Question: estion Completion Status: Save and A Click Submit to complete this assessment. Questi estion 25 1 points Sa Which of the following best describes an

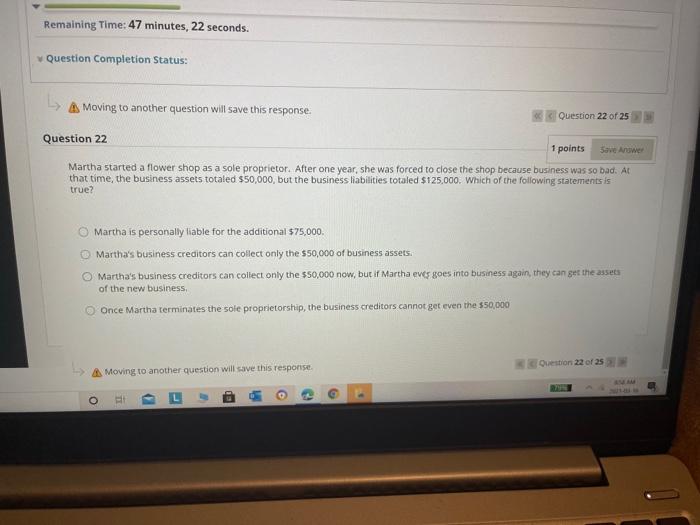

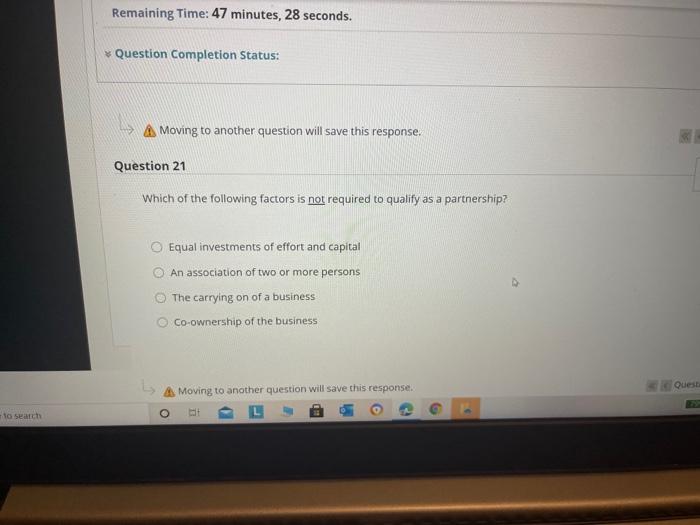

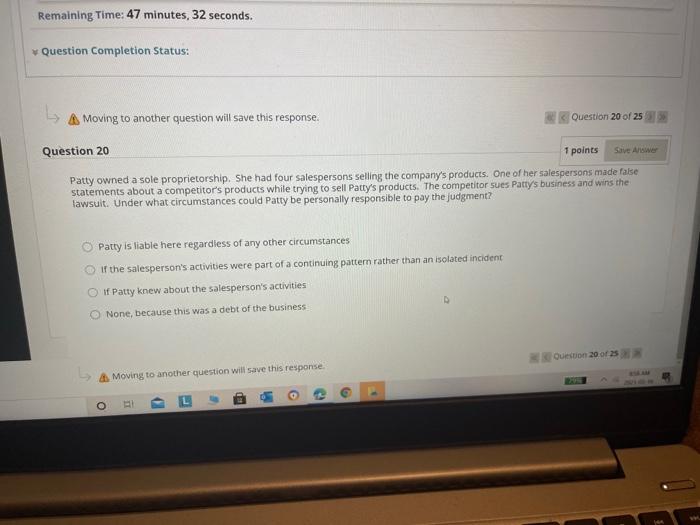

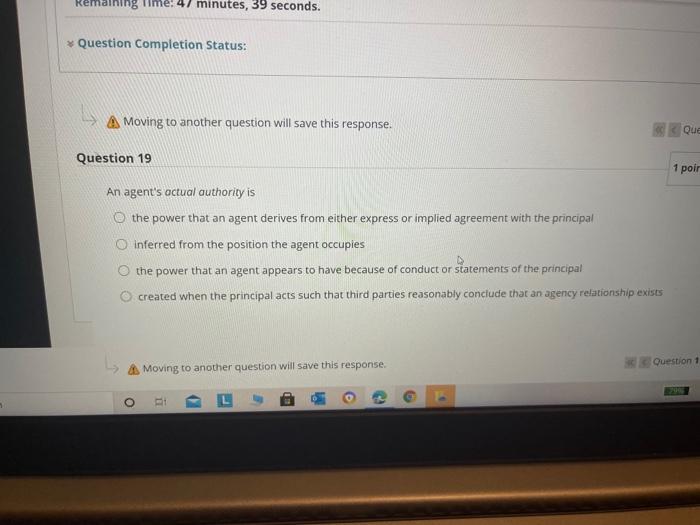

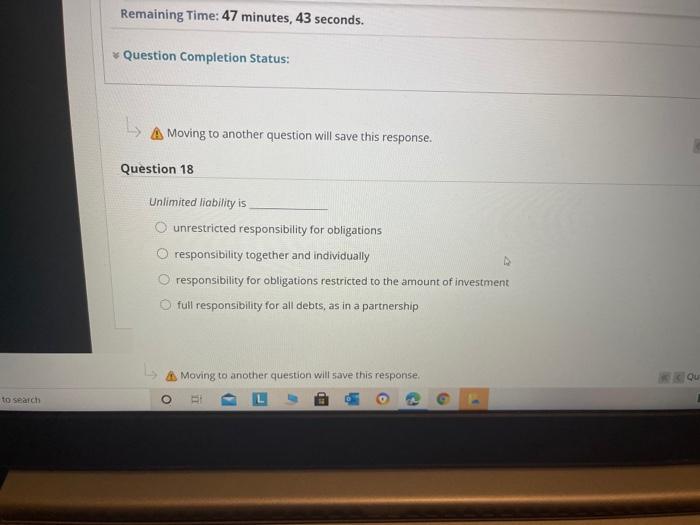

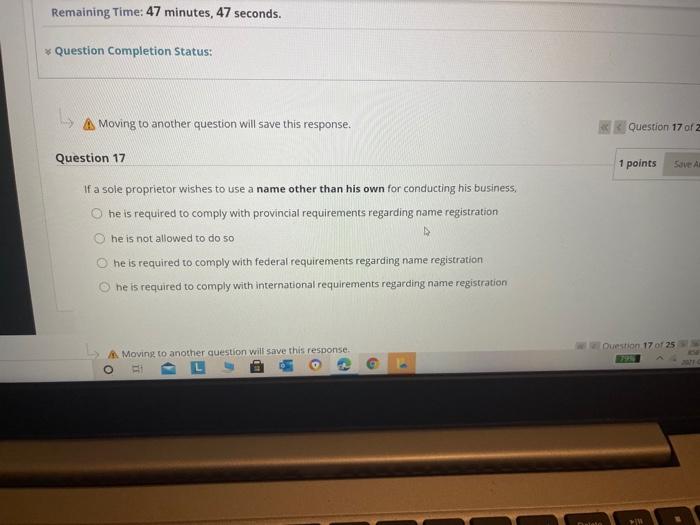

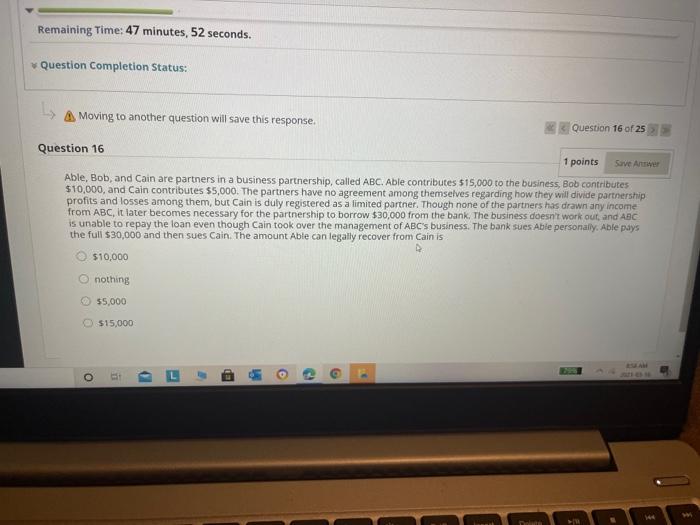

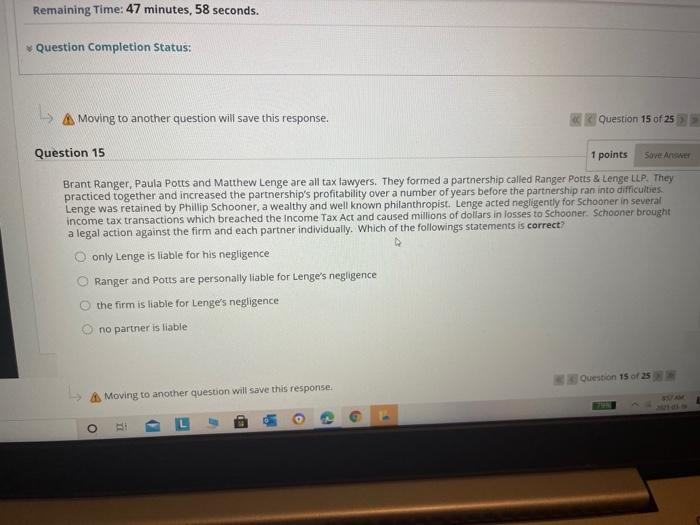

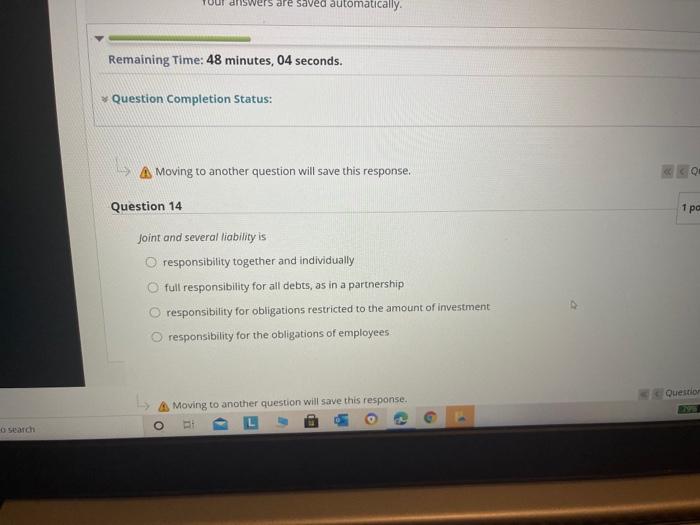

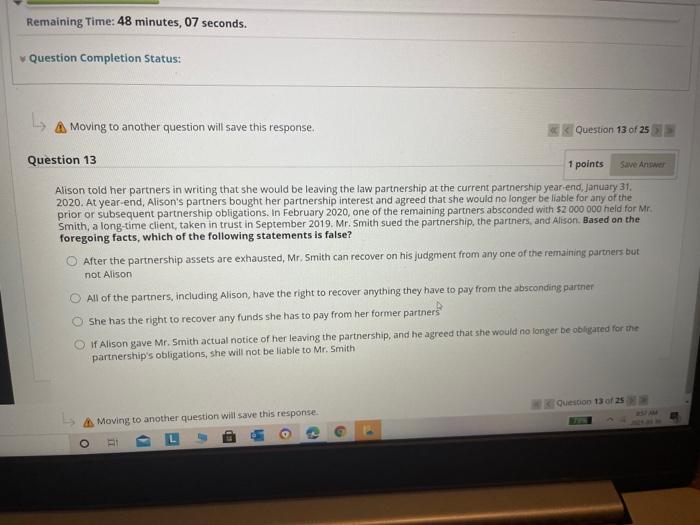

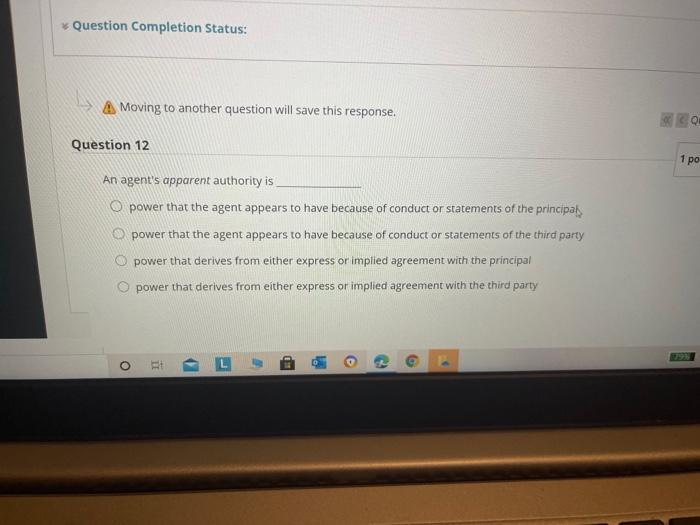

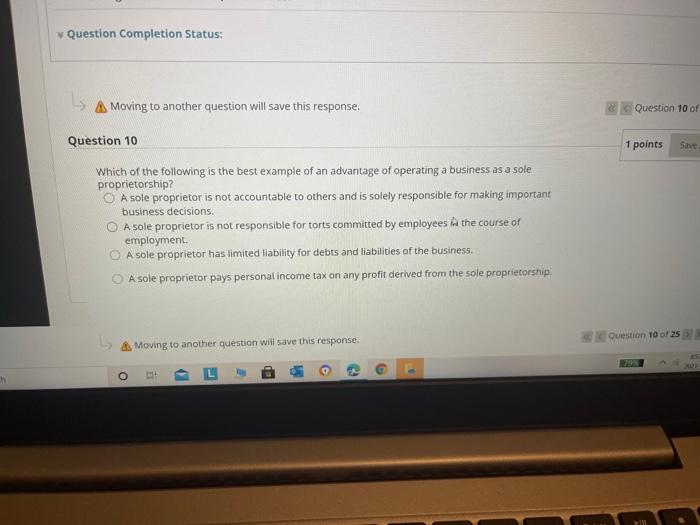

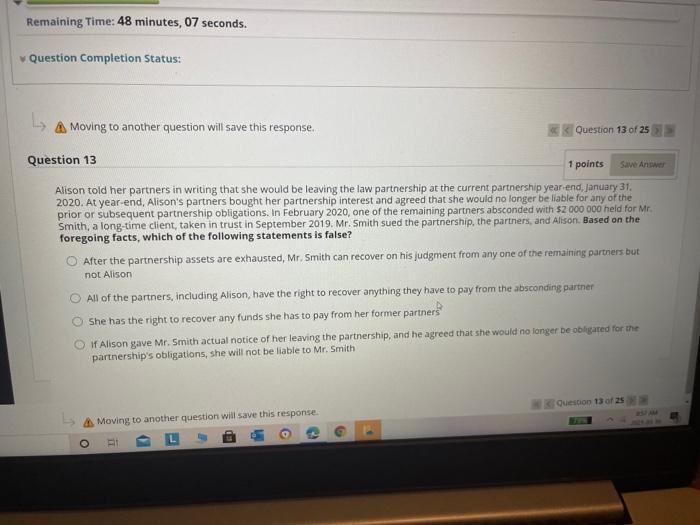

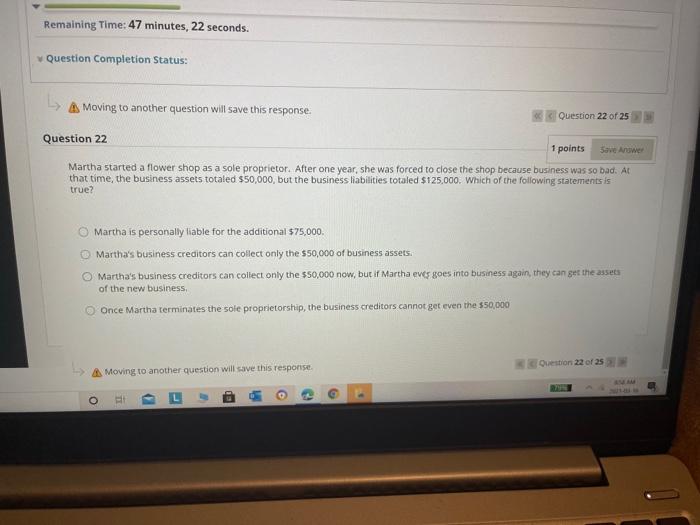

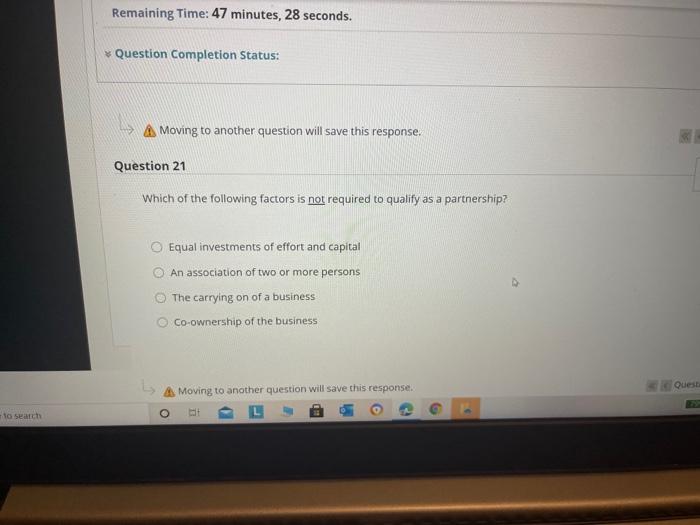

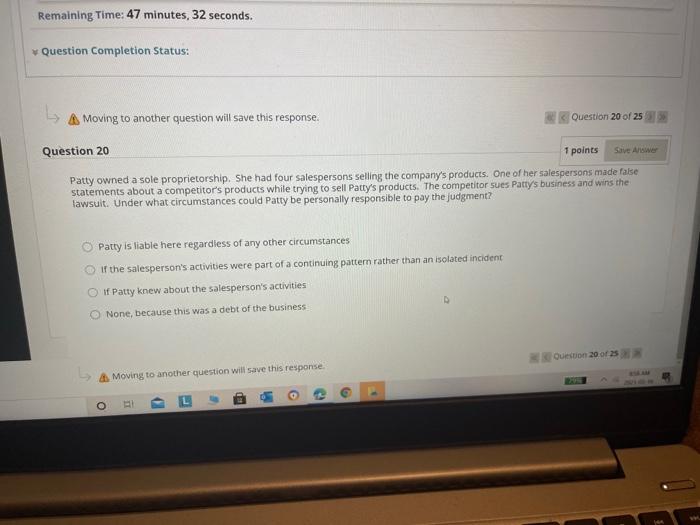

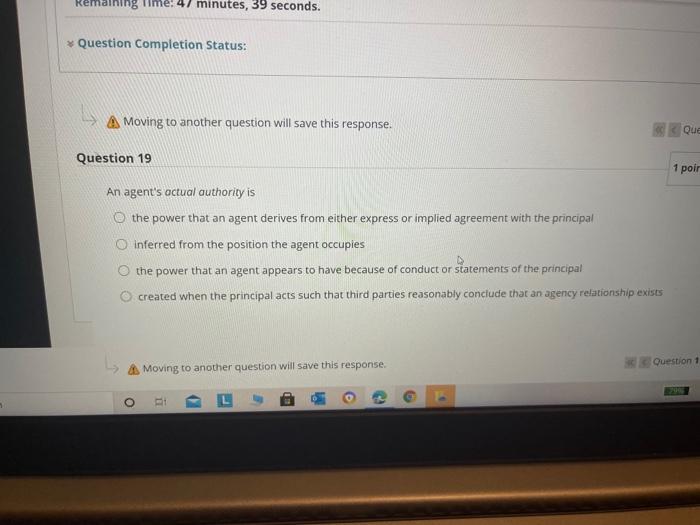

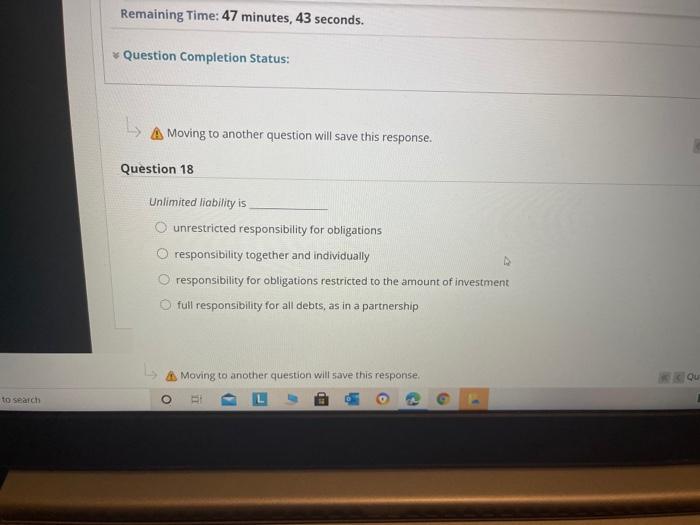

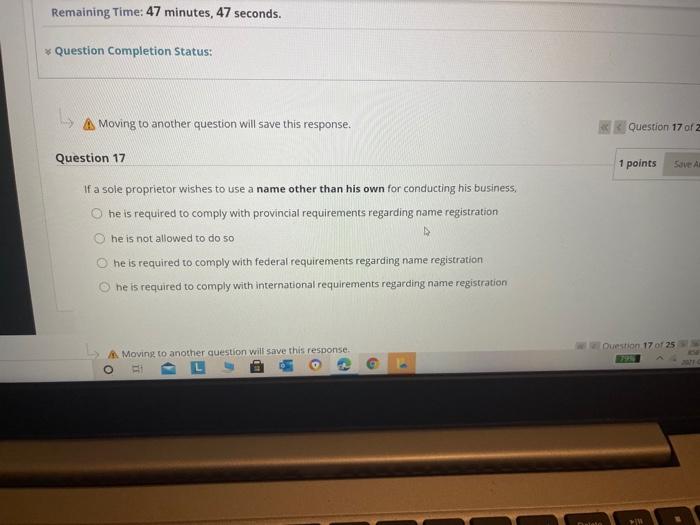

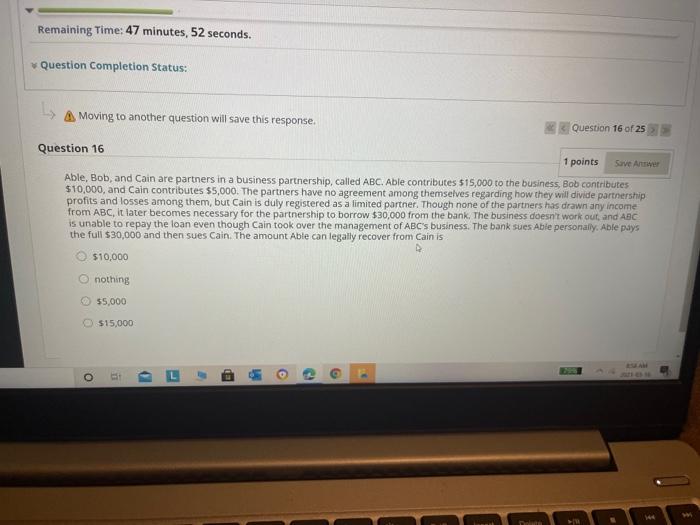

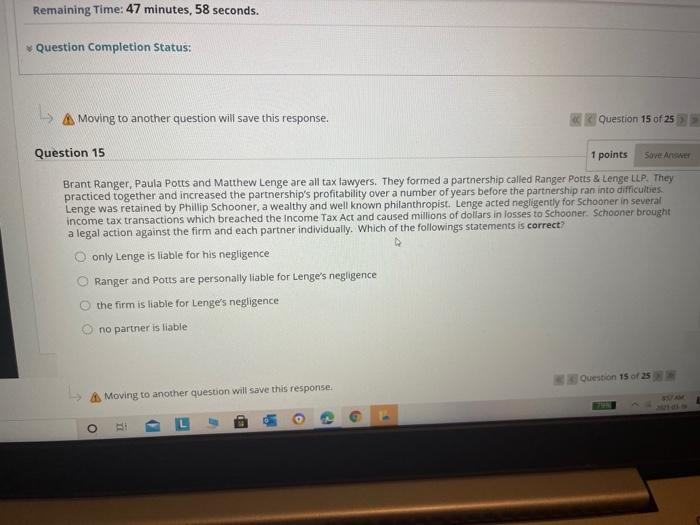

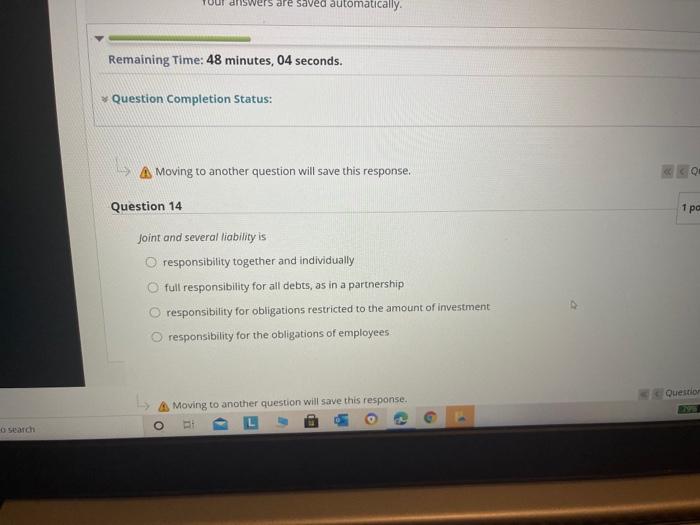

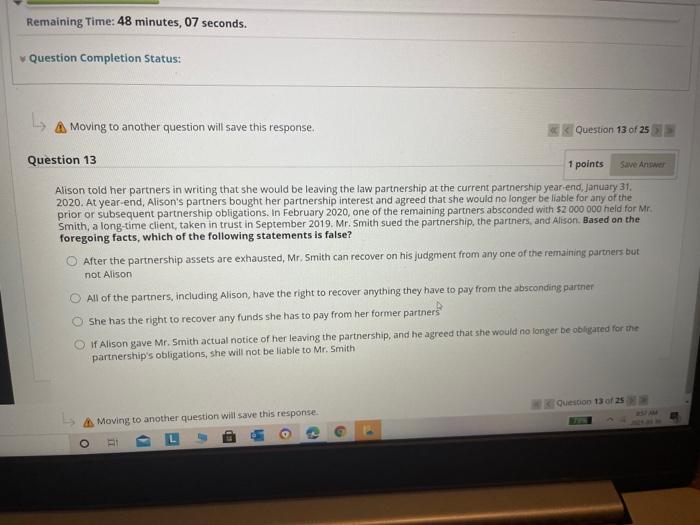

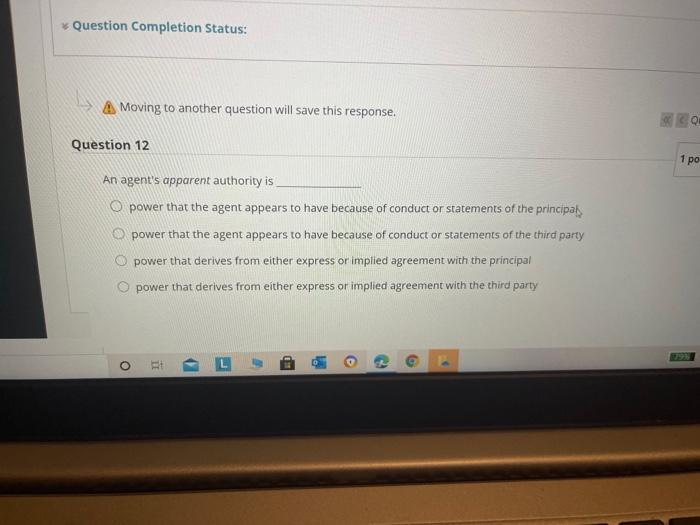

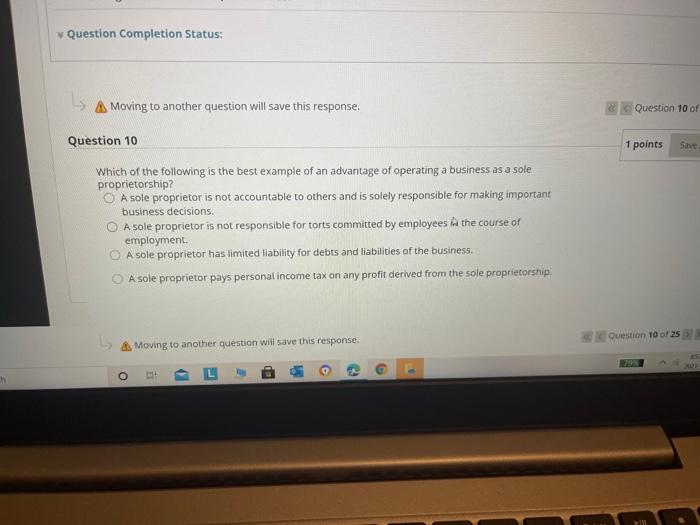

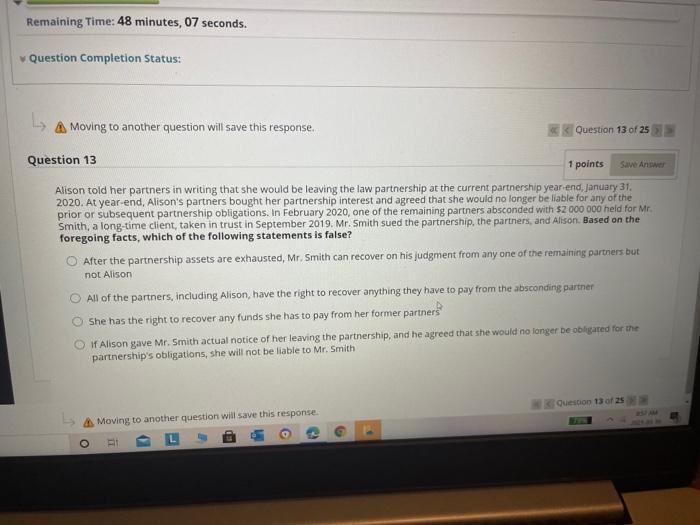

estion Completion Status: Save and A Click Submit to complete this assessment. Questi estion 25 1 points Sa Which of the following best describes an effect of forming and registering a limited partnership? Some of the partners have limited liability for the partnership debts. All of the partners have limited liability for the partnership debts. The general partners have limited liability for the partnership debts. The partnership has limited liability for the partnership debts. Question 25 Click Submit to complete this assessment Save and Submit O TI Remaining Time: 47 minutes, 09 seconds. Question Completion Status: Save and A Click Submit to complete this assessment. Questio Question 25 1 points SOV Which of the following best describes an effect of forming and registering a limited partnership O Some of the partners have limited liability for the partnership debts. All of the partners have limited liability for the partnership debts. The general partners have limited liability for the partnership debts. The partnership has limited liability for the partnership debts. L Click Submit to complete this assessment. Question 25 Save and Sub o arch - . Remaining Time: 47 minutes, 13 seconds. Question Completion Status: A Moving to another question will save this response. Question 24 of 25 Question 24 1 points Save Answer Sharon is a partner in XYZ Partnership, but does not have consent from her partners to act for XYZ in forming contracts of any kind. However, Sharon represents herself to be an agent for the partnership in entering a contract to purchase office supplies on credit for the partnership from Joe's Stationery. the partnership is bound to pay for the office supplies, because Sharon had apparent authority to act as its agent the partnership is bound to pay for the office supplies, because Sharon had actual authority to act as its agent the partnership is not bound to pay for the office supplies, because Sharon did not have authority to act as its agent the partnership is not bound to pay for the office supplies, because Joe's Stationery had a duty to investigate whether Sharon had authority to act as its agent Moving to another question will save this response. Question 24 of 25 ED O o G Remaining Time: 47 minutes, 22 seconds. Question Completion Status: Moving to another question will save this response Question 22 of 25 Question 22 1 points Save Anwe Martha started a flower shop as a sole proprietor. After one year, she was forced to close the shop because business was so bad. At that time, the business assets totaled $50,000, but the business liabilities totaled $125,000. Which of the following statements is true? Martha is personally liable for the additional $75,000 Martha's business creditors can collect only the $50,000 of business assets. Martha's business creditors can collect only the $50,000 now, but if Martha eves goes into business again, they can get the assets of the new business, Once Martha terminates the sole proprietorship, the business creditors cannot get even the $50,000 Question 22 of 252 A Moving to another question will save this response o . Remaining Time: 47 minutes, 28 seconds. Question Completion Status: Moving to another question will save this response. Question 21 Which of the following factors is not required to qualify as a partnership? Equal investments of effort and capital An association of two or more persons The carrying on of a business Co-ownership of the business Moving to another question will save this response. Quest o to search ED Remaining Time: 47 minutes, 32 seconds. Question Completion Status: A Moving to another question will save this response. Question 20 of 25 Question 20 1 points Save Answer Patty owned a sole proprietorship. She had four salespersons selling the company's products. One of her salespersons made false statements about a competitor's products while trying to sell Patty's products. The competitor sues Pattys business and wins the lawsuit. Under what circumstances could Patty be personally responsible to pay the judgment? Patty is liable here regardless of any other circumstances if the salesperson's activities were part of a continuing pattern rather than an isolated incident D If Patty knew about the salesperson's activities None, because this was a debt of the business Question 20 of 2 Moving to another question will save this response. o - 5 emaining 47 minutes, 39 seconds. Question Completion Status: A Moving to another question will save this response. Que Question 19 1 poir An agent's actual authority is O the power that an agent derives from either express or implied agreement with the principal O inferred from the position the agent occupies the power that an agent appears to have because of conduct or statements of the principal created when the principal acts such that third parties reasonably conclude that an agency relationship exists Moving to another question will save this response. Question 1 G o Remaining Time: 47 minutes, 43 seconds. Question Completion Status: A Moving to another question will save this response. Question 18 Unlimited liability is unrestricted responsibility for obl ons responsibility together and individually responsibility for obligations restricted to the amount of investment full responsibility for all debts, as in a partnership Moving to another question will save this response. to search G Remaining Time: 47 minutes, 47 seconds. * Question Completion Status: Moving to another question will save this response. Question 17 of 2 Question 17 1 points Save A If a sole proprietor wishes to use a name other than his own for conducting his business, he is required to comply with provincial requirements regarding name registration he is not allowed to do 50 > he is required to comply with federal requirements regarding name registration he is required to comply with international requirements regarding name registration Question 17 of 25 A Moving to another question will save this response. LED 0 G . Remaining Time: 47 minutes, 52 seconds. Question Completion Status: A Moving to another question will save this response. Question 16 of 25 Question 16 1 points Save Awe Able, Bob, and Cain are partners in a business partnership, called ABC. Able contributes $15,000 to the business, Bob contributes $10,000, and Cain contributes 55,000. The partners have no agreement among themselves regarding how they will divide partnership profits and losses among them, but Cain is duly registered as a limited partner. Though none of the partners has drawn any income from ABC, it later becomes necessary for the partnership to borrow $30,000 from the bank. The business doesn't work out, and ABC is unable to repay the loan even though Cain took over the management of ABC's business. The bank sues Able personally. Able pays the full $30,000 and then sues Cain. The amount Able can legally recover from Cain is $10,000 nothing $5,000 $15,000 ED o O @ Remaining Time: 47 minutes, 58 seconds. Question Completion Status: Save Answer A Moving to another question will save this response. Question 15 of 25 Question 15 1 points Brant Ranger, Paula Potts and Matthew Lenge are all tax lawyers. They formed a partnership called Ranger Potts & Lenge LLP. They practiced together and increased the partnership's profitability over a number of years before the partnership ran into difficulties Lenge was retained by Phillip Schooner, a wealthy and well known philanthropist. Lenge acted negligently for Schooner in several income tax transactions which breached the Income Tax Act and caused millions of dollars in losses to Schooner. Schooner brought a legal action against the firm and each partner individually. Which of the followings statements is correct? only Lenge is liable for his negligence Ranger and Potts are personally liable for lenge's negligence the firm is liable for Lenge's negligence no partner is liable Question 15 of 25 Moving to another question will save this response. o 2 answers are saved automatically Remaining Time: 48 minutes, 04 seconds. Question Completion Status: A Moving to another question will save this response. QE Question 14 1 pc Joint and several liability is responsibility together and individually full responsibility for all debts, as in a partnership responsibility for obligations restricted to the amount of investment responsibility for the obligations of employees Questio Moving to another question will save this response. o search Remaining Time: 48 minutes, 07 seconds. Question Completion Status: L A Moving to another question will save this response. Question 13 of 25 Question 13 1 points Save Answer Alison told her partners in writing that she would be leaving the law partnership at the current partnership year end, January 31. 2020. At year-end, Alison's partners bought her partnership interest and agreed that she would no longer be liable for any of the prior or subsequent partnership obligations. In February 2020, one of the remaining partners absconded with $2 000 000 held for Mr. Smith, a long-time client, taken in trust in September 2019. Mr. Smith sued the partnership, the partners, and Alison Based on the foregoing facts, which of the following statements is false? After the partnership assets are exhausted, Mr. Smith can recover on his judgment from any one of the remaining partners but not Alison All of the partners, including Alison, have the right to recover anything they have to pay from the absconding partner She has the right to recover any funds she has to pay from her former partners if Alison gave Mr. Smith actual notice of her leaving the partnership, and he agreed that she would no longer be obligated for the partnership's obligations, she will not be liable to Mr. Smith Question 13 of 25 Moving to another question will save this response 5 o Question Completion Status: A Moving to another question will save this response. Question 12 1 po An agent's apparent authority is O power that the agent appears to have because of conduct or statements of the principals power that the agent appears to have because of conduct or statements of the third party power that derives from either express or implied agreement with the principal power that derives from either express or implied agreement with the third party O . L Question Completion Status: Moving to another question will save this response. Question 10 of Question 10 1 points Save Which of the following is the best example of an advantage of operating a business as a sole proprietorship? A sole proprietor is not accountable to others and is solely responsible for making important business decisions. A sole proprietor is not responsible for torts committed by employees the course of employment A sole proprietor has limited liability for debts and liabilities of the business. A sole proprietor pays personal income tax on any profit derived from the sole proprietorship Question 10 of 25 Moving to another question will save this response th Remaining Time: 48 minutes, 07 seconds. Question Completion Status: L A Moving to another question will save this response. Question 13 of 25 Question 13 1 points Save Answer Alison told her partners in writing that she would be leaving the law partnership at the current partnership year end, January 31. 2020. At year-end, Alison's partners bought her partnership interest and agreed that she would no longer be liable for any of the prior or subsequent partnership obligations. In February 2020, one of the remaining partners absconded with $2 000 000 held for Mr. Smith, a long-time client, taken in trust in September 2019. Mr. Smith sued the partnership, the partners, and Alison Based on the foregoing facts, which of the following statements is false? After the partnership assets are exhausted, Mr. Smith can recover on his judgment from any one of the remaining partners but not Alison All of the partners, including Alison, have the right to recover anything they have to pay from the absconding partner She has the right to recover any funds she has to pay from her former partners if Alison gave Mr. Smith actual notice of her leaving the partnership, and he agreed that she would no longer be obligated for the partnership's obligations, she will not be liable to Mr. Smith Question 13 of 25 Moving to another question will save this response 5 o