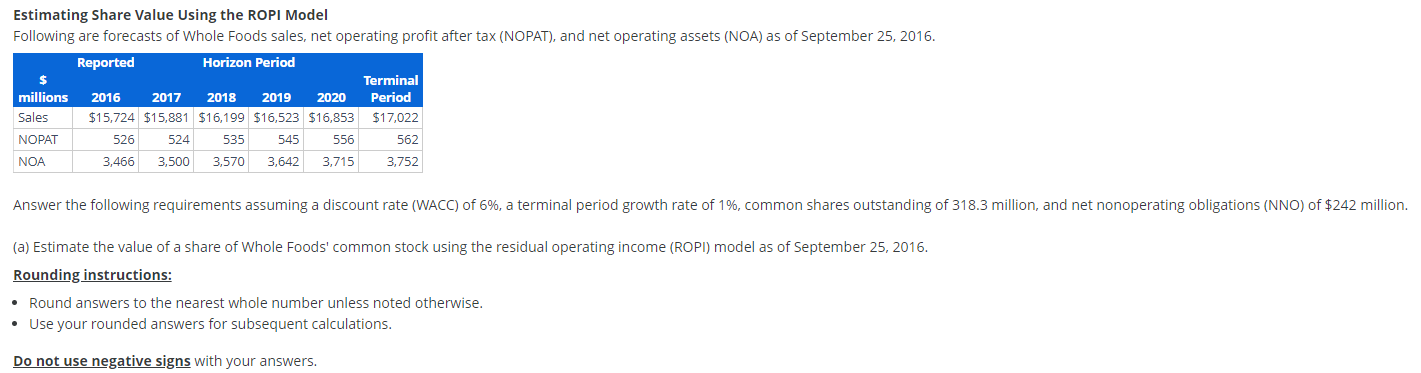

Question: Estimating Share Value Using the ROPI Model Following are forecasts of Whole Foods sales, net operating profit after tax (NOPAT), and net operating assets (NOA)

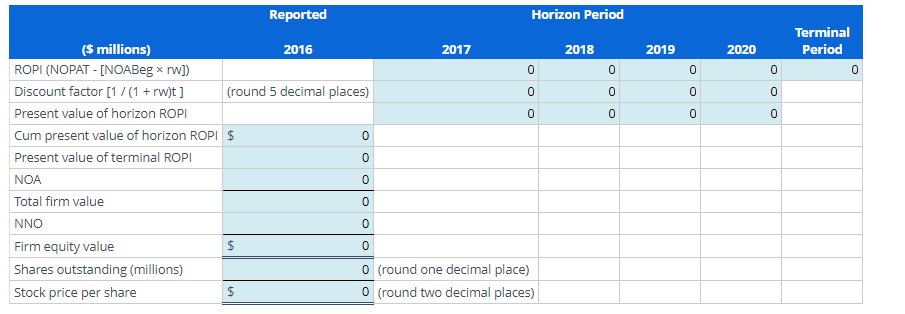

Estimating Share Value Using the ROPI Model Following are forecasts of Whole Foods sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of September 25,2016. (a) Estimate the value of a share of Whole Foods' common stock using the residual operating income (ROPI) model as of September 25, 2016. Rounding instructions: - Round answers to the nearest whole number unless noted otherwise. - Use your rounded answers for subsequent calculations. Do not use negative signs with your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts