Question: Estimate Future Interest Rates Using the Yield Curve t You can calculate the yield curve, given inflation and maturity-related risks. Looking at the yield curve,

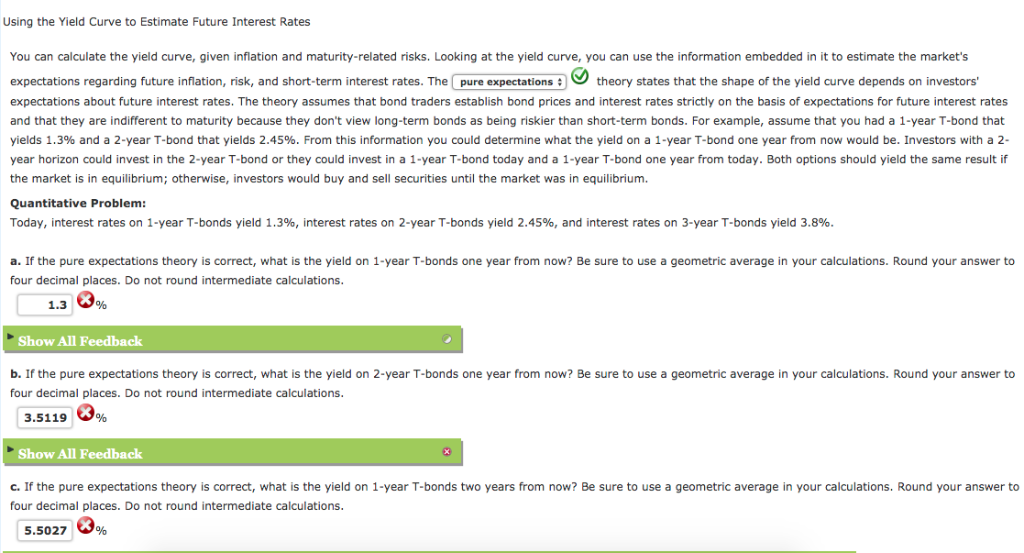

Estimate Future Interest Rates Using the Yield Curve t You can calculate the yield curve, given inflation and maturity-related risks. Looking at the yield curve, you can use the information embedded in it to estimate the market's expectations regarding future inflation, risk, and short-term interest rates. The pure expectations theory states that the shape of the yield curve depends on investors expectations about future interest rates. The theory assumes that bond traders establish bond prices and interest rates strictly on the basis of expectations for future interest rates and that they are indifferent to maturity because they don't view long-term bonds as being riskier than short-term bonds. For example, assume that you had a 1-year T-bond that yields 1.3% and a 2-year T-bond that yields 2.45%. From this information you could determine what the yield on a 1-year T-bond one year from now would be. Investors with a 2- year horizon could invest in the 2-year T-bond or they could invest in a 1-year T-bond today and a 1-year T-bond one year from today. Both options should yield the same result if equilibrium. the market is in equilibrium; otherwise, investors would buy and sell securities until the market was Quantitative Problem Today, interest rates on 1-year T-bonds yield 1.3%, interest rates on 2-year T-bonds yield 2.45%, and interest rates on 3-year T-bonds yield 3.8% a. If the pure expectations theory is correct, what is the yield on 1-year T-bonds one year from now? Be sure to use a geometric average your calculations. Round your answer to four decimal places. Do not round intermediate calculations. 1.3 6 Show All Feedback b. If the pure expectations theory is correct, what is the yield on 2-year T-bonds one year from now? Be sure to use a geometric average nyour calculations. Round your answer to four decimal places. Do not round intermediate calculations. 3.5119 0% Show All Feedback c. If the pure expectations theory is correct, what is the yield on 1-year T-bonds two years from now? Be sure to use a geometric average in your calculations. Round your answer to four decimal places. Do not round intermediate calculations. 5.5027

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts