Question: et as Default Color Borde Page Background Document Formatting 5. A corporate bond with a 5.5 percent coupon has 20 years left to maturity. It

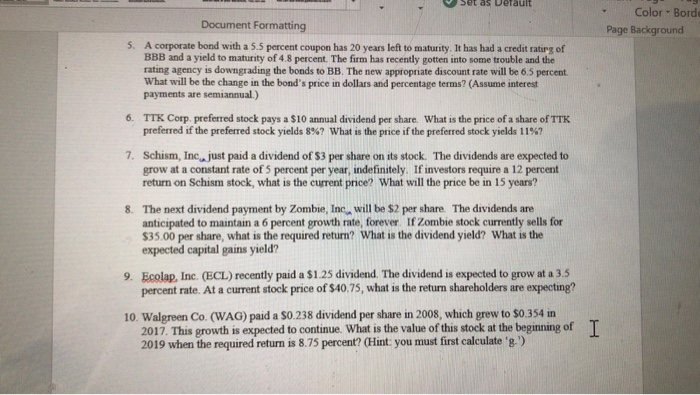

et as Default Color Borde Page Background Document Formatting 5. A corporate bond with a 5.5 percent coupon has 20 years left to maturity. It has had a credit ratirg of BBB and a yield to maturity of 4.8 percent. The firm has recently gotten into some trouble and the rating agency is downgrading the bonds to BB. The new appropriate discount rate will be 6.5 percent. What will be the change in the bond's price in dollars and percentage terms? (Assume interest payments are semiannual.) 6. TTK Corp, preferred stock pays a $10 annual dividend per share. What is the price of a share of TTK preferred if the preferred stock yields 8%? what is the price if the preferred stock yields l 1%? 7. Schism, Inc just paid a dividend of $3 per share on its stock. The dividends are expected to grow at a constant rate of 5 percent per year, indefinitely. If investors require a 12 percent return on Schism stock, what is the current price? What will the price be in 15 years? 8. The next dividend payment by Zombie, Inc, will be $2 per share. The dividends are anticipated to maintain a 6 percent growth rate, forever. If Zombie stock currently sells for $35.00 per share, what is the required return? What is the dividend yield? What is the expected capital gains yield? 9. Ecolap, Inc. (ECL) recently paid a $1.25 dividend. The dividend is expected to grow at a 3.5 percent rate. At a current stock price of $40.75, what is the return shareholders are expecting? 10. Walgreen Co. (WAG) paid a S0.238 dividend per share in 2008, which grew to $0.354 in T 2017. This growth is expected to continue. What is the value of this stock at the beginning of 2019 when the required return is 8.75 percent? (Hint: you must first calculate '8.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts