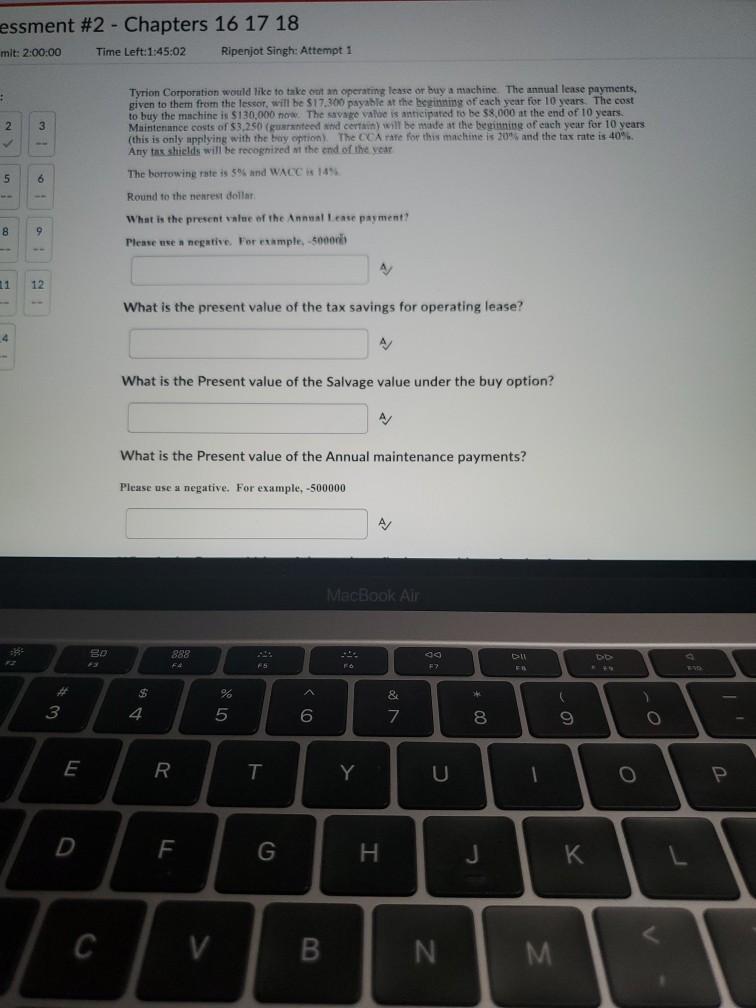

Question: essment #2 - Chapters 16 17 18 mit: 2:00:00 Time Left:1:45:02 Ripenjot Singh: Attempt 1 . 2 3 Tyrion Corporation would like to take out

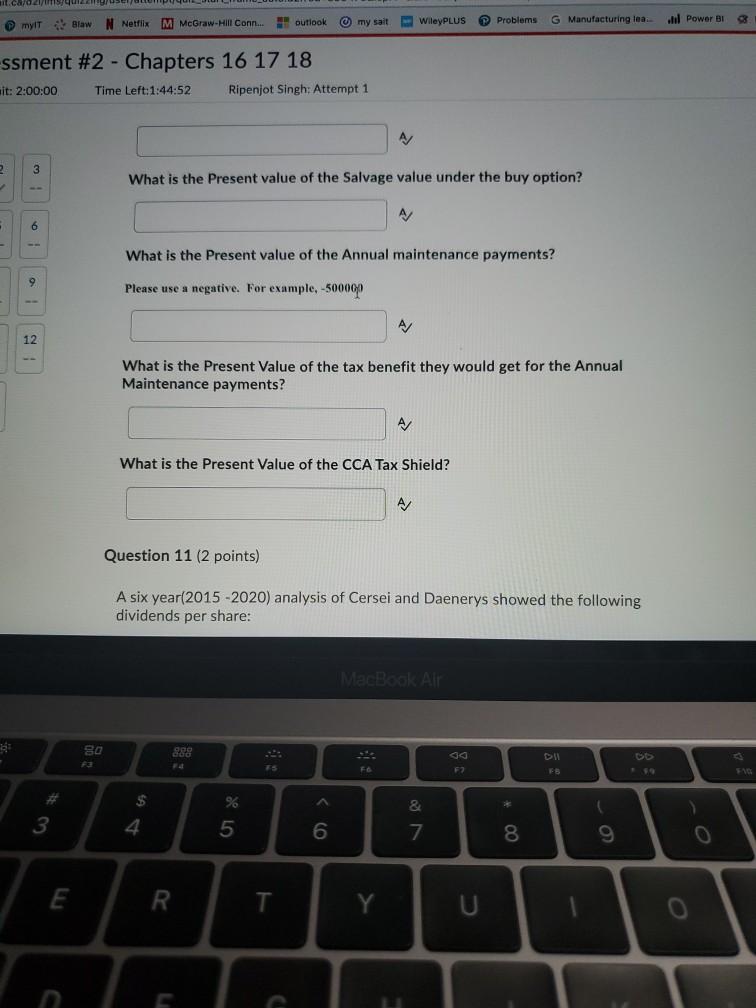

essment #2 - Chapters 16 17 18 mit: 2:00:00 Time Left:1:45:02 Ripenjot Singh: Attempt 1 . 2 3 Tyrion Corporation would like to take out an operating lease or buy a machine. The annual lease payments, given to them from the lessor, will be $17.300 payable at the beginning of each year for 10 years. The cost to buy the machine is $130,000 now. The savage value is anticipated to be 58.000 at the end of 10 years Maintenance costs of 3.250 guaranteed and certain will be made at the beginning of each year for 10 years with the )is Any tax shields will be recoghired at the end of the year 5 6 The borrowing rate is 56 and WACCR 14% Round to the nearest dollar 8 9 What is the present value of the Annual Lease payment? Please use a negative. For example, sorb 11 12 What is the present value of the tax savings for operating lease? 4 A/ What is the Present value of the Salvage value under the buy option? A/ What is the Present value of the Annual maintenance payments? Please use a negative. For example, -500000 A/ MacBook Air 888 F DO . FS FO F2 A % 5 3 4 & 7 6 8 9 E R T Y 1 F G J K V B N M . N Netflix M McGraw-Hill Conn... outlook myit Blaw my sait Problems WileyPLUS G Manufacturing lea. il Power BI ssment #2 - Chapters 16 17 18 it: 2:00:00 Time Left:1:44:52 Ripenjot Singh: Attempt 1 A/ 2 3 What is the Present value of the Salvage value under the buy option? A/ 6 What is the Present value of the Annual maintenance payments? Please use a negative. For example, -500000 12. What is the Present Value of the tax benefit they would get for the Annual Maintenance payments? A What is the Present Value of the CCA Tax Shield? A/ Question 11 (2 points) A six year(2015-2020) analysis of Cersei and Daenerys showed the following dividends per share: MacBook Air 80 988 ES F F? $ C 3 % 5 4 6 & 7 8 9 E R T essment #2 - Chapters 16 17 18 mit: 2:00:00 Time Left:1:45:02 Ripenjot Singh: Attempt 1 . 2 3 Tyrion Corporation would like to take out an operating lease or buy a machine. The annual lease payments, given to them from the lessor, will be $17.300 payable at the beginning of each year for 10 years. The cost to buy the machine is $130,000 now. The savage value is anticipated to be 58.000 at the end of 10 years Maintenance costs of 3.250 guaranteed and certain will be made at the beginning of each year for 10 years with the )is Any tax shields will be recoghired at the end of the year 5 6 The borrowing rate is 56 and WACCR 14% Round to the nearest dollar 8 9 What is the present value of the Annual Lease payment? Please use a negative. For example, sorb 11 12 What is the present value of the tax savings for operating lease? 4 A/ What is the Present value of the Salvage value under the buy option? A/ What is the Present value of the Annual maintenance payments? Please use a negative. For example, -500000 A/ MacBook Air 888 F DO . FS FO F2 A % 5 3 4 & 7 6 8 9 E R T Y 1 F G J K V B N M . N Netflix M McGraw-Hill Conn... outlook myit Blaw my sait Problems WileyPLUS G Manufacturing lea. il Power BI ssment #2 - Chapters 16 17 18 it: 2:00:00 Time Left:1:44:52 Ripenjot Singh: Attempt 1 A/ 2 3 What is the Present value of the Salvage value under the buy option? A/ 6 What is the Present value of the Annual maintenance payments? Please use a negative. For example, -500000 12. What is the Present Value of the tax benefit they would get for the Annual Maintenance payments? A What is the Present Value of the CCA Tax Shield? A/ Question 11 (2 points) A six year(2015-2020) analysis of Cersei and Daenerys showed the following dividends per share: MacBook Air 80 988 ES F F? $ C 3 % 5 4 6 & 7 8 9 E R T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts