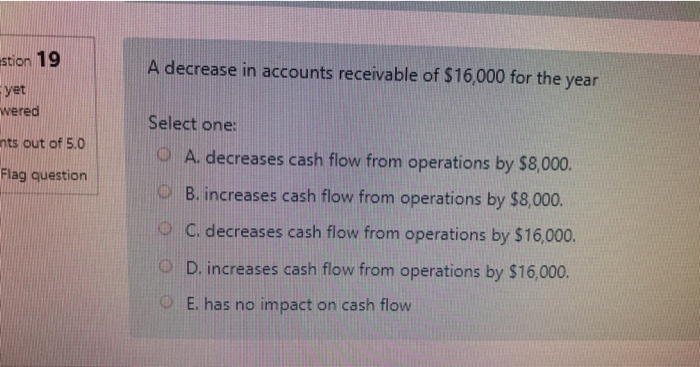

Question: estion 19 A decrease in accounts receivable of $16,000 for the year yet wered ants out of 5.0 Flag question Select one: O A. decreases

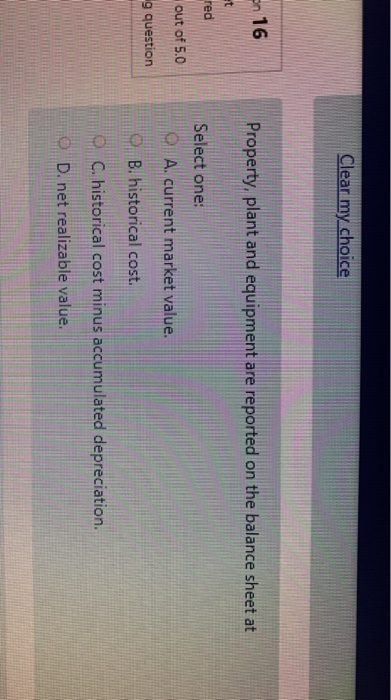

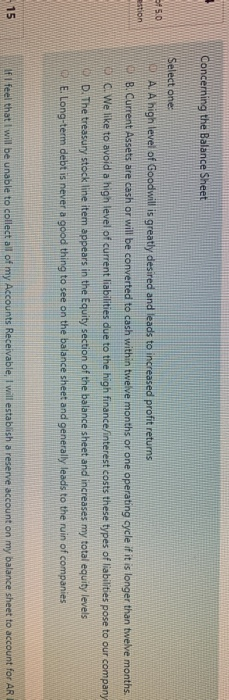

estion 19 A decrease in accounts receivable of $16,000 for the year yet wered ants out of 5.0 Flag question Select one: O A. decreases cash flow from operations by $8,000. B. increases cash flow from operations by $8,000. C. decreases cash flow from operations by $16,000. O D. increases cash flow from operations by $16,000. E. has no impact on cash flow Clear my choice on 16 Property, plant and equipment are reported on the balance sheet at red out of 5.0 g question Select one: A. current market value. O B. historical cost C. historical cost minus accumulated depreciation. O D.net realizable value. WWW Concerning the Balance Sheet 50 W estion Select one A. A high level of Goodwill is greatly desired and leads to increased profit returns B. Current Assets are cash or will be converted to cash within twelve months or one operating cycle if it is longer than twelve months. We like to avoid a high level of current liabilities due to the high finance/interest costs these types of liabilities pose to our company D he treasury stock line item appears in the Equity section of the balance sheet and increases my total equity levels E. Long-term debt is never a good thing to see on the balance sheet and generally leads to the ruin of companies 515 If I feel that I will be unable to collect all of my Accounts Receivable, I will establish a reserve account on my balance sheet to account for ARL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts