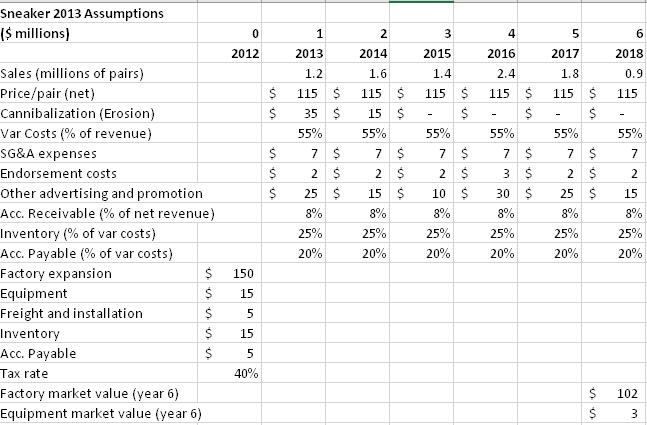

Question: Estimate the incremental cash flows for Sneaker 2013 project. Estimate the projects payback period, net present value, and internal rate of return. (Use excel template

- Estimate the incremental cash flows for Sneaker 2013 project. Estimate the projects payback period, net present value, and internal rate of return. (Use excel template posted)

2. Estimate the incremental cash flows for Persistence project. Estimate the projects payback period, net present value, and internal rate of return. (Use excel template posted)

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{15}{|l|}{ Sneaker 2013 Assumptions } \\ \hline \multirow[t]{2}{*}{ (\$ millions) } & & 0 & & 1 & & 2 & & 3 & & 4 & & 5 & & 6 \\ \hline & & 2012 & & 2013 & & 2014 & & 2015 & & 2016 & & 2017 & & 2018 \\ \hline Sales (millions of pairs) & & & & 1.2 & & 1.6 & & 1.4 & & 2.4 & & 1.8 & & 0.9 \\ \hline Price/pair (net) & & & $ & 115 & $ & 115 & $ & 115 & $ & 115 & $ & 115 & $ & 115 \\ \hline Cannibalization (Erosion) & & & $ & 35 & $ & 15 & $ & - & $ & - & $ & - & $ & - \\ \hline Var Costs ( % of revenue) & & & & 55% & & 55% & & 55% & & 55% & & 55% & & 55% \\ \hline SG\&A expenses & & & $ & 7 & $ & 7 & $ & 7 & $ & 7 & $ & 7 & $ & 7 \\ \hline Endorsement costs & & & $ & 2 & $ & 2 & $ & 2 & $ & 3 & $ & 2 & $ & 2 \\ \hline \multicolumn{3}{|l|}{ Other advertising and promotion } & $ & 25 & $ & 15 & $ & 10 & $ & 30 & $ & 25 & $ & 15 \\ \hline \multicolumn{3}{|c|}{ Acc. Receivable ( % of net revenue) } & & 8% & & 8% & & 8% & & 8% & & 8% & & 8% \\ \hline Inventory ( % of var costs) & & & & 25% & & 25% & & 25% & & 25% & & 25% & & 25% \\ \hline Acc. Payable ( % of var costs) & & & & 20% & & 20% & & 20% & & 20% & & 20% & & 20% \\ \hline Factory expansion & $ & 150 & & & & & & & & & & & & \\ \hline Equipment & $ & 15 & & & & & & & & & & & & \\ \hline Freight and installation & $ & 5 & & & & & & & & & & & & \\ \hline Inventory & $ & 15 & & & & & & & & & & & & \\ \hline Acc. Payable & $ & 5 & & & & & & & & & & & & \\ \hline Tax rate & & 40% & & & & & & & & & & & & \\ \hline Factory market value (year 6) & & & & & & & & & & & & & $ & 102 \\ \hline \multicolumn{3}{|l|}{ Equipment market value (year 6 ) } & & & & & & & & & & & $ & 3 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{15}{|l|}{ Sneaker 2013 Assumptions } \\ \hline \multirow[t]{2}{*}{ (\$ millions) } & & 0 & & 1 & & 2 & & 3 & & 4 & & 5 & & 6 \\ \hline & & 2012 & & 2013 & & 2014 & & 2015 & & 2016 & & 2017 & & 2018 \\ \hline Sales (millions of pairs) & & & & 1.2 & & 1.6 & & 1.4 & & 2.4 & & 1.8 & & 0.9 \\ \hline Price/pair (net) & & & $ & 115 & $ & 115 & $ & 115 & $ & 115 & $ & 115 & $ & 115 \\ \hline Cannibalization (Erosion) & & & $ & 35 & $ & 15 & $ & - & $ & - & $ & - & $ & - \\ \hline Var Costs ( % of revenue) & & & & 55% & & 55% & & 55% & & 55% & & 55% & & 55% \\ \hline SG\&A expenses & & & $ & 7 & $ & 7 & $ & 7 & $ & 7 & $ & 7 & $ & 7 \\ \hline Endorsement costs & & & $ & 2 & $ & 2 & $ & 2 & $ & 3 & $ & 2 & $ & 2 \\ \hline \multicolumn{3}{|l|}{ Other advertising and promotion } & $ & 25 & $ & 15 & $ & 10 & $ & 30 & $ & 25 & $ & 15 \\ \hline \multicolumn{3}{|c|}{ Acc. Receivable ( % of net revenue) } & & 8% & & 8% & & 8% & & 8% & & 8% & & 8% \\ \hline Inventory ( % of var costs) & & & & 25% & & 25% & & 25% & & 25% & & 25% & & 25% \\ \hline Acc. Payable ( % of var costs) & & & & 20% & & 20% & & 20% & & 20% & & 20% & & 20% \\ \hline Factory expansion & $ & 150 & & & & & & & & & & & & \\ \hline Equipment & $ & 15 & & & & & & & & & & & & \\ \hline Freight and installation & $ & 5 & & & & & & & & & & & & \\ \hline Inventory & $ & 15 & & & & & & & & & & & & \\ \hline Acc. Payable & $ & 5 & & & & & & & & & & & & \\ \hline Tax rate & & 40% & & & & & & & & & & & & \\ \hline Factory market value (year 6) & & & & & & & & & & & & & $ & 102 \\ \hline \multicolumn{3}{|l|}{ Equipment market value (year 6 ) } & & & & & & & & & & & $ & 3 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts