Question: ethics question 10 Homework: Ethics Assignment i 10 Part 2 of 3 2.14 points Skopped eBook Hint Print References Saved Simon Company's year-end balance sheets

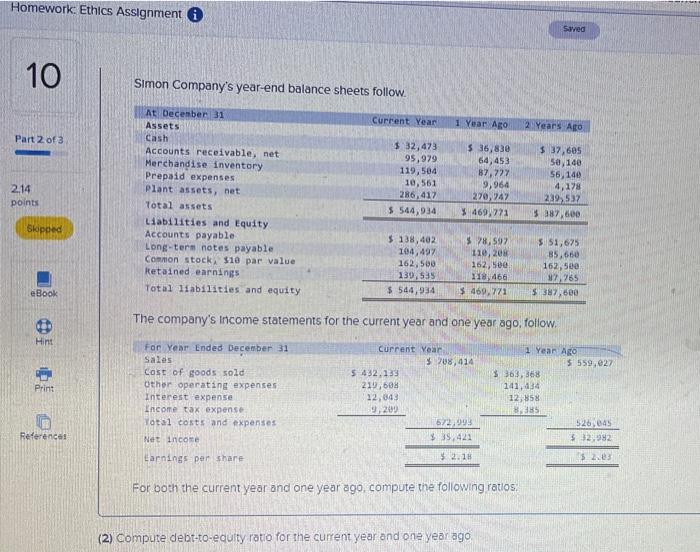

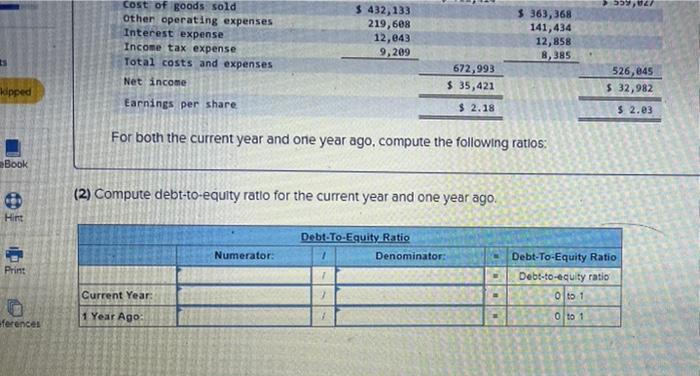

Homework: Ethics Assignment i 10 Part 2 of 3 2.14 points Skopped eBook Hint Print References Saved Simon Company's year-end balance sheets follow. At December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash $ 36,830 $ 37,605 $ 32,473 95,979 119,504 64,453 Accounts receivable, net Merchandise inventory. Prepaid expenses 50,140 87,777 56,140 4,178 Plant assets, net 10, 561 286,417 $544,934. 9,964 270,747 239,537 Total assets $ 469,771 $ 387,600. Liabilities and Equity. Accounts payable Long-term notes payable. $ 138,402 104,497 162,500 139,535 $78,597 110, 208 162, 500 118,466 Common stock, $10 par value $ 51,675 85,660 162,500 97,765 Retained earnings Total liabilities and equity $ 544,934 $469,771 $ 387,600 The company's Income statements for the current year and one year ago, follow. Current Year 1 Year Ago For Year Ended December 31 Sales $ 708,414 Cost of goods sold S 432,133 $363,368 141, 434 Other operating expenses 219,608 12,858 Interest expense 12,043 9,209 8,385 Income tax expense Total costs and expenses 672,993 Net Income $ 35,421 $2.18 Earnings per share For both the current year and one year ago, compute the following ratios: (2) Compute debt-to-equity ratio for the current year and one year ago. $ 559,027 526,045 $ 32,982 $2.03 ES kipped Book Hint Print ferences Cost of goods sold $ 432,133 $ 363,368 Other operating expenses Interest expense 219,608 141,434 12,858 Income tax expense 12,043 9,209 8,385 Total costs and expenses 672,993 Net income $ 35,421 Earnings per share $ 2.18 For both the current year and one year ago, compute the following ratios: (2) Compute debt-to-equity ratio for the current year and one year ago. Debt-To-Equity Ratio Numerator: 1 Denominator: 1 Current Year: 7 1 1 Year Ago: 559,02 526,045 $ 32,982 $ 2.03 Debt-To-Equity Ratio Debt-to-equity ratio 0 to 1 0 to 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts