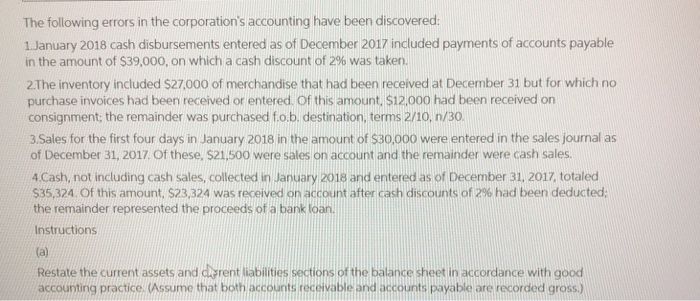

ES-9 (Curront Assets Ard Curre - + https://edugen wile dugen/iti/main.uni Kieso, Intermediate lGe The current assets and current liabilities sections of the balance sheet of Allessandro Scarlatti Company appear as follows ALLESSANDRO SCARLA BALANCE SHEET (PARTIAL) DECEMBER 31, 2017 Accounts payable Notes payable s 61,000 67,000 $128,000 $89,000 Less: Allowance for doubtful accounts Inventory 7,000 82,000 171,000 9,000 $302,000 Prepaid expenses The following errors in the corporation's accounting have been discovered 2. The inventory 3. Sales for the first four days in January of $30,000 were lanuary 2018 cash dsbursements entered as of Decerber 2017 Indluded payments of purchased fob destination, terms 2/10, n30. accounts payable in the amount of s39 included $27,000 of merchandise that had been received at December 31 but for which no purchase invoices ha ry 2018 in the amount of $30,000 were entered in the sales yournal as of December 31, 4. Cash, not induding cash sales, collected in January 2018 and entered as of December 31, 2017, totaled $35,324. of this an represented the proceeds of a bank loan. Calculate the following adjusted balances. Cash Accounts Receivable s 42896 82800 159000 Accounts Payable s 115000 67000 Notes Payable to search The following errors in the corporation's accounting have been discovered 1 January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of S39.000, on which a cash discount of 2% was taken. 2 The inventory included $27.00o of merchandise that had been received at December 31 but for which no purchase invoices had been received or entered. Of this amount, $12.000 had been received on consignment, the remainder was purchased fo.b destination, terms 2/10, n/30 3.Sales for the first four days in January 2018 in the amount of $30,000 were entered in the sales journal as of December 31, 2017. Of these, $21,500 were sales on account and the remainder were cash sales 4 Cash, not including cash sales, collected in January 2018 and entered as of December 31, 2017, totaled $35,324. Of this amount, S23324 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan. Instructions Restate the current assets and digrent liabilities sections of the balance sheet in accordance with good accounting practice Assume that both accounts receivable and accounts payable are recorded gross)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts