Question: est: Test 2 (Chapters 14-16) Time Remaining:00417.48 Suom is Question: 1 pt 25 of 40 (23 complete) This Test: 40 pts pos 0% 70 shares

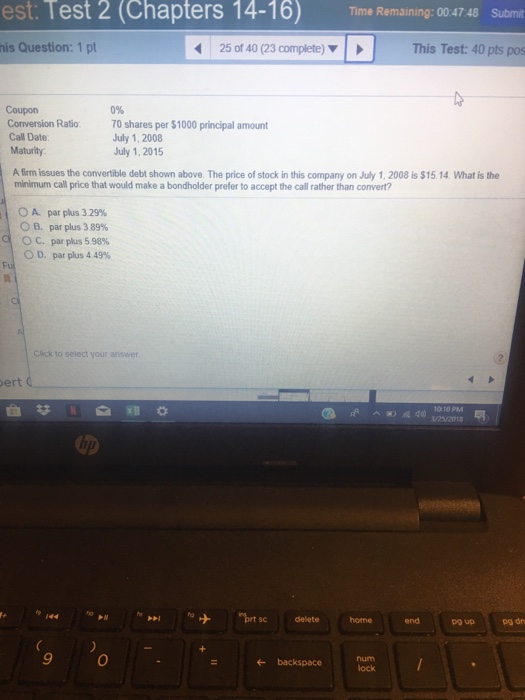

est: Test 2 (Chapters 14-16) Time Remaining:00417.48 Suom is Question: 1 pt 25 of 40 (23 complete) This Test: 40 pts pos 0% 70 shares per $1000 principal amount July 1, 2008 July 1, 2015 Coupon Conversion Ratio Call Date Maturity A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $15.14 What is the minimum call price that would make a bondholder prefer to accept the call rather than convert? O A. par plus 329% 0 B. par plus 3 89% oc, par plus 598% OD. par plus 4 49% Click to select your answer ert C 10 10 PM end 9 num lock backspace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts