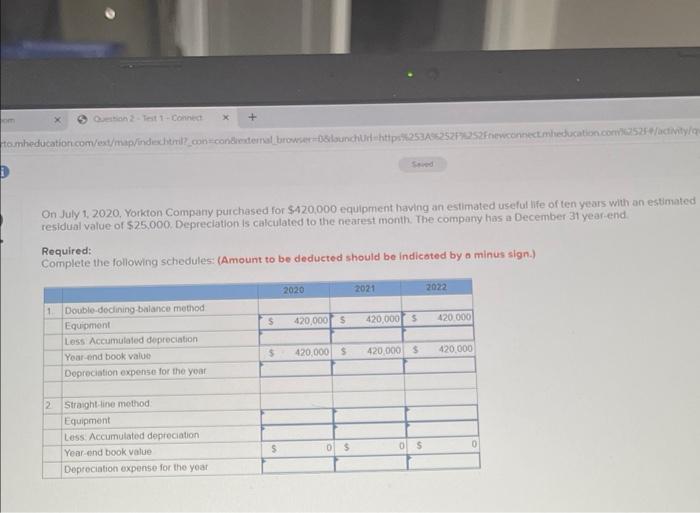

Question: et Connect X Homheducation.com/ext/map/indechtil?con.concederal browserBlouchd-https253A%252Fwconnecteducation.co521/activity On July 1, 2020. Yorkton Company purchased for $420,000 equipment having an estimated useful life of ten years with an

et Connect X Homheducation.com/ext/map/indechtil?con.concederal browserBlouchd-https253A%252Fwconnecteducation.co521/activity On July 1, 2020. Yorkton Company purchased for $420,000 equipment having an estimated useful life of ten years with an estimated residual value of $25.000 Depreciation is calculated to the nearest month. The company has a December 31 year end Required: Complete the following schedules: (Amount to be deducted should be indicated by a minus sign.) 2020 2021 2022 1 $ 420.000 $ 420,000 s 120.000 Double-dochining balance method Equipment Less Accumulated depreciation Year-end book value Depreciation expense for the year 5 420.000$ 420.000 $ 420.000 2 Straight line mothod Equipment Less. Accumulated depreciation Year-end book value Depreciation expense for the year 5 0$ 0$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts