Question: Estates Construction Inc. contracted to build a high-rise apartment complex for a fixed price of $12,640,000. Construction began on April 25, 2021. Construction of the

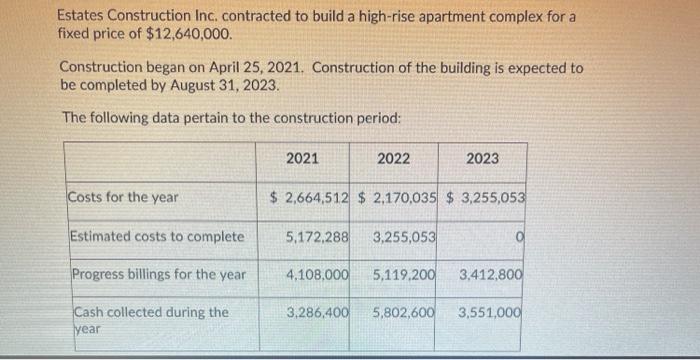

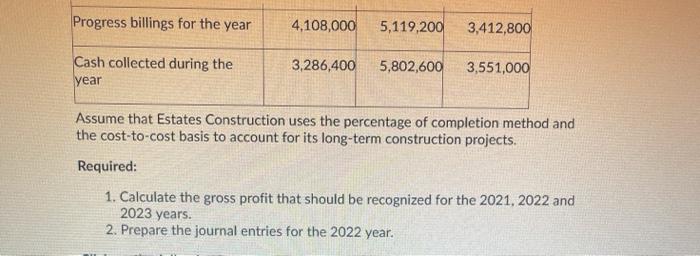

Estates Construction Inc. contracted to build a high-rise apartment complex for a fixed price of $12,640,000. Construction began on April 25, 2021. Construction of the building is expected to be completed by August 31, 2023. The following data pertain to the construction period: 2021 2022 2023 Costs for the year $ 2,664,512 $ 2,170,035 $ 3,255,053 Estimated costs to complete 5,172,288 3,255,053 Progress billings for the year 4,108,000 5,119,200 3,412,800 3,286,400 Cash collected during the year 5,802,600 3,551,000 Progress billings for the year 4,108,000 5,119,200 3,412,800 Cash collected during the year 3,286,400 5,802,600 3,551,000 Assume that Estates Construction uses the percentage of completion method and the cost-to-cost basis to account for its long-term construction projects. Required: 1. Calculate the gross profit that should be recognized for the 2021, 2022 and 2023 years. 2. Prepare the journal entries for the 2022 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts