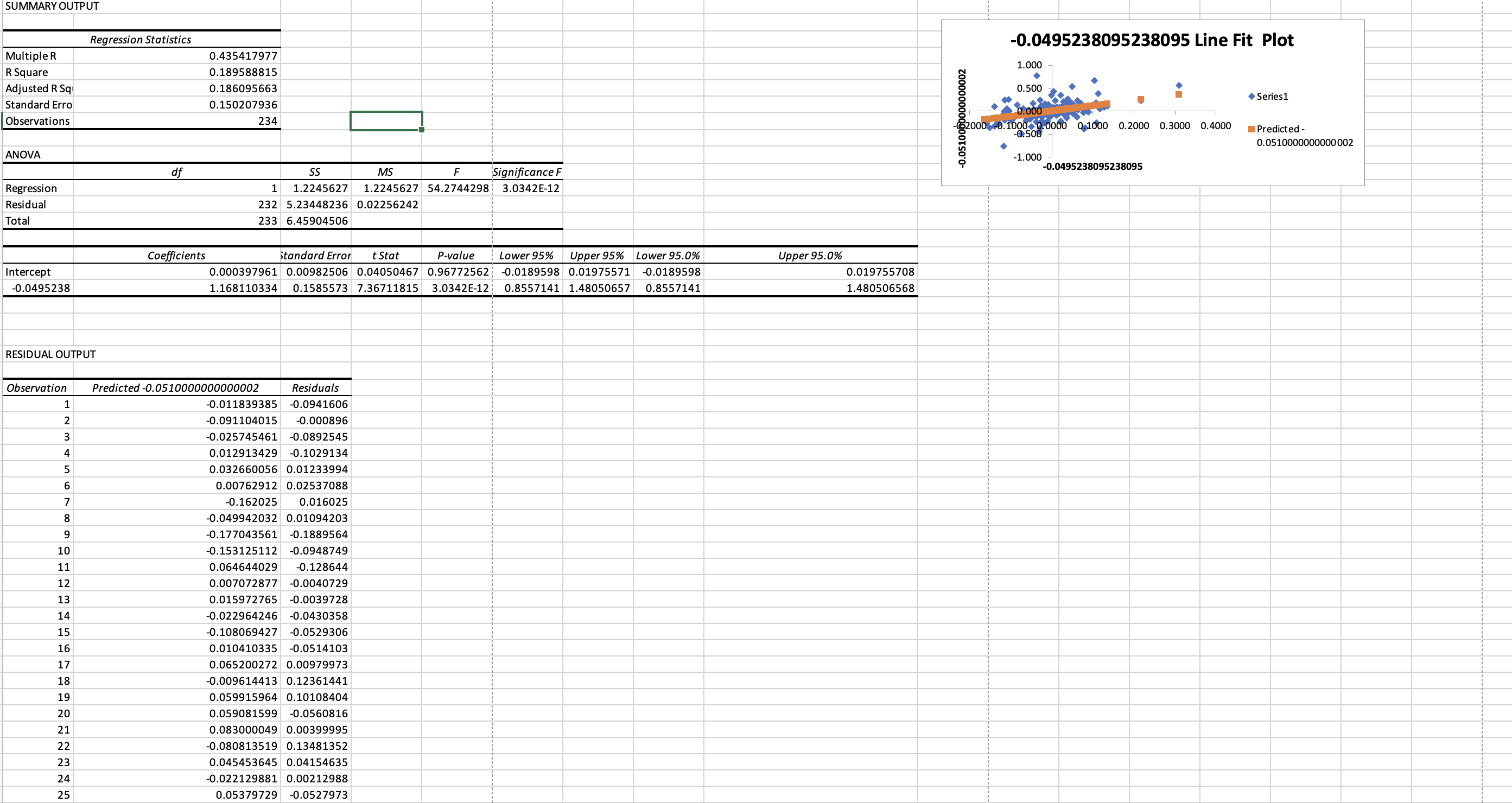

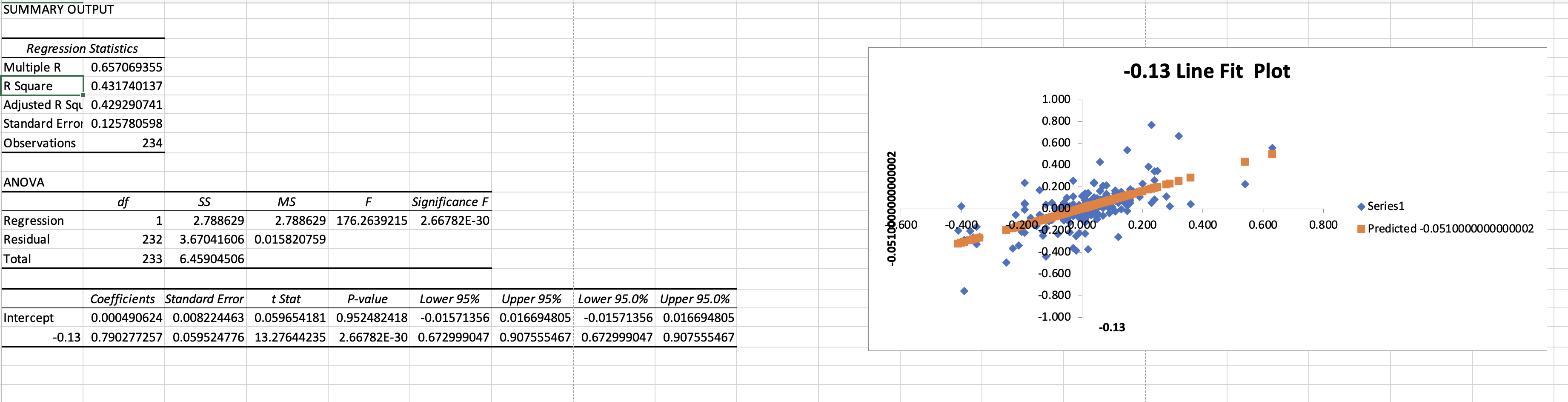

Question: Estimate the optimal hedge ratio using regression analysis using close price data from the beginning of the sample period until July 5, 2024. Use price

Estimate the optimal hedge ratio using regression analysis using close price data from the beginning of the sample period until July 5, 2024. Use price changes in your model. Tabulate the estimated results in the report, explain them in detail, and recommend the most suitable Futures contract for hedging.(6 marks).

Can you give me the full instructions as well as the formula for optimal hedge ratio using regression analysis in this case ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts