Question: estions, 2 hrs) Saved Help Save & Exit S Stepnoski Corporation is considering a capital budgeting project that would involve investing $160,000 in equipment with

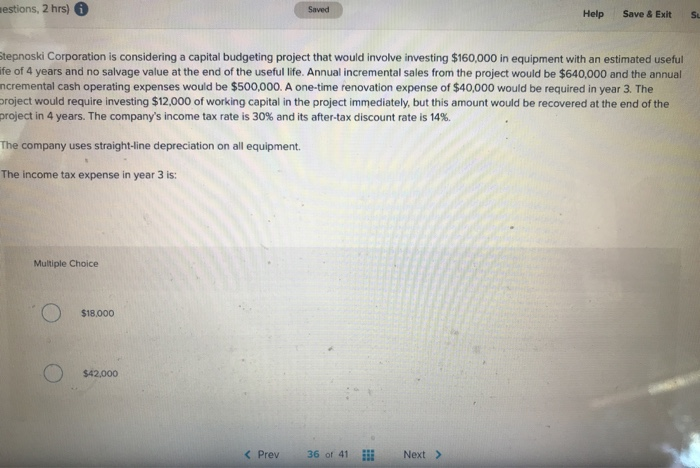

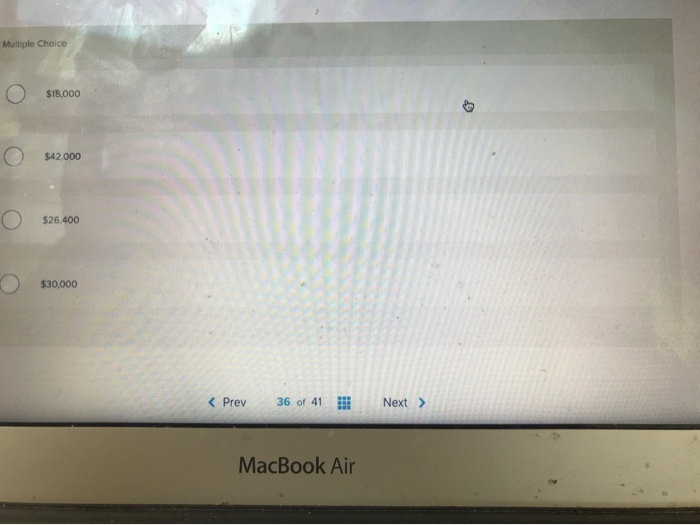

estions, 2 hrs) Saved Help Save & Exit S Stepnoski Corporation is considering a capital budgeting project that would involve investing $160,000 in equipment with an estimated useful ife of 4 years and no salvage value at the end of the useful life. Annual incremental sales from the project would be $640,000 and the annual ncremental cash operating expenses would be $500,000. A one-time renovation expense of $40,000 would be required in year 3. The project would require investing $12,000 of working capital in the project immediately, but this amount would be recovered at the end of the project in 4 years. The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is: Multiple Choice O $18.000 O $42,000 Multiple Choice O $18,000 O $42.000 O O MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts