Question: estate planning, All true or false PLEASE ANSWER AS MANY AS POSSIBLY Morgan is considered a gift from 25. Lyle established a revocable trust six

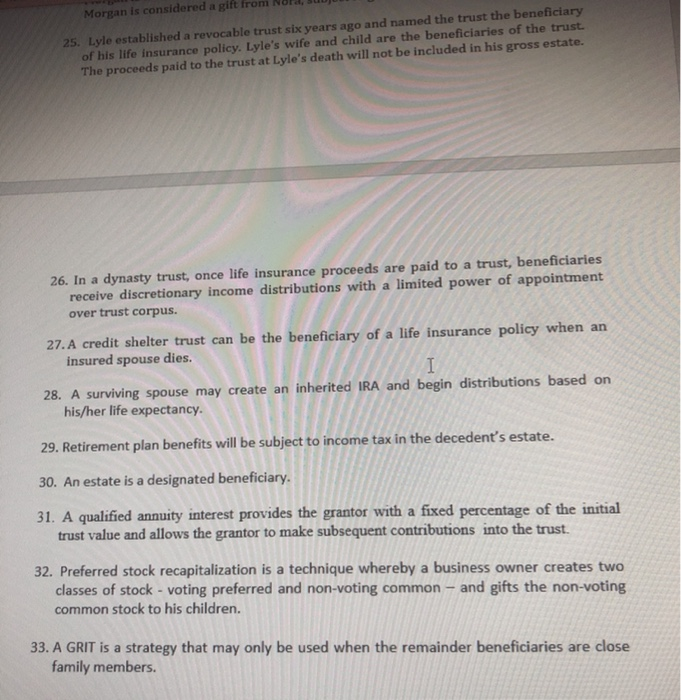

Morgan is considered a gift from 25. Lyle established a revocable trust six years ago and named the trust the beneficiary of his life insurance policy. Lyle's wife and child are the beneficiaries of the trust. The proceeds paid to the trust at Lyle's death will not be included in his gross estate. 26. In a dynasty trust, once life insurance proceeds are paid to a trust, beneficiaries receive discretionary income distributions with a limited power of appointment over trust corpus. 27. A credit shelter trust can be the beneficiary of a life insurance policy when an insured spouse dies. I 28. A surviving spouse may create an inherited IRA and begin distributions based on his/her life expectancy. 29. Retirement plan benefits will be subject to income tax in the decedent's estate. 30. An estate is a designated beneficiary. 31. A qualified annuity interest provides the grantor with a fixed percentage of the initial trust value and allows the grantor to make subsequent contributions into the trust. 32. Preferred stock recapitalization is a technique whereby a business owner creates two classes of stock - voting preferred and non-voting common - and gifts the non-voting common stock to his children. 33. A GRIT is a strategy that may only be used when the remainder beneficiaries are close family members

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts