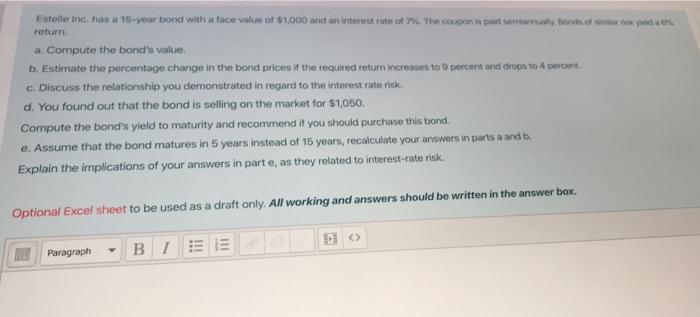

Question: Estello Inc, has a 15-year bond with a face value of $1,000 and an interest rate of the company is paid a Montserrike return a.

Estello Inc, has a 15-year bond with a face value of $1,000 and an interest rate of the company is paid a Montserrike return a. Compute the bond's value. b. Estimate the percentage change in the bond prices if the required return increases to percent and drop to 4 percent c. Discuss the relationship you demonstrated in regard to the interest rate risk d. You found out that the bond is selling on the market for $1,050. Compute the bond's yield to maturity and recommend if you should purchase this bond. e. Assume that the bond matures in 5 years instead of 15 years, recalculate your answers in parts a and b. Explain the implications of your answers in parte, as they related to interest-rate risk Optional Excel sheet to be used as a craft only. All working and answers should be written in the answer box. Paragraph BIELE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts