Question: especially looking for b) c) and d) written calculations would be appreciated a. If your firm's project is all equity financed, estimate its cost of

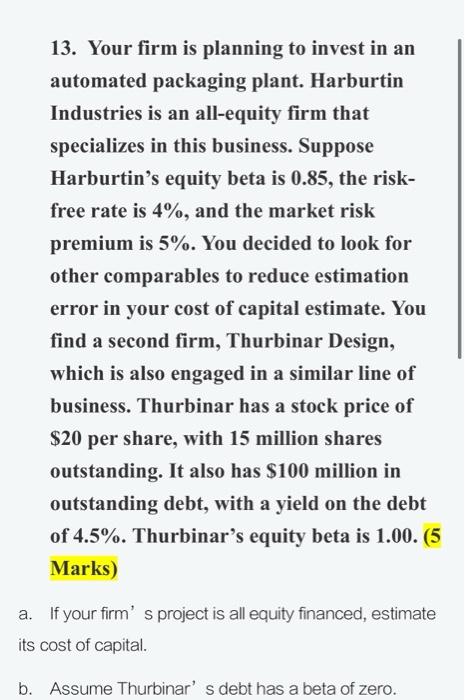

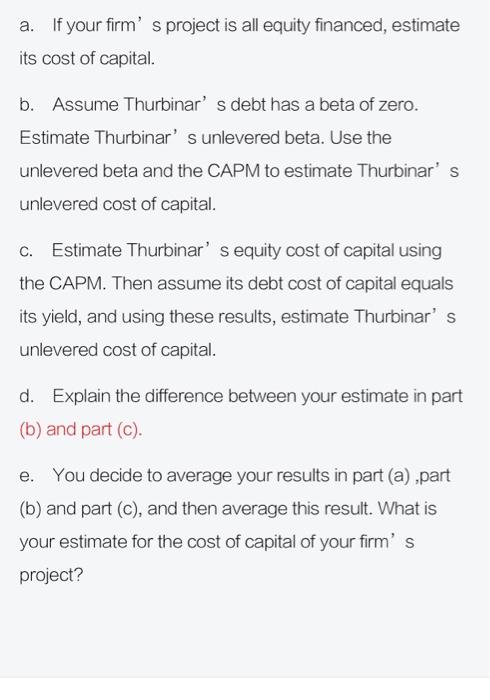

a. If your firm's project is all equity financed, estimate its cost of capital. b. Assume Thurbinar's debt has a beta of zero. Estimate Thurbinar' s unlevered beta. Use the unlevered beta and the CAPM to estimate Thurbinar's unlevered cost of capital. C. Estimate Thurbinar's equity cost of capital using the CAPM. Then assume its debt cost of capital equals its yield, and using these results, estimate Thurbinar's unlevered cost of capital. d. Explain the difference between your estimate in part (b) and part (c). e. You decide to average your results in part (a),part (b) and part (c), and then average this result. What is your estimate for the cost of capital of your firm's project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts