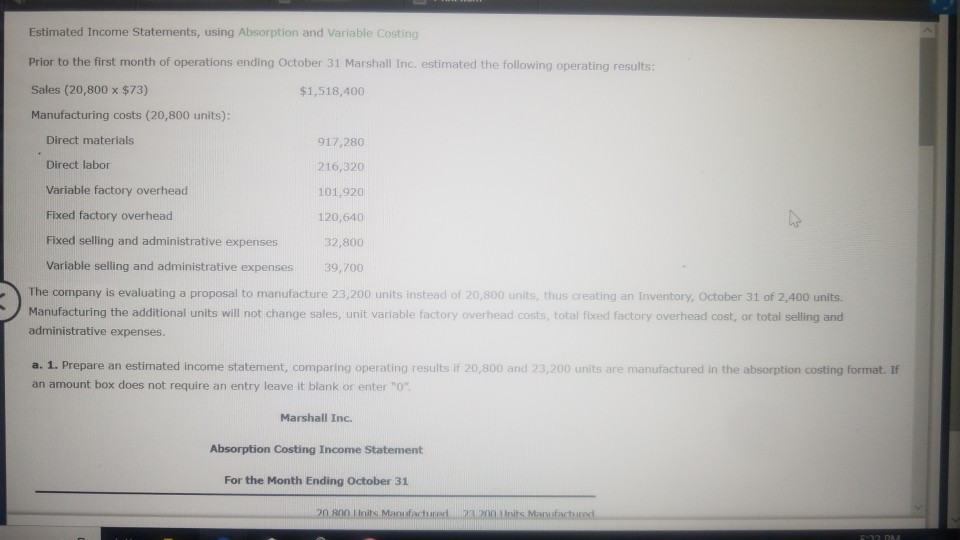

Question: Estimated Incorne Statements, using Absorption and Variable Costing Prior to the first month of operations ending October 31 Marshall Inc. estimated the following operating results

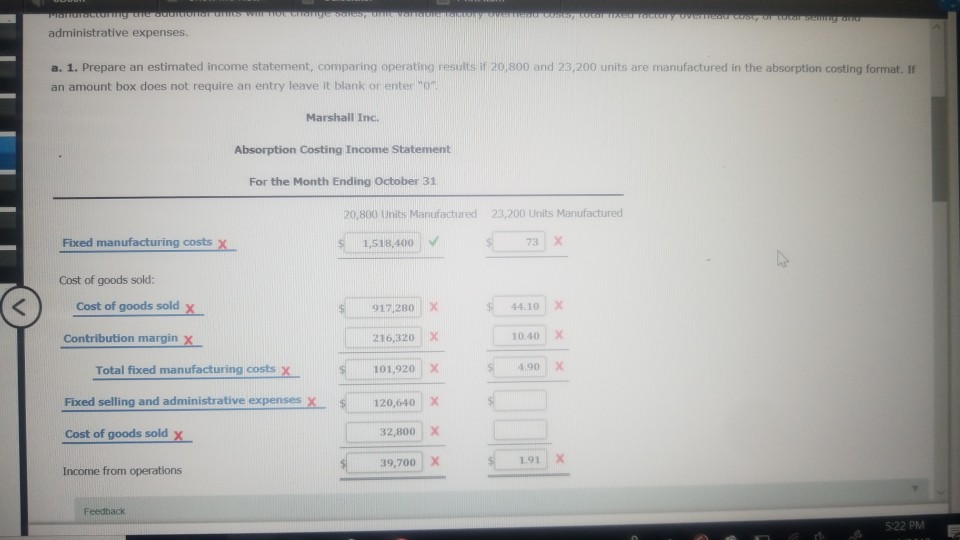

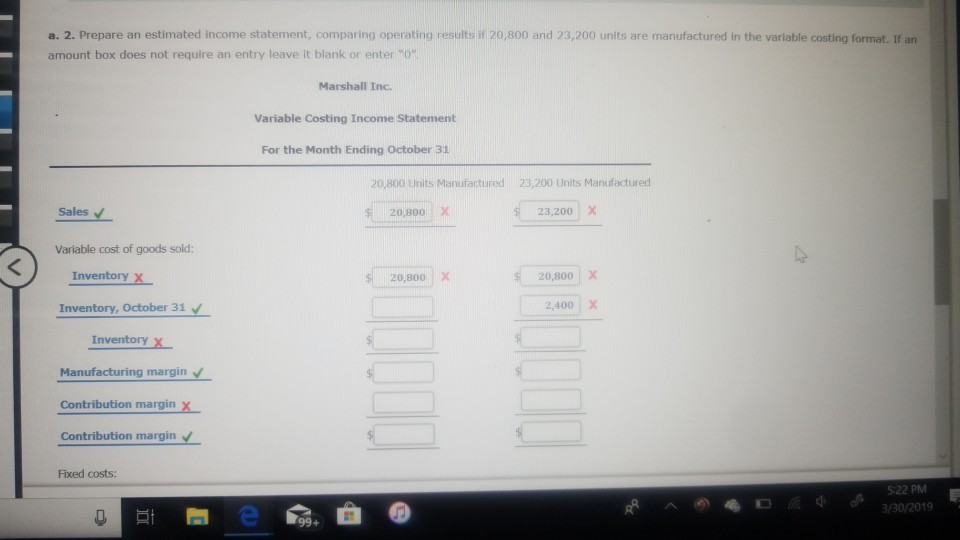

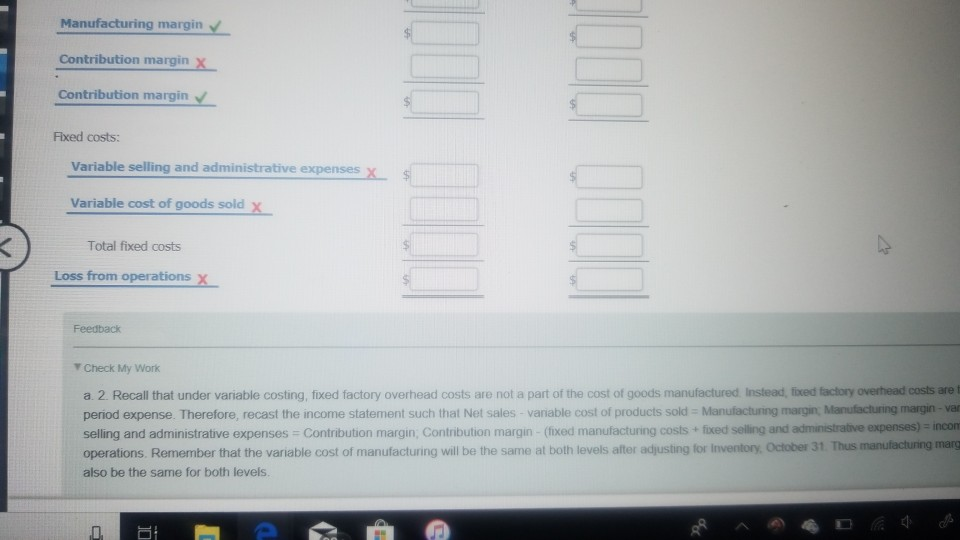

Estimated Incorne Statements, using Absorption and Variable Costing Prior to the first month of operations ending October 31 Marshall Inc. estimated the following operating results Sales (20,800 x $73) Manufacturing costs (20,800 units) $1,518,400 Direct materials Direct labor Variable factory overhead Fixed factory overhead Fixed selling and administrative expenses Variable selling and administrative expenses 917,280 216,320 101,920 120,640 32,800 39,700 The company is evaluating a proposal to manufacture 23,200 units instead of 20,800 unilts, thus creating an Inventory, October 31 of 2,400 units Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses a. 1. Prepare an estimated income statement, comparing operating results if 20,800 and 23,200 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank or enter "O" Marshall Inc. Absorption Costing Income Statement For the Month Ending October 31 administrative expenses. a. 1. Prepare an estimated income statement, comparing operating results if 20,800 and 23,200 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank or enter Marshall Inc. Absorption Costing Income Statement For the Month Ending October 31 20, 800 Units Manufactured 23,200 Units Manufactured Fixed manufacturing costs x 1,518,400 73 X Cost of goods sold: 44101 x 10.40X 4.90 X ) 917,2801 x 216,320 | 101,920 X 120,640 X 32,800X 39,700 Cost of goods sold X Contribution margin Total fixed manufacturing costs X Fixed selling and administrative expenses x Cost of goods sold x Income from operations 191 X Feedback 522 PM 2. Prepare an estimated income statement, comparing operating result i 20, 0 and 3,200 units are manufactured in the vartable costing format It an 20,800 and 23,200 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank or enter "O Marshall Inc. Variable Costing Income Statement For the Month Ending October 31 20,800 Units Manufactured 23,200 Units Manufactured Sales V 20,800 X 23,200 ) Variable cost of goods sold Inventory x 20,800 | X $ 20,800|x Inventory, October 31 2,400X Inventory x Manufacturing margin Contribution margin x Fixed costs: 522 PM 3/30/2019 99+ Manufacturing margin Contribution margin X Contribution margin Fixed costs: Variable selling and administrative expenses Variable cost of goods sold Total fixed costs Loss from operations x Feedback Y Check My Work a 2. Recall that under variable costing, fixed factory overhead costs are not a part of the cost of goods manufactured Instead, fixed factory overhead costs are t period expense. Therefore, recast the income statement such that Net sales - variable cost of products sold Manufacturing margin Manufacturing margin- var selling and administrative expenses Contribution margin on ribution margin ed manu ac n coststi e se ling andam netranee penses nor operations. Remember that the variable cost of manufacturing will be the same at both levels after adjusting for Inventory, October 31. Thus manufacturing mang also be the same for both levels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts