Question: Estimating Bad Debts Journal Entry Problem: ( 2 pts - Completed Journal Entries ) Important: Please watch this video > > > > > New

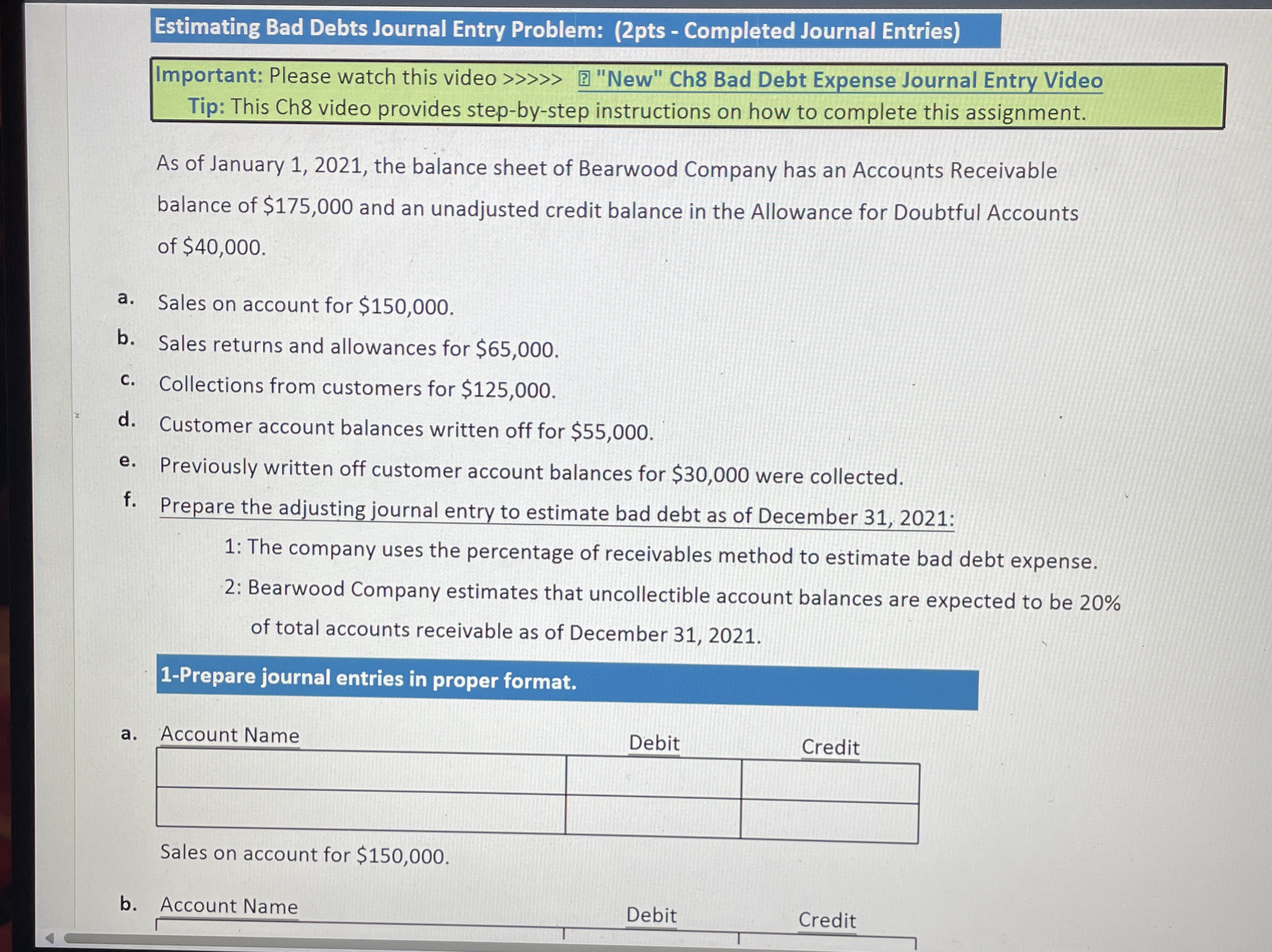

Estimating Bad Debts Journal Entry Problem: pts Completed Journal Entries

Important: Please watch this video "New" Ch Bad Debt Expense Journal Entry Video

Tip: This Ch video provides stepbystep instructions on how to complete this assignment.

As of January the balance sheet of Bearwood Company has an Accounts Receivable balance of $ and an unadjusted credit balance in the Allowance for Doubtful Accounts of $

a Sales on account for $

b Sales returns and allowances for $

c Collections from customers for $

d Customer account balances written off for $

e Previously written off customer account balances for $ were collected.

f Prepare the adjusting journal entry to estimate bad debt as of December :

: The company uses the percentage of receivables method to estimate bad debt expense.

: Bearwood Company estimates that uncollectible account balances are expected to be of total accounts receivable as of December

Prepare journal entries in proper format.

a Account Name

Debit

Credit

Sales on account for $

b Account Name

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock