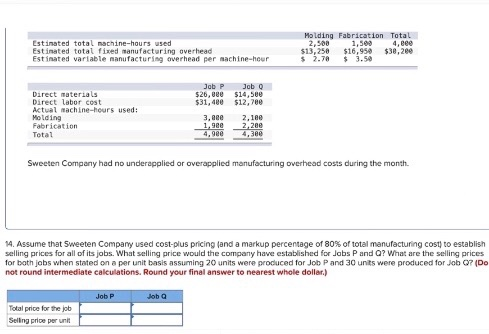

Question: Estimated total machine-hours used Estinated total fixed manufacturing overhead Estinated variable manufacturing overhead per machine-hour Molding Fabrication Total 2,500 1,500 $13,250 $16,950 $38,200 $ 2.78

Estimated total machine-hours used Estinated total fixed manufacturing overhead Estinated variable manufacturing overhead per machine-hour Molding Fabrication Total 2,500 1,500 $13,250 $16,950 $38,200 $ 2.78 $ 3.50 Direct materials Direct labor cost Actual machine-hours used: Molding Fabrication Total Job P Job O $26,Bee $14,500 $31,480 $12,700 3,000 2,100 1,900 2,200 4,900 4,360 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month 14. Assume that Sweeten Company used cost-plus pricing and a markup percentage of 80% of total manufacturing costs to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for Job P and 30 units were produced for Job ? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Job P Job a Total price for the job Selling price per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts