Question: Estimating Bad Debts Expense and Reporting Receivables At Dec. 31, Barber Co. had a balance of age of AR current 1-60 days past due

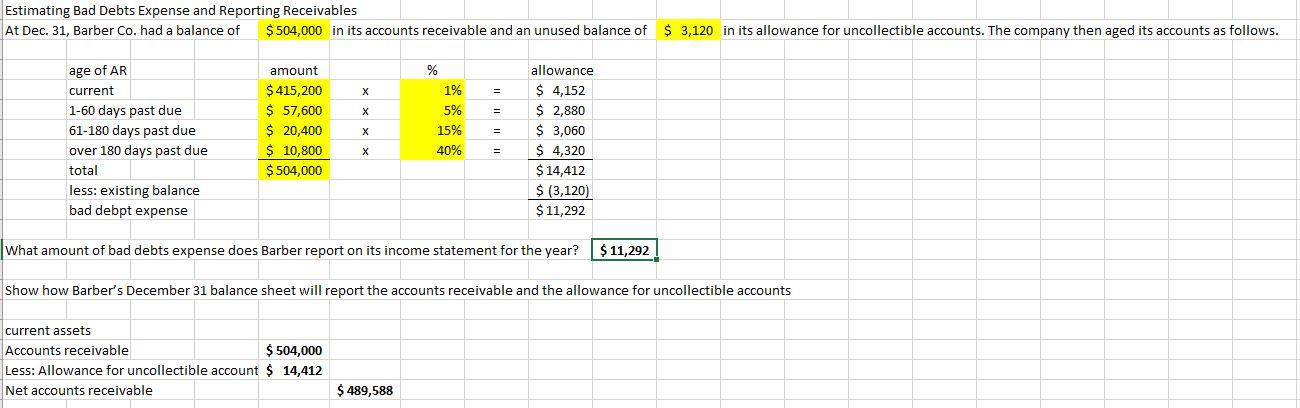

Estimating Bad Debts Expense and Reporting Receivables At Dec. 31, Barber Co. had a balance of age of AR current 1-60 days past due 61-180 days past due $504,000 in its accounts receivable and an unused balance of $ 3,120 in its allowance for uncollectible accounts. The company then aged its accounts as follows. amount allowance % $415,200 X 1% = $ 4,152 $ 57,600 X 5% = $ 2,880 $ 20,400 X 15% = $ 3,060 over 180 days past due total $ 10,800 X 40% = $ 4,320 $504,000 $14,412 less: existing balance bad debpt expense $ (3,120) $11,292 What amount of bad debts expense does Barber report on its income statement for the year? $11,292 Show how Barber's December 31 balance sheet will report the accounts receivable and the allowance for uncollectible accounts current assets Accounts receivable $504,000 Less: Allowance for uncollectible account $ 14,412 Net accounts receivable $489,588

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts