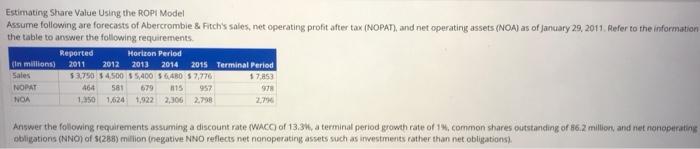

Question: Estimating Share Value Using the ROPI Model Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating

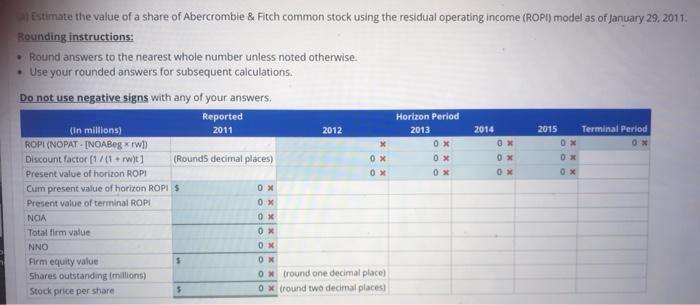

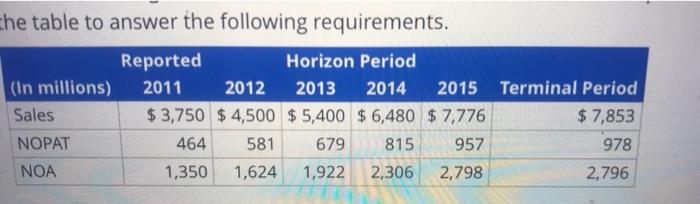

Estimating Share Value Using the ROPI Model Assume following are forecasts of Abercrombie \& Fitch's sales, net operating profit after tax (NOPAT), and net operating assets iNOA) as of jandary 29,2011 , Refer to the information the table to answer the following requirements. Answer the following requirements assuming a discount rate (WACG of 13.34, a terminal period growth rate of 19 , common shares outstanding of 86.2 million, and net nonoperaling obligations (NNO) of s(288) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations). Estimate the value of a share of Abercrombie \& Fitch common stock using the residual operating income (ROPi) model as of January 29.2011. Rounding instructions: - Round answers to the nearest whole number unless noted otherwise. - Use your rounded answers for subsequent calculations. he table to answer the following requirements. Mswer the following requirements assuming a discount rate WACC) of 13:39, a terminal period growth rate of 1%, common shares outstanding of 862 milion and net nenoperating btigations (NNO) of S(288) million (negative NNO rellects net nonoperating assets such as investments rather than net obligationst. a) Estimate the value of a share of Abercrombie \& Fitch common stock using the residual operating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts