Question: Estimating Share Value Using the DCF Model Following are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax ( NOPAT ) ,

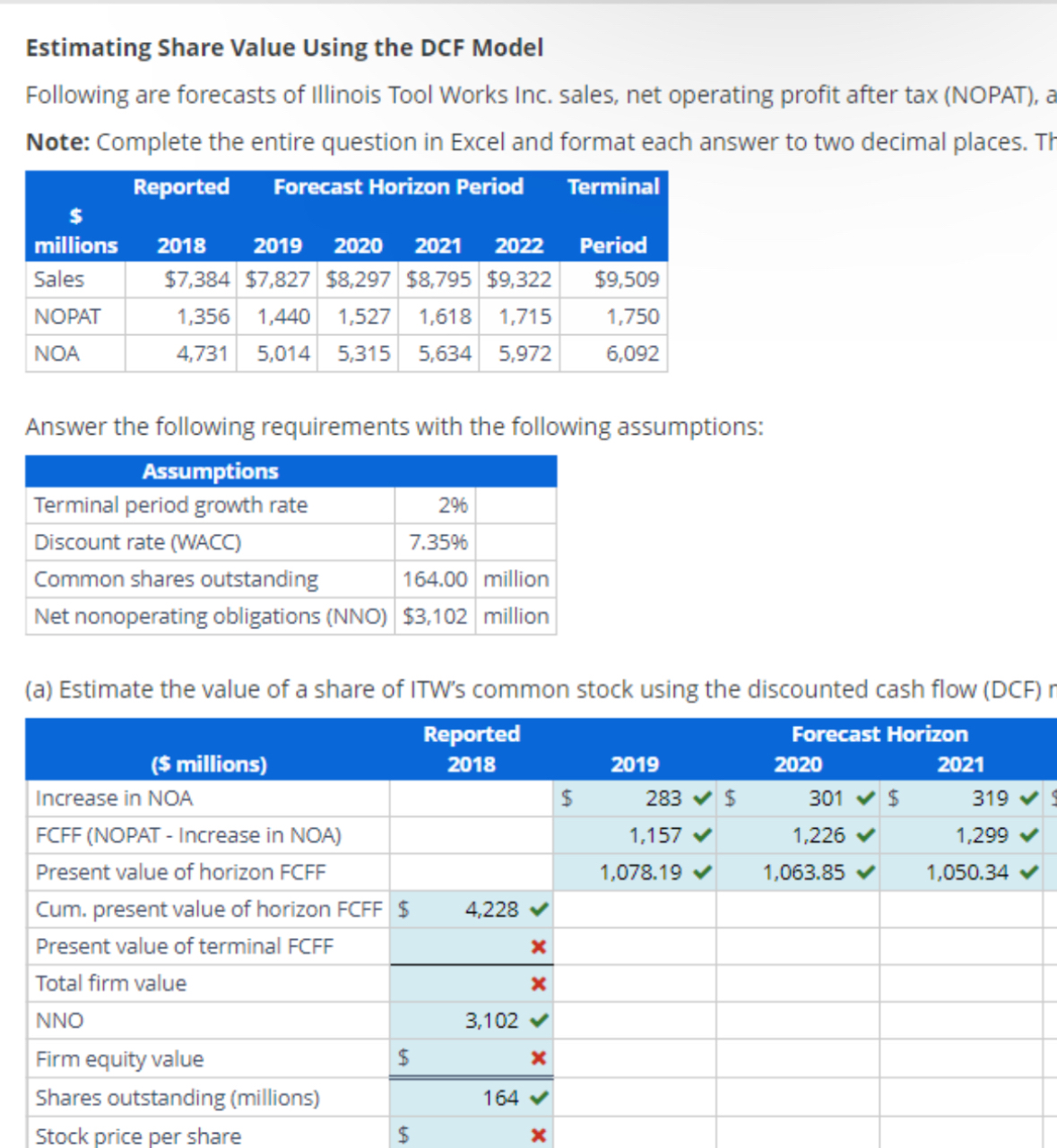

Estimating Share Value Using the DCF Model

Following are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax NOPAT a

Note: Complete the entire question in Excel and format each answer to two decimal places. Th

tableReportedForecast Horizon Period,TerminaltablemillionsPeriodSales$$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock