Question: Estimate the optimal hedge ratio using regression analysis using close price data from the beginning of the sample period until July 5, 2024. Use price

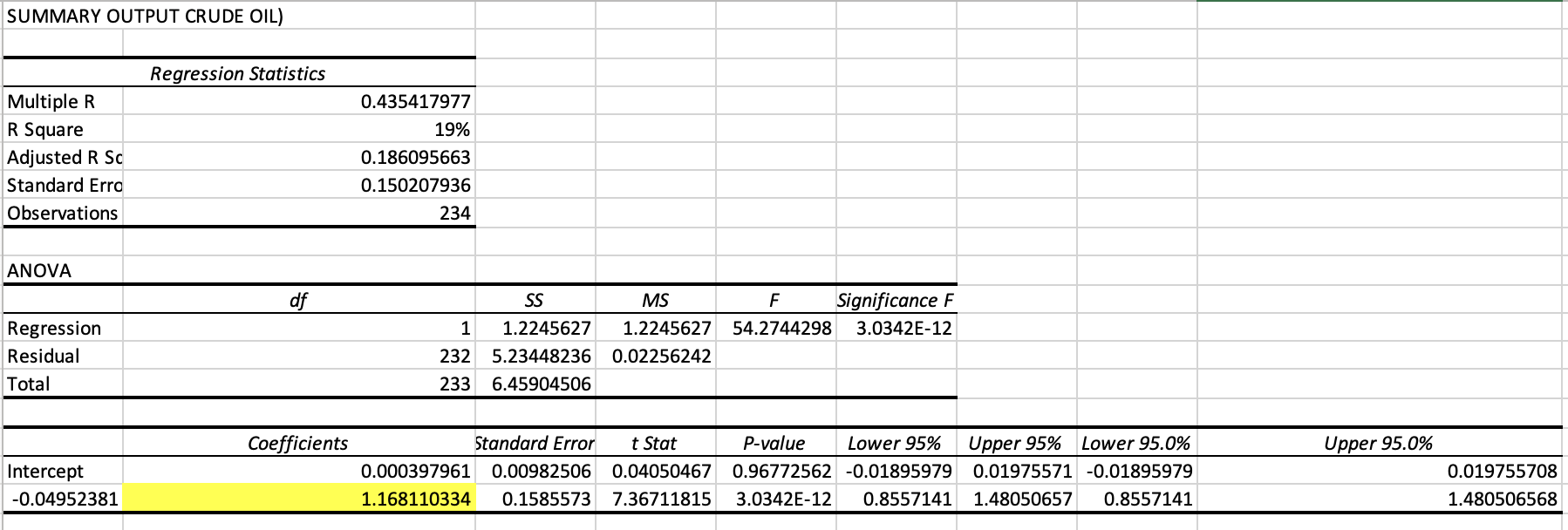

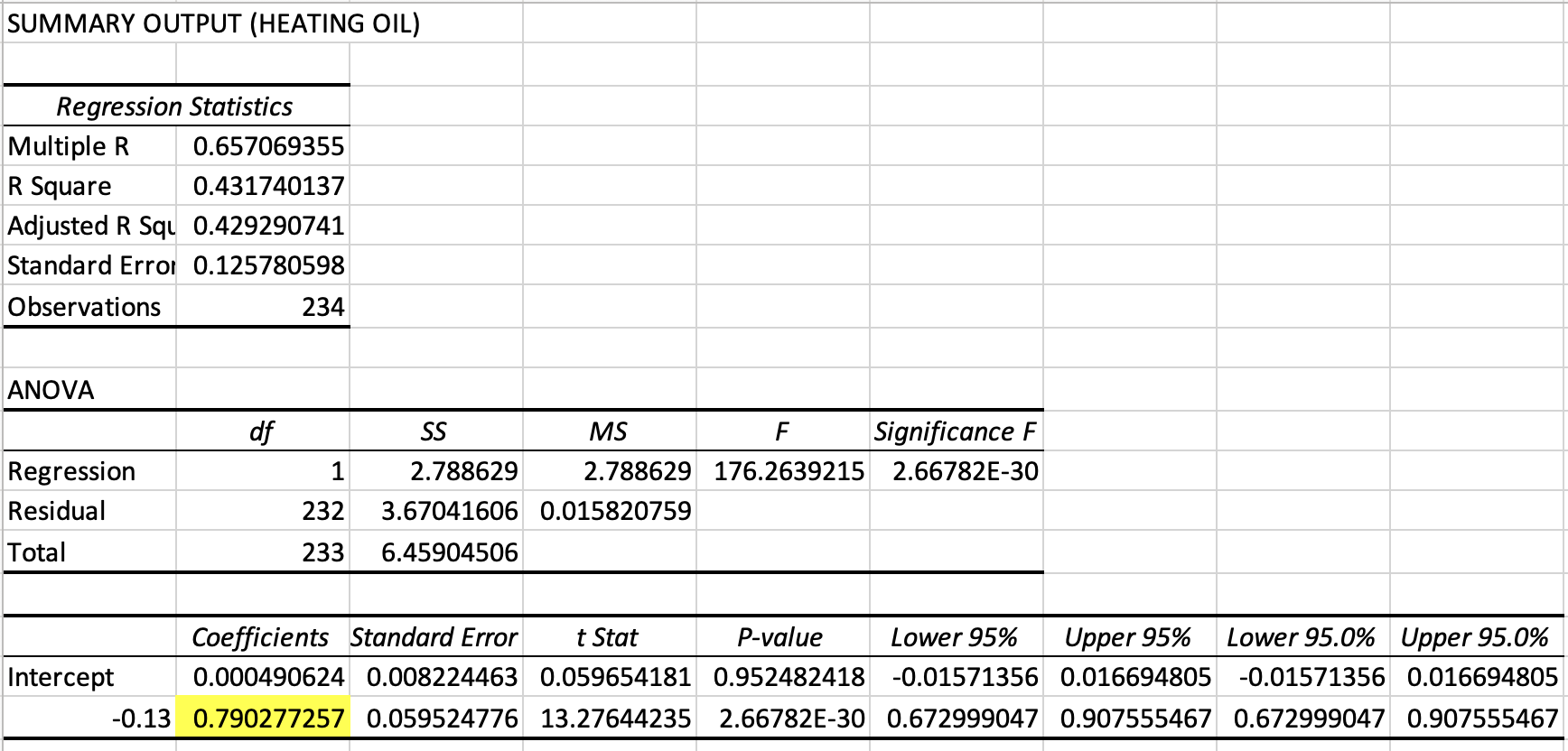

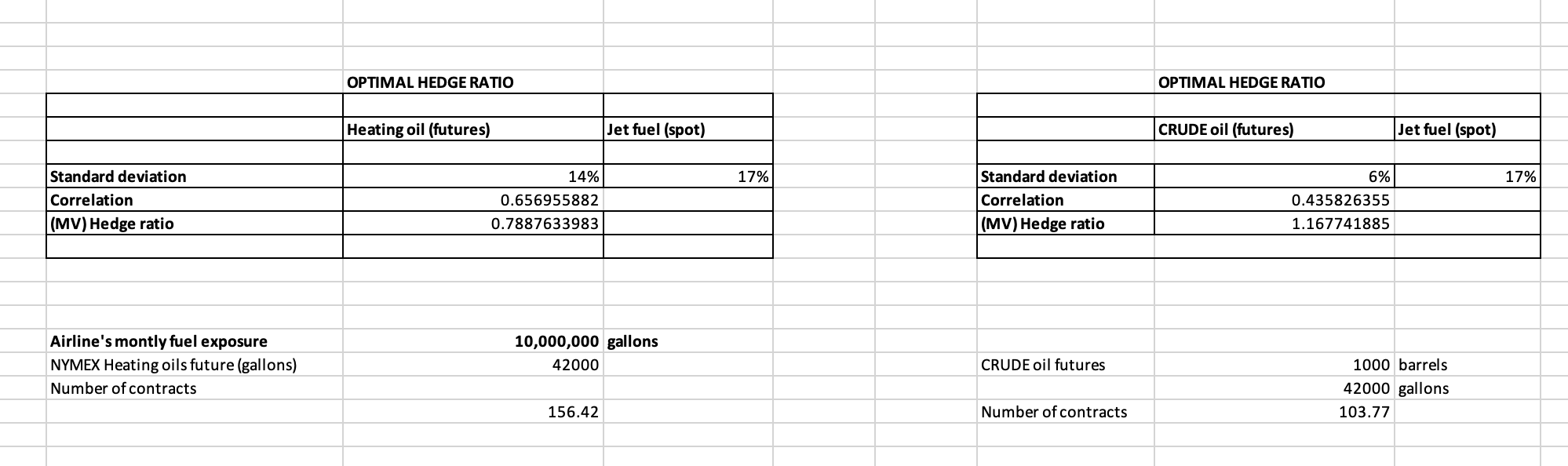

- Estimate the optimal hedge ratio using regression analysis using close price data from the beginning of the sample period until July 5, 2024. Use price changes in your model. Tabulate the estimated results in the report, explain them in detail, and recommend the most suitable Futures contract for hedging.

- The Chief Executive Officer of the medium-sized airline located in Melbourne Haris indicated that the airline's monthly fuel exposure amounts to 10 million gallons of jet fuel and asked you to implement your proposed hedging strategy from July 5, 2024, to September 27, 2024, utilizing the preferred Futures contract identified in your response to question 1. For the sake of simplicity, assume that hedging positions are established during the first week of each month and are closed out just before the expiration dates of the contracts occurring during the last week of the month. Analyse the hedging strategy during the period specified by Haris and recommend whether she should utilize futures to hedge the fuel exposure. Present the findings in tables

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock