Question: Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Forecast Horizon Period Colgate

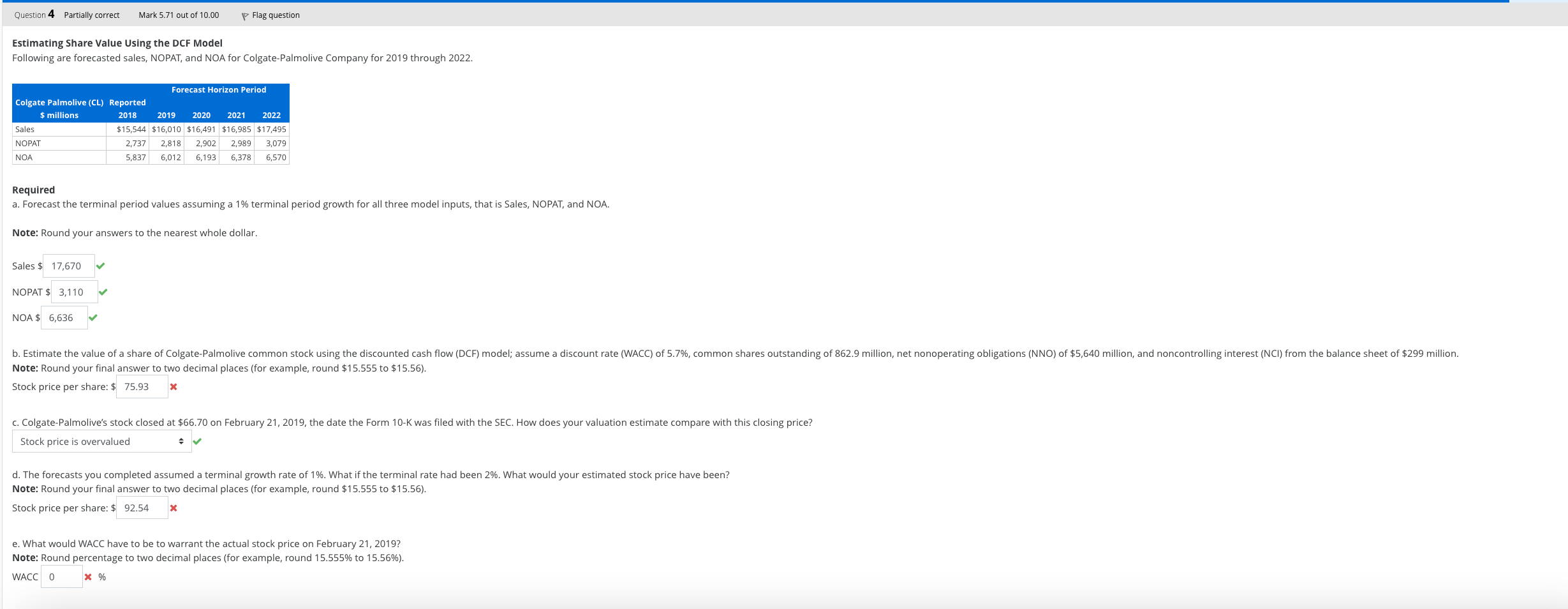

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022.

| Forecast Horizon Period | |||||

|---|---|---|---|---|---|

| Colgate Palmolive (CL) | Reported | ||||

| $ millions | 2018 | 2019 | 2020 | 2021 | 2022 |

| Sales | $15,544 | $16,010 | $16,491 | $16,985 | $17,495 |

| NOPAT | 2,737 | 2,818 | 2,902 | 2,989 | 3,079 |

| NOA | 5,837 | 6,012 | 6,193 | 6,378 | 6,570 |

Required a. Forecast the terminal period values assuming a 1% terminal period growth for all three model inputs, that is Sales, NOPAT, and NOA. Note: Round your answers to the nearest whole dollar. Sales $Answer

NOPAT $Answer

NOA $Answer

b. Estimate the value of a share of Colgate-Palmolive common stock using the discounted cash flow (DCF) model; assume a discount rate (WACC) of 5.7%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,640 million, and noncontrolling interest (NCI) from the balance sheet of $299 million. Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $Answer

c. Colgate-Palmolives stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? AnswerStock price is overvaluedStock price is undervaluedStock price is appropriately valued

d. The forecasts you completed assumed a terminal growth rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $Answer

e. What would WACC have to be to warrant the actual stock price on February 21, 2019? Note: Round percentage to two decimal places (for example, round 15.555% to 15.56%). WACC Answer

%

Question 4 Partially correct Mark 5.71 out of 10.00 p Flag question Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Forecast Horizon Period Colgate Palmolive (CL) Reported $ millions 2018 2019 2020 2021 2022 Sales $15,544 $16,010 $16,491 $16,985 $17,495 NOPAT 2,737 2,818 2,902 2,989 3,079 NOA 5,837 6,012 6,193 6,378 6,570 Required a. Forecast the terminal period values assuming a 1% terminal period growth for all three model inputs, that is Sales, NOPAT, and NOA. Note: Round your answers to the nearest whole dollar. Sales $ 17,670 NOPAT $ 3,110 NOA $ 6,636 b. Estimate the value of a share of Colgate-Palmolive common stock using the discounted cash flow (DCF) model; assume a discount rate (WACC) of 5.7%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,640 million, and noncontrolling interest (NCI) from the balance sheet of $299 million. Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 75.93 x C. Colgate-Palmolive's stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? Stock price is overvalued d. The forecasts you completed assumed a terminal growth rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 92.54 X e. What would WACC have to be to warrant the actual stock price on February 21, 2019? Note: Round percentage two decimal places (for example, round 15.555% to 15.56%). WACC 0 X % Question 4 Partially correct Mark 5.71 out of 10.00 p Flag question Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Forecast Horizon Period Colgate Palmolive (CL) Reported $ millions 2018 2019 2020 2021 2022 Sales $15,544 $16,010 $16,491 $16,985 $17,495 NOPAT 2,737 2,818 2,902 2,989 3,079 NOA 5,837 6,012 6,193 6,378 6,570 Required a. Forecast the terminal period values assuming a 1% terminal period growth for all three model inputs, that is Sales, NOPAT, and NOA. Note: Round your answers to the nearest whole dollar. Sales $ 17,670 NOPAT $ 3,110 NOA $ 6,636 b. Estimate the value of a share of Colgate-Palmolive common stock using the discounted cash flow (DCF) model; assume a discount rate (WACC) of 5.7%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,640 million, and noncontrolling interest (NCI) from the balance sheet of $299 million. Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 75.93 x C. Colgate-Palmolive's stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? Stock price is overvalued d. The forecasts you completed assumed a terminal growth rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 92.54 X e. What would WACC have to be to warrant the actual stock price on February 21, 2019? Note: Round percentage two decimal places (for example, round 15.555% to 15.56%). WACC 0 X %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts