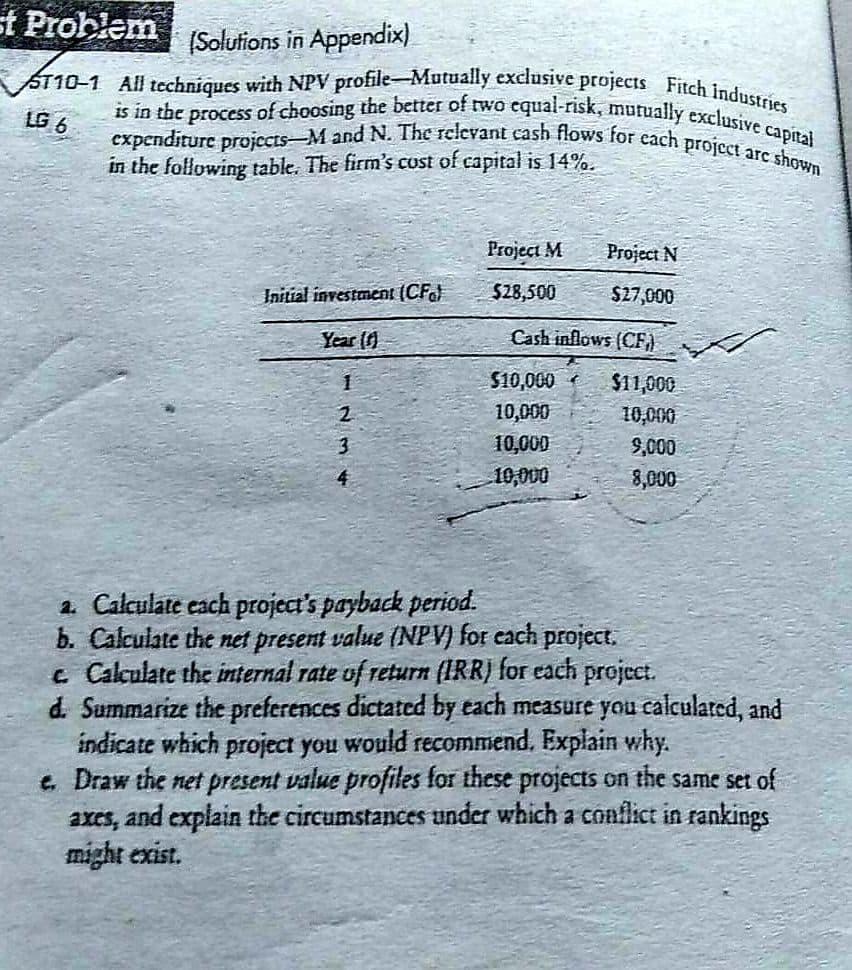

Question: Et Problem (Solutions in Appendix) ST10-1 All techniques with NPV profile-Mutually exclusive projects Fitch industries expenditure projects-M and N. The relevant cash flows for each

Et Problem (Solutions in Appendix) ST10-1 All techniques with NPV profile-Mutually exclusive projects Fitch industries expenditure projects-M and N. The relevant cash flows for each project arc shown is in the process of choosing the better of two equal-risk, mutually exclusive capital in the following table. The firm's cost of capital is 14%. LG 6 Project M Project N Initial investment (CF) $28,500 $27,000 Year Cash inflows (CF) 1 2 $10,000 10,000 10,000 10,000 $11,000 10,000 9,000 8,000 3 4 2. Calculate each project's payback period. b. Calculate the net present value (NPV) for each project. c Calculate the internal rate of return (IRR) for each project. 4 Summarize the preferences dictated by each measure you calculated, and indicate which project you would recommend. Explain why. . Draw the net present value profiles for these projects on the same set of axes, and explain the circumstances under which a conflict in rankings might exist. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts