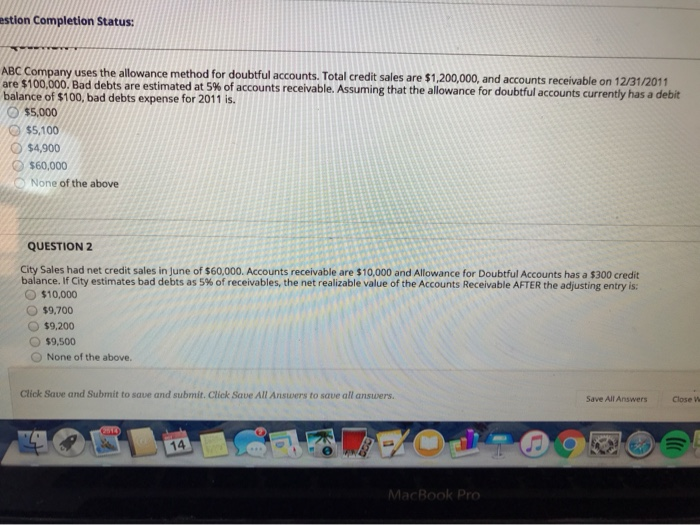

Question: estion Completion Status: ABC Company uses the allowance method for doubtful accounts. Total credit sales are $1,200,000, and accounts receivable on 12/31/2011 are $100,000. Bad

estion Completion Status: ABC Company uses the allowance method for doubtful accounts. Total credit sales are $1,200,000, and accounts receivable on 12/31/2011 are $100,000. Bad debts are estimated at 5 % of accounts receivable. Assuming that the allowance for doubtful accounts currently has a debit balance of $100, bad debts expense for 2011 is. $5,000 $5,100 $4,900 $60,000 None of the above QUESTION 2 City Sales had net credit sales in June of $60,000. Accounts receivable are $10,000 and Allowance for Doubtful Accounts has a $300 credit balance. If City estimates bad debts as 5% of receivables, the net realizable value of the Accounts Receivable AFTER the adjusting entry is: $10,000 $9,700 $9,200 $9,500 None of the above. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close We 14 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts