Question: Esquire Incorporated uses the LIFO method to report its inventory. Inventory at the beginning of the year was $780,000 (39,000 units at $20 each).

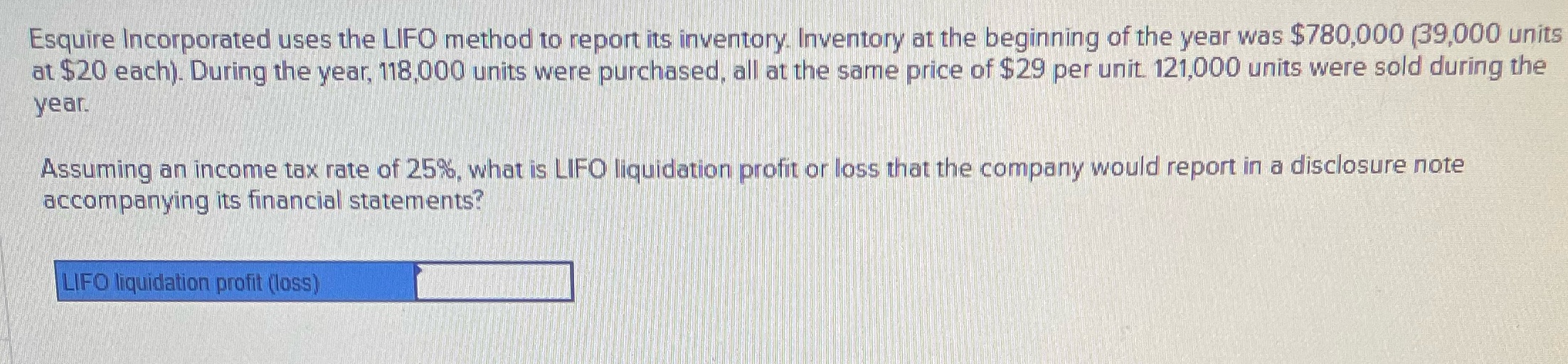

Esquire Incorporated uses the LIFO method to report its inventory. Inventory at the beginning of the year was $780,000 (39,000 units at $20 each). During the year, 118,000 units were purchased, all at the same price of $29 per unit. 121,000 units were sold during the year. Assuming an income tax rate of 25%, what is LIFO liquidation profit or loss that the company would report in a disclosure note accompanying its financial statements? LIFO liquidation profit (loss)

Step by Step Solution

There are 3 Steps involved in it

To calculate the LIFO liquidation profit or loss we need to determine the cost of goods sold COGS un... View full answer

Get step-by-step solutions from verified subject matter experts