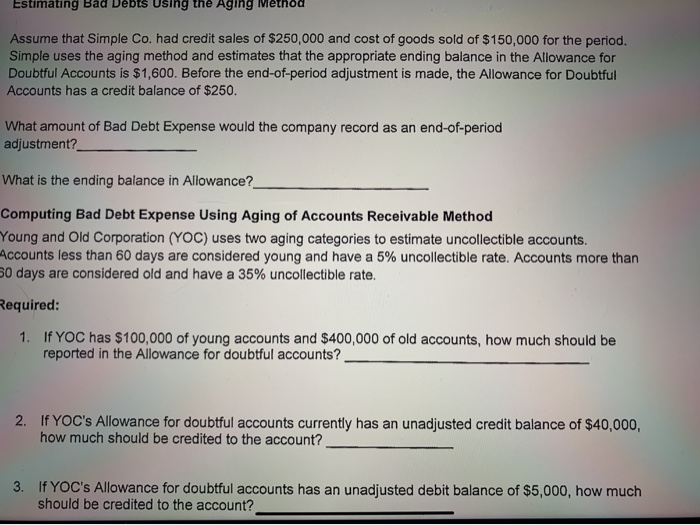

Question: Estimating bad vents using the Aging menou Assume that Simple Co. had credit sales of $250,000 and cost of goods sold of $150,000 for the

Estimating bad vents using the Aging menou Assume that Simple Co. had credit sales of $250,000 and cost of goods sold of $150,000 for the period. Simple uses the aging method and estimates that the appropriate ending balance in the Allowance for Doubtful Accounts is $1,600. Before the end-of-period adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $250. What amount of Bad Debt Expense would the company record as an end-of-period adjustment? What is the ending balance in Allowance? Computing Bad Debt Expense Using Aging of Accounts Receivable Method Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than 60 days are considered young and have a 5% uncollectible rate. Accounts more than 30 days are considered old and have a 35% uncollectible rate. Required: 1. If YOC has $100,000 of young accounts and $400,000 of old accounts, how much should be reported in the Allowance for doubtful accounts? 2. If YOC's Allowance for doubtful accounts currently has an unadjusted credit balance of $40,000, how much should be credited to the account? 3. If YOC's Allowance for doubtful accounts has an unadjusted debit balance of $5,000, how much should be credited to the account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts