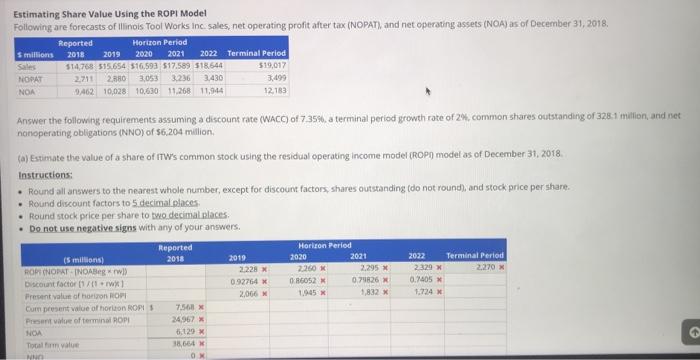

Question: Estimating Share Value Using the ROPI Model Following are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax (NOPAT) and net operating

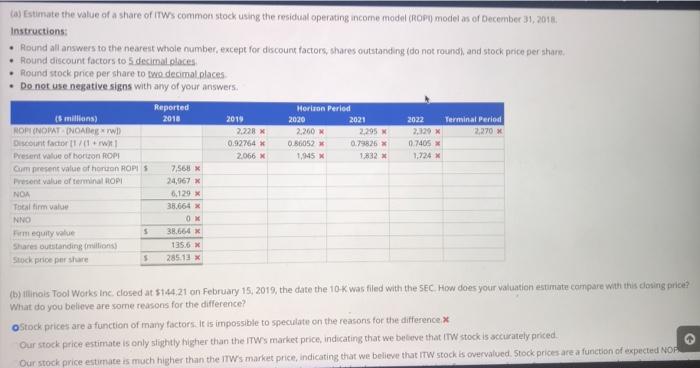

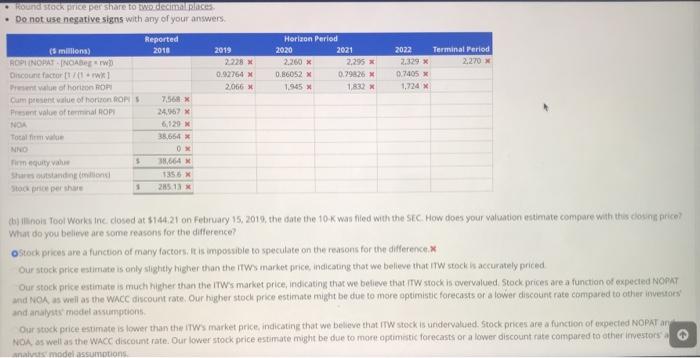

Estimating Share Value Using the ROPI Model Following are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax (NOPAT) and net operating assets (NO) as of December 31, 2018. Reported Horizon Period Smillions 2018 2019 2020 2021 2022 Terminal Period Sales $14,768 515.654 516.593 517.589 518 544 $19,017 NOPAT 2.711 2.880 3.053 3.430 3,499 NOA 9A62 10,028 10,630 11.268 11,944 12.183 Answer the following requirements assuming a discount rate (WACC) of 7359, a terminal period growth rate of 2%, common shares outstanding of 328.1 million, and net nonoperating obligations (NNO) of 6,204 million (a) Estimate the value of a share of ITW's common stock using the residual operating income model (ROPO model as of December 31, 2018 Instructions: Round all answers to the nearest whole number, except for discount factors, shares outstanding (do not round), and stock price per share. Round discount factors to 5 decimal places Round stock price per share to two decimal places Do not use negative signs with any of your answers. Reported Horison Period (5 millions) 2018 2020 2021 2022 Terminal Period RORONOPATINOABegw) 2.228 x 2260 K 2.295 x Discount factor [1/11 092764 X 06052 0.71826 0.1405 X Present value of horizon ROP 2,066 1,832 Cum present value of horizon ROP3 7.500 Pentue of terminal ROP 24.967 6.129 X Total value 38,664 2019 2329 2,270 X 1.724 NOA OM ca) Estimate the value of a share of its common stock using the residual operating income model (ROPU model as of December 31, 2018, Instructions: Round all answers to the nearest whole number, except for discount factors, shares outstanding (do not round) and stock price per share Round discount factors to 5 decimal places Round stock price per share to two decimal places Do not use negative signs with any of your answers. Reported Horizon Period (5 millions) 2018 2019 2020 2021 2022 Terminal Period OPINOPAT (NOAGE 2.22 2,260 X 2,295 2.120 2.270 Discount factor 11/11 0.92764 0.86052 0.79826 0.7405 Present value of boron ROP 2066 X 1945 x 1832 1.224 X Gum present value of horon ROPIS 7,568 Present value of terminal ROPI 24,967 X NOA 6,129 X Tocaltim value 38.664 X NNO OX Firm equity value 38.664 X Share outstanding milions) 135.6 x Stock price per share 5 285.13 x 5 (b) illinois Tool Works Inc. closed at $164.21 on February 15, 2019, the date the 10K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? oStock prices are a function of many factors. It is impossible to speculate on the reasons for the difference Our stock price estimate is only slightly higher than the ITWs market price, indicating that we believe that ITW stock is accurately priced. Our stock price estimate is much higher than the ITW's market price, indicating that we believe that ITW stock is overvalued. Stock prices are a function of expected NOP Horizon Period 2020 2021 2.250 X 2,295 x 0.86052 X 0.79826 1.945 180 Terminal Period 2.270 2022 2.329 0.7405 X 1.724 Round stock price per Share to becimal places Do not use negative signs with any of your answers Reported (5 millions) 2018 2019 RODINOPATINOARE 2.228 x Discount factor [1/(1-W1 0.92764 M Palun of horizon ROR 2,066 Cum present value of horron ONS 7,568 X Preet value of terminal ROP 24.67 NOA 6.720 X Total firme 38.654 NO OX Form equity value 5 38,664 X Share outstanding on 1355 X Stock pricepers 1 28511 X (b) no Tool Works in closed at $144.21 on February 15, 2019, the date the 10k was hled with the SEC How does your valuation estimate compare with this count price? What do you believe are some reasons for the difference? Stock prices are a function of many factors, it is impossible to speculate on the reasons for the difference Our stock price estimate is only slightly higher than the TWS market price, indicating that we believe that stock is accurately priced Our stock price estimate is much higher than the ITW's market price, indicating thar we believe that ITW stock is overvalued Stock prices are a function of expected NOMAT and NOA, as well as the WACC discount rate Our higher stock price estimate might be due to more optimistic forecasts or a tower discount rate compared to other westors and analysts model assumptions Our stock price estimate is lower than the market price, indicating that we believe that IW stock is undervalued. Stock prices are a function of expected NOPAT an NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors model assumptions Estimating Share Value Using the ROPI Model Following are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax (NOPAT) and net operating assets (NO) as of December 31, 2018. Reported Horizon Period Smillions 2018 2019 2020 2021 2022 Terminal Period Sales $14,768 515.654 516.593 517.589 518 544 $19,017 NOPAT 2.711 2.880 3.053 3.430 3,499 NOA 9A62 10,028 10,630 11.268 11,944 12.183 Answer the following requirements assuming a discount rate (WACC) of 7359, a terminal period growth rate of 2%, common shares outstanding of 328.1 million, and net nonoperating obligations (NNO) of 6,204 million (a) Estimate the value of a share of ITW's common stock using the residual operating income model (ROPO model as of December 31, 2018 Instructions: Round all answers to the nearest whole number, except for discount factors, shares outstanding (do not round), and stock price per share. Round discount factors to 5 decimal places Round stock price per share to two decimal places Do not use negative signs with any of your answers. Reported Horison Period (5 millions) 2018 2020 2021 2022 Terminal Period RORONOPATINOABegw) 2.228 x 2260 K 2.295 x Discount factor [1/11 092764 X 06052 0.71826 0.1405 X Present value of horizon ROP 2,066 1,832 Cum present value of horizon ROP3 7.500 Pentue of terminal ROP 24.967 6.129 X Total value 38,664 2019 2329 2,270 X 1.724 NOA OM ca) Estimate the value of a share of its common stock using the residual operating income model (ROPU model as of December 31, 2018, Instructions: Round all answers to the nearest whole number, except for discount factors, shares outstanding (do not round) and stock price per share Round discount factors to 5 decimal places Round stock price per share to two decimal places Do not use negative signs with any of your answers. Reported Horizon Period (5 millions) 2018 2019 2020 2021 2022 Terminal Period OPINOPAT (NOAGE 2.22 2,260 X 2,295 2.120 2.270 Discount factor 11/11 0.92764 0.86052 0.79826 0.7405 Present value of boron ROP 2066 X 1945 x 1832 1.224 X Gum present value of horon ROPIS 7,568 Present value of terminal ROPI 24,967 X NOA 6,129 X Tocaltim value 38.664 X NNO OX Firm equity value 38.664 X Share outstanding milions) 135.6 x Stock price per share 5 285.13 x 5 (b) illinois Tool Works Inc. closed at $164.21 on February 15, 2019, the date the 10K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? oStock prices are a function of many factors. It is impossible to speculate on the reasons for the difference Our stock price estimate is only slightly higher than the ITWs market price, indicating that we believe that ITW stock is accurately priced. Our stock price estimate is much higher than the ITW's market price, indicating that we believe that ITW stock is overvalued. Stock prices are a function of expected NOP Horizon Period 2020 2021 2.250 X 2,295 x 0.86052 X 0.79826 1.945 180 Terminal Period 2.270 2022 2.329 0.7405 X 1.724 Round stock price per Share to becimal places Do not use negative signs with any of your answers Reported (5 millions) 2018 2019 RODINOPATINOARE 2.228 x Discount factor [1/(1-W1 0.92764 M Palun of horizon ROR 2,066 Cum present value of horron ONS 7,568 X Preet value of terminal ROP 24.67 NOA 6.720 X Total firme 38.654 NO OX Form equity value 5 38,664 X Share outstanding on 1355 X Stock pricepers 1 28511 X (b) no Tool Works in closed at $144.21 on February 15, 2019, the date the 10k was hled with the SEC How does your valuation estimate compare with this count price? What do you believe are some reasons for the difference? Stock prices are a function of many factors, it is impossible to speculate on the reasons for the difference Our stock price estimate is only slightly higher than the TWS market price, indicating that we believe that stock is accurately priced Our stock price estimate is much higher than the ITW's market price, indicating thar we believe that ITW stock is overvalued Stock prices are a function of expected NOMAT and NOA, as well as the WACC discount rate Our higher stock price estimate might be due to more optimistic forecasts or a tower discount rate compared to other westors and analysts model assumptions Our stock price estimate is lower than the market price, indicating that we believe that IW stock is undervalued. Stock prices are a function of expected NOPAT an NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors model assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts