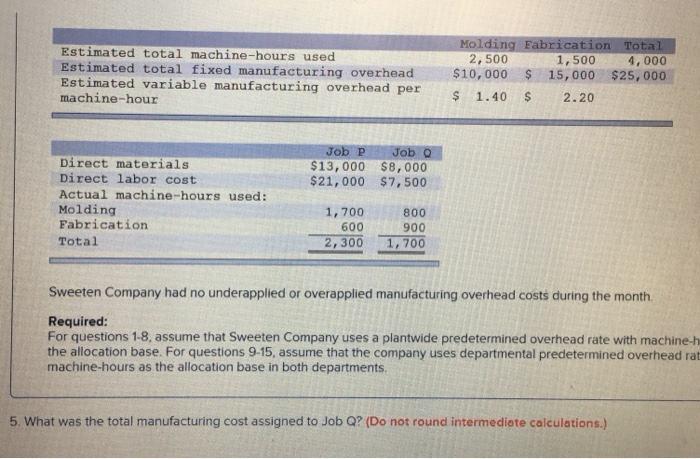

Question: Estimated total machine-hours used Estimated total fixed overhead Estimated variable manufacturing overhead per machine-hour 2, 500 manufacturing overhead$10,000 1,500 4,000 15,000 $25,000 Direct materials Direct

Estimated total machine-hours used Estimated total fixed overhead Estimated variable manufacturing overhead per machine-hour 2, 500 manufacturing overhead$10,000 1,500 4,000 15,000 $25,000 Direct materials Direct labor cost Actual machine-hours used Molding Fabrication Total $13,000 $8,000 $21,000 $7,500 1,700800 900 2,3001,700 600 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-h the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rat machine-hours as the allocation base in both departments. 5. What was the total manufacturing cost assigned to Job Q? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts