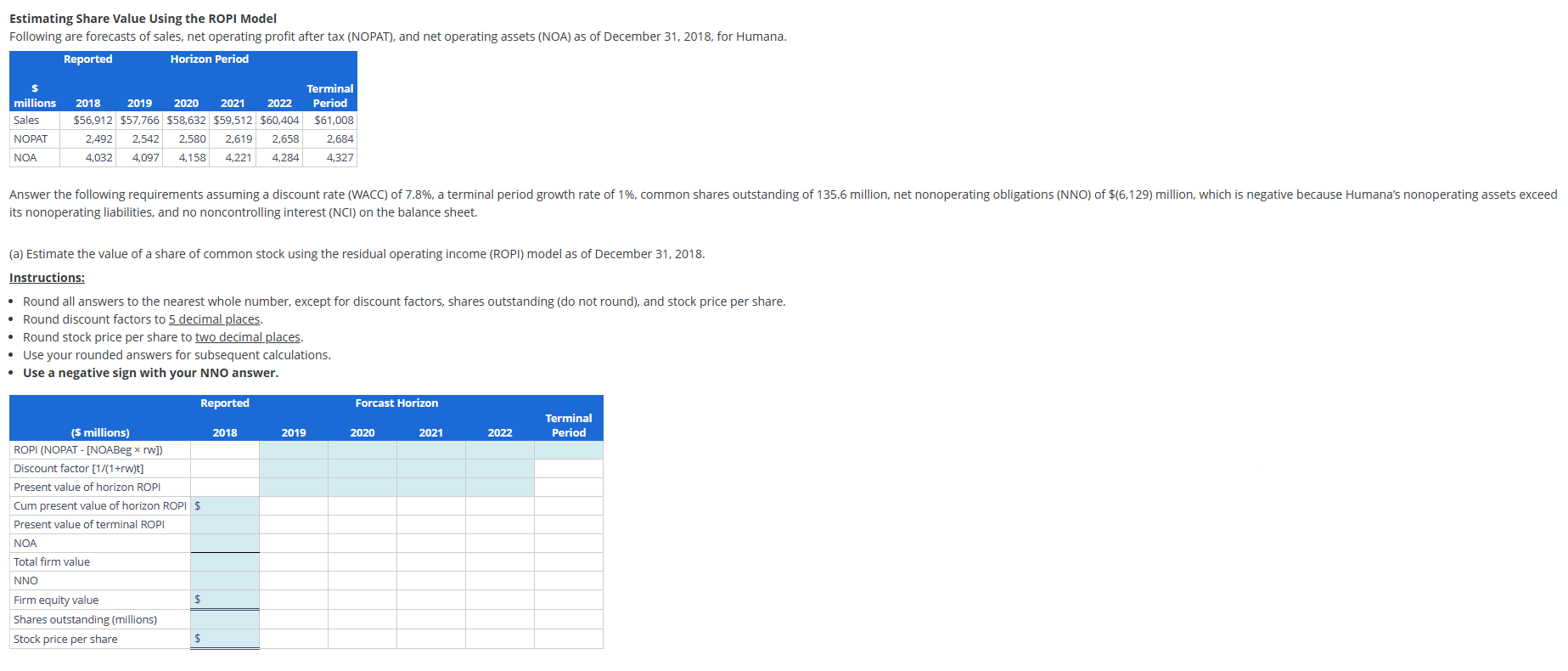

Question: Estimating Share Value Using the ROPI Model Following are forecasts of sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of

Estimating Share Value Using the ROPI Model Following are forecasts of sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 31, 2018, for Humana. its nonoperating liabilities, and no noncontrolling interest (NCl) on the balance sheet. (a) Estimate the value of a share of common stock using the residual operating income (ROPI) model as of December 31, 2018. Instructions: - Round all answers to the nearest whole number, except for discount factors, shares outstanding (do not round), and stock price per share. - Round discount factors to 5 decimal places. - Round stock price per share to two decimal places. - Use your rounded answers for subsequent calculations. (b) Humana (HUM) stock closed at $307.56 on February 21,2019 , the date the 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? Ostock prices are a function of many factors. It is impossible to speculate on the reasons for the difference. more optimistic forecasts or a lower discount rate compared to other investors' and analysts' model assumptions. more pessimistic forecasts or a higher discount rate compared to other investors' and analysts' model assumptions. more pessimistic forecasts or a higher discount rate compared to other investors' and analysts' model assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts