Question: Estett tto - - - - Table for Nex) When x SO - The Whi - - - - t e 17. Suppose that the

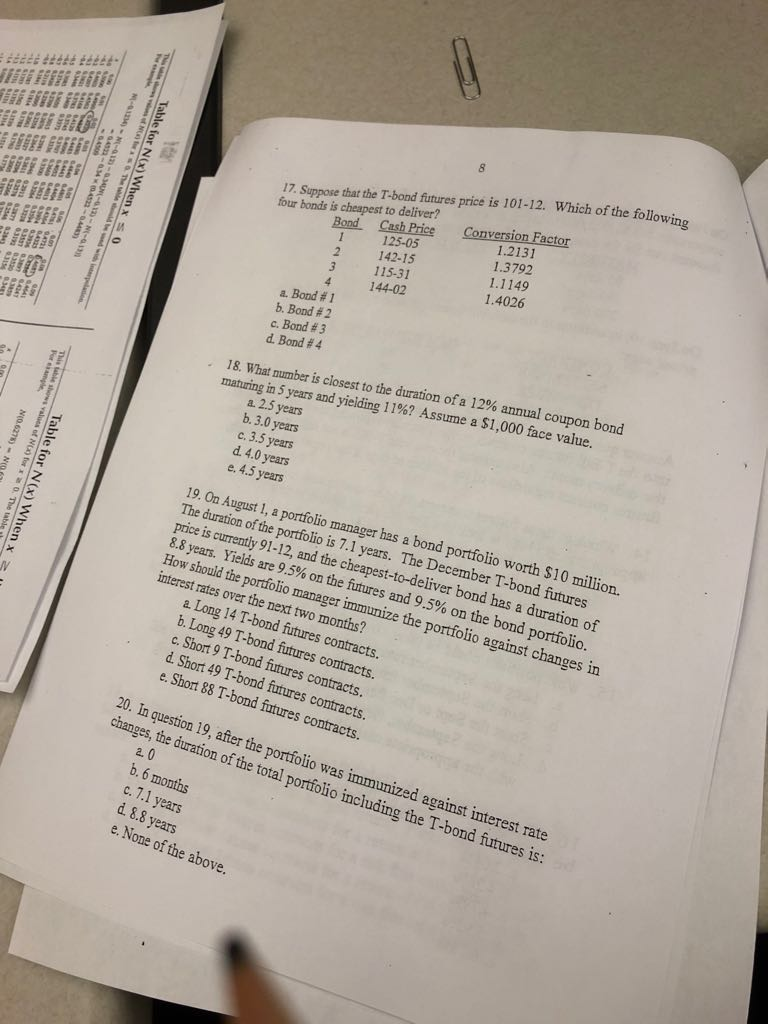

Estett tto - - - - Table for Nex) When x SO - The Whi - - - - t e 17. Suppose that the T-bond futures price is 101-12. Which of the followinn four bonds is cheapest to deliver? Bond Cash Price Conversion Factor 125-05 1.2131 142-15 1.3792 115-31 1.1149 144-02 a. Bond #1 1.4026 b. Bond # 2 c. Bond #3 This thesis of N106278) - NO tex . The table Table for N(x) When x SI d. Bond #4 18. What number is closest to the duration of a 12% annual coupon bond maturing in 5 years and yielding 11%? Assume a $1,000 face value. a. 2.5 years b. 3.0 years c. 3.5 years d. 4.0 years e. 4.5 years 19. On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio is 7.1 years. The December T-bond futures price is currently 91-12, and the cheapest-to-deliver bond has a duration of 8.8 vears. Yields are 9.5% on the futures and 9.5% on the bond portfolio. How should the portfolio manager immunize the portfolio against changes in interest rates over the next two months? a. Long 14 T-bond futures contracts. b. Long 49 T-bond futures contracts. c. Short 9 T-bond futures contracts. d. Short 49 T-bond futures contracts. e. Short 88 T-bond futures contracts. 20. In question 19, after the portfolio was immunized against interest rate changes, the duration of the total portfolio including the T-bond futures is: 2.0 b. 6 months c. 7.1 years d. 8.8 years e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts