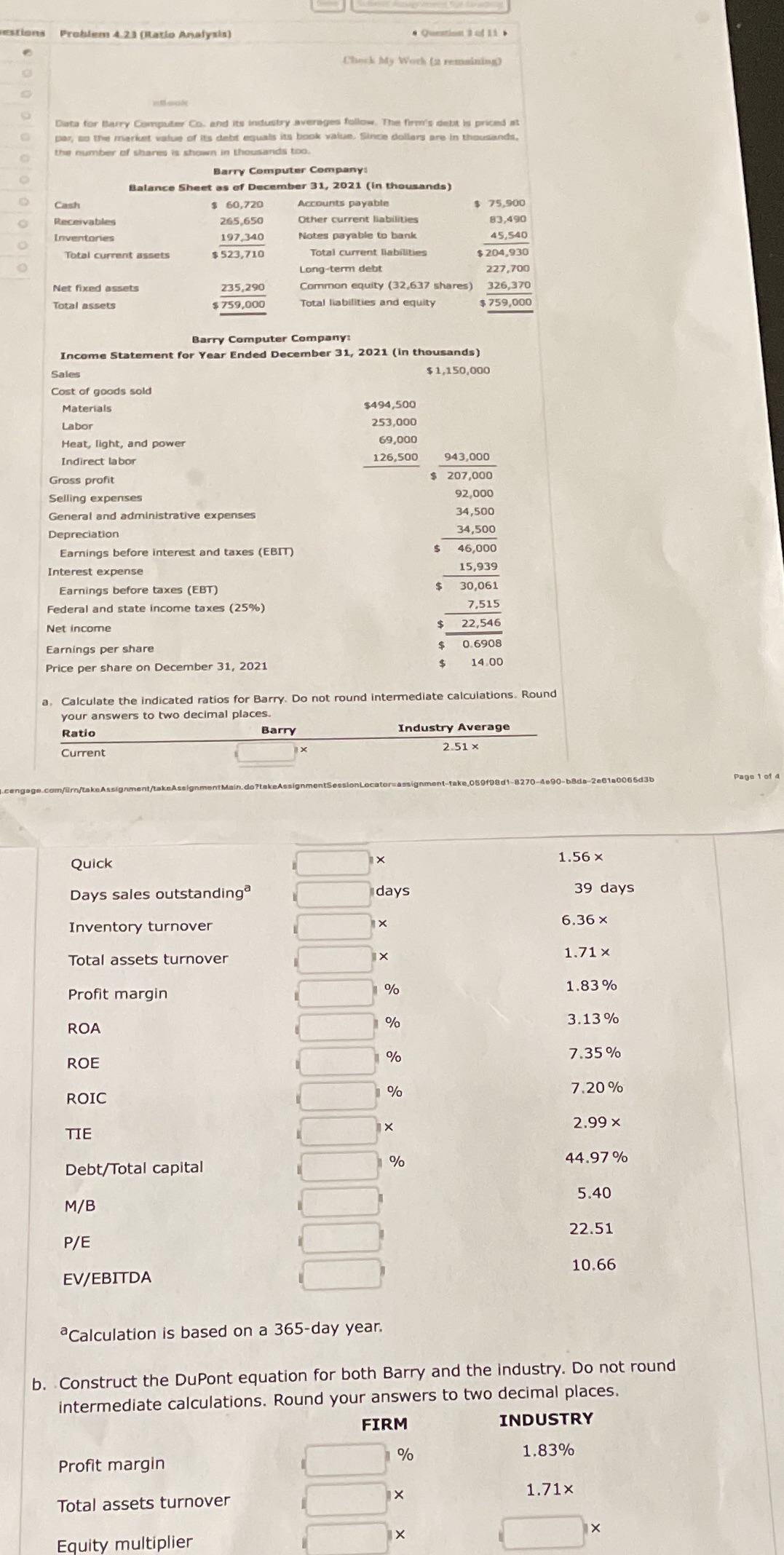

Question: estions Problem 4.23 (Ratio Analysis) Check My Work (a remaining Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced

estions Problem 4.23 (Ratio Analysis) Check My Work (a remaining Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, to the market value of its debt equals its book value. Since dollars are in the ands. the number of shares is show ands too. Barry Computer Company: Balance Sheet as of December 31, 2021 (In thousands) Cash $ 60,720 Accounts payable $ 75,900 Receivables 265,650 Other current liabilities 83,490 Inventories 197.340 Notes payable to bank 45,540 Total current assets $ 523,710 Total current labilities $ 204,930 O Long-term debt 227,700 Net fixed assets 235,290 Common equity (32,637 shares) 326,370 Total assets 759,000 Total liabilities and equity $ 759,000 Barry Computer Company: Income Statement for Year Ended December 31, 2021 (In thousands) Sales $ 1,150,000 Cost of goods sold Materials $494,500 Labor 253,000 Heat, light, and power 69,000 Indirect labor 126,500 943,000 Gross profit 207,000 Selling expenses 92,000 General and administrative expenses 34,500 Depreciation 34,500 Earnings before interest and taxes (EBM) 46,000 Interest expense 15,939 Earnings before taxes (EBT) 30,061 Federal and state income taxes (25%) 7,515 Net income 22,546 Earnings per share 0.6908 Price per share on December 31, 2021 14.00 . Calculate the indicated ratios for Barry. Do not round intermediate calculations. Round your answers to two decimal places. Ratio Barry Industry Average Current X 2.51 x cengage. ment-take,059f98d1-8270-4090-bada-261 0065d3b Page 1 of 4 Quick X 1.56 x Days sales outstanding days 39 days Inventory turnover X 6.36 x Total assets turnover X 1.71 x Profit margin 1.83% ROA 3.13% ROE 7.35% ROIC 7.20% TIE X 2.99 x Debt/Total capital 0/% 44.97% M/B 5.40 P/E 22.51 EV/EBITDA 10.66 Calculation is based on a 365-day year. b. Construct the DuPont equation for both Barry and the industry. Do not round intermediate calculations. Round your answers to two decimal places. FIRM INDUSTRY Profit margin % 1.83% Total assets turnover X 1.71x Equity multiplier X X