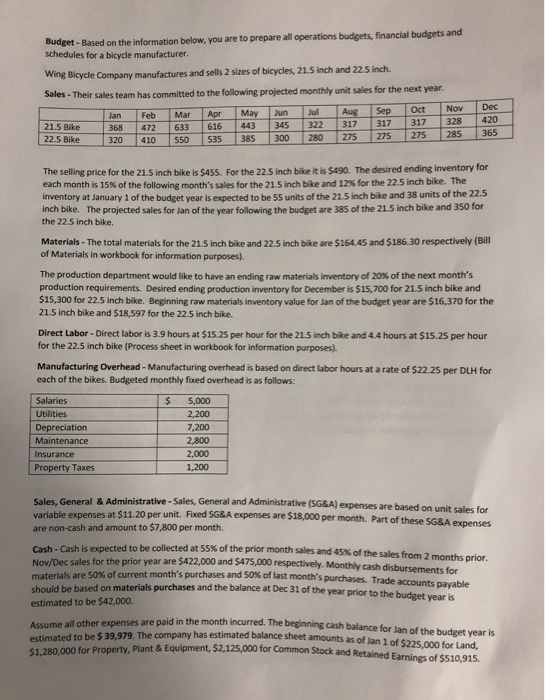

Question: et - Based on the information below, you are to prepare all operations budgets, financial budgets and schedules for a bicycle manufacturer Budget Wi boel

et - Based on the information below, you are to prepare all operations budgets, financial budgets and schedules for a bicycle manufacturer Budget Wi boel Company nende 3 Sales- Their sales team has committed to the following projected monthly unit sales for the next year Jan FebMar Apr May 368 472 633 616 443345 322 317317 317 328 Junul Aug Sep Oct Nov Dec 420 21.5 Bik 320 10 S50 535 385 300 280 275 275 275 285 365 The selling price for the 21.5 inch bike is $455. For the 22.5 inch bike it is $490. The desired ending inventory for each month is 15% of the following month's sales for the 215 inch bike and 12% for the 22.5 inch bike. The inventory at January 1 of the budget year is expected to be 5S units of the 21.5 inch bike and 38 units of the 22.5 inch bike. The projected sales for Jan of the year following the budget are 385 of the 21.5 inch bike and 350 for the 22.5 inch bike. Materials - The total materials for the 21.5 inch bike and 22.5 inch bike are $164.45 and $186.30 respectively (Bill of Materials in workbook for information purposes) The production department would like to have an ending raw materials inventory of 20% of the next month's production requirements. Desired ending production inventory for December is $15,700 for 21.5 inch bike and $15,300 for 22.5 inch bike. Beginning raw materials inventory value for Jan of the budget year are $16,370 for the 21.5 inch bike and $18,597 for the 22.5 inch bike. Direct Labor- Direct labor is 3.9 hours at $15.25 per hour for the 215 inch bike and 4.4 hours at $15.25 per hour for the 22.5 inch bike (Process sheet in workbook for information purposes). Manufacturing Overhead -Manufacturing overhead is based on direct labor hours at a rate of $22.25 per DLH for each of the bikes. Budgeted monthly fixed overhead is as follows Salaries Utilities Depreciation Maintenance Insurance Property Taxes $ 5,000 2,200 7,200 2,800 2,000 1,200 sales, General & Administrative- Sales, variable expenses at $11.20 per unit. Fixed SG&A are non-cash and amount to $7,800 per month. General and Administrative (SG&A) expenses are based on unit sales for expenses are $18,000 per month. Part of these SG&A expenses Cash-Cash is expected to be collected at 55% of the prior month sales and 45% of the Nov/Dec sales for the prior year are $422,000 and $475,000 respectively. materials are 50% of current month's purchases and 50% of last month's purchases. should be based on materials purchases and the balance at Dec 31 of the estimated to be $42,000. sales from 2 months prior Monthly cash disbursements for Trade accounts payable year prior to the budget year is expenses are paid in the month incurred. The beginning cash balance for Jan of the budget year is Assume all other estimated to be $ 39,979. The company has estimated balance sheet amounts as of $1,280,000 Jan 1 of $225,000 for Land, Plant & Equipment, $2,125,000 for Common Stock and Retained Earnings of $510,915. for Property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts