Question: Estimating Share Value Using the DCF Model Following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets

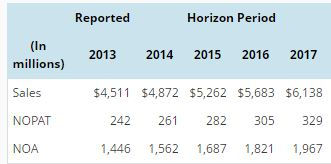

Estimating Share Value Using the DCF Model Following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2013.

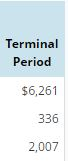

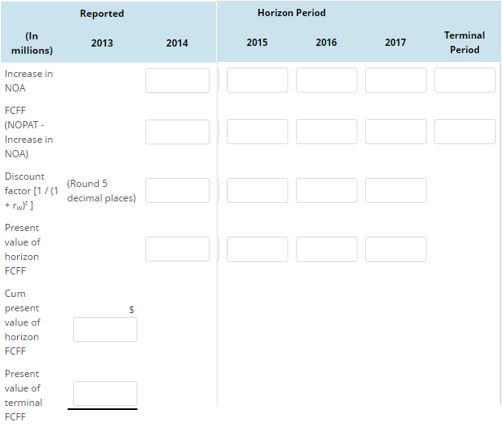

Answer the following requirements assuming a discount rate (WACC) of 10%, a terminal period growth rate of 2%, common shares outstanding of 78.4 million, and net nonoperating obligations (NNO) of $(372) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations). (a) Estimate the value of a share of Abercrombie & Fitch common stock using the discounted cash flow (DCF) model as of February 2, 2013. Rounding instructions: Round answers to the nearest whole number unless noted otherwise. Use your rounded answers for subsequent calculations.

**please show all work

Reported Horizon Period 2013 2014 2015 2016 2017 millions) $4,511 $4,872 $5,262 $5,683 $6,138 Sales 242 261 282 305 329 NOPAT NOA. 1,446 562 1,687 821 1,967

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts