Question: Estimating Share Value Using the DCF Model Following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets

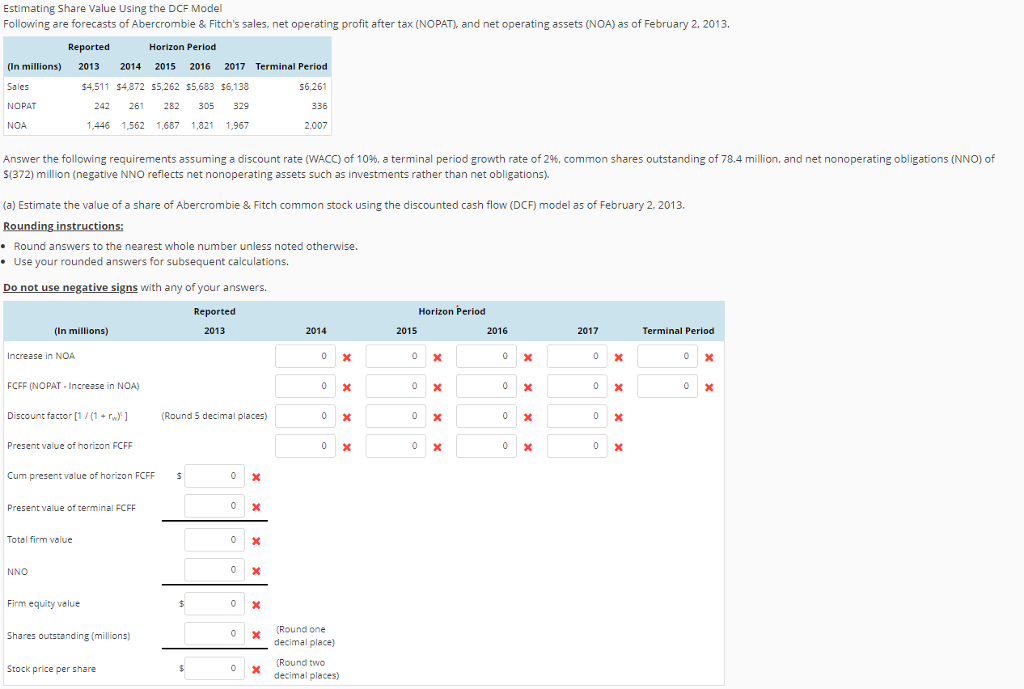

Estimating Share Value Using the DCF Model Following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2013. Horizon Period (In millions) 2013 2014 2015 2016 2017 Terminal Period Sales NOPAT NOA $6,261 336 2,007 4,511 S4,872 S5,262 S5,683 $6,133 242 261 282 305 329 1446 1,562 1,687 1,821 1,967 Answer the following requirements assuming a discount rate (WACC) of 10%, a terminal period growth rate of 2% common shares outstanding of 78.4 million, and net nonoperating obligations (NNO) of S(372) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations). (a) Estimate the value of a share of Abercrombie & Fitch common stock using the discounted cash flow (DCF) model as of February 2, 2013. Round answers to the nearest whole number unless noted otherwise. Use your rounded answers for subsequent calculations. Do not use negative signs with any of your answers. . Reported Horizon Period (In millions) 2013 2014 2015 2016 2017 Terminal Period Increase in NO FCFF (NOPAT Increase in NOA) Discount factor[1(1 rw) Round 5 decimal places) Present value of horizon FCFF Cum present value of horizon FCFFS Present value of terminal FCFF Total firm value NNO Firm equity velue Round one decimal place) Shares outstanding (millions) Round two Stock price per share OX decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts