Question: ETM Co is considering two different projects. Project A is a local project with all cash flows in kwacha while project B is a

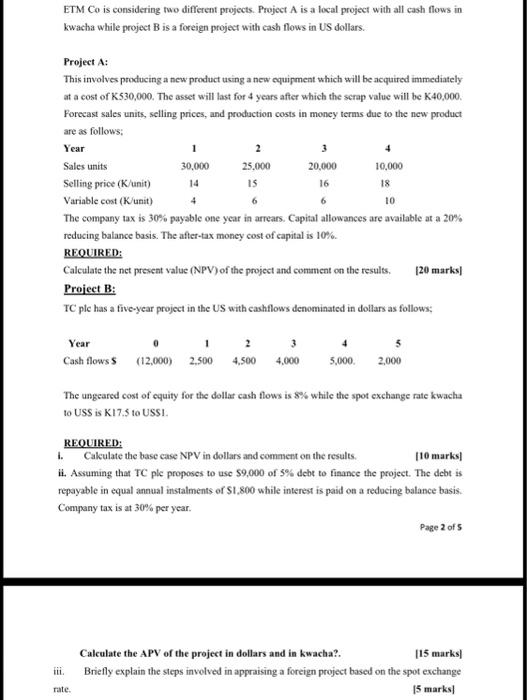

ETM Co is considering two different projects. Project A is a local project with all cash flows in kwacha while project B is a foreign project with cash flows in US dollars. Project A: This involves producing a new product using a new equipment which will be acquired immediately at a cost of K530,000. The asset will last for 4 years after which the scrap value will be K40,000. Forecast sales units, selling prices, and production costs in money terms due to the new product are as follows: 2 Year Sales units 25,000 Selling Price (K/unit) 15 Variable cost (K/unit) 6 The company tax is 30% payable one year in arrears. Capital allowances are available at a 20% reducing balance basis. The after-tax money cost of capital is 10%. REQUIRED: 30,000 14 4 Year 1 2 3 Cash flows $ (12,000) 2.500 4,500 4,000 20,000 16 10,000 18 Calculate the net present value (NPV) of the project and comment on the results. [20 marks] Project B: TC ple has a five-year project in the US with cashflows denominated in dollars as follows: rate. 10 5,000 2,000 The ungeared cost of equity for the dollar cash flows is 8% while the spot exchange rate kwacha to USS is K17.5 to USSI. REQUIRED: 1. [10 marks] Calculate the base case NPV in dollars and comment on the results. ii. Assuming that TC ple proposes to use $9,000 of 5% debt to finance the project. The debt is repayable in equal annual instalments of $1,800 while interest is paid on a reducing balance basis. Company tax is at 30% per year. Page 2 of 5 Calculate the APV of the project in dollars and in kwacha?. [15 marks] Briefly explain the steps involved in appraising a foreign project based on the spot exchange 15 marks]

Step by Step Solution

3.25 Rating (146 Votes )

There are 3 Steps involved in it

The image youve provided contains a case study with questions regarding the calculation of the Net Present Value NPV and the Adjusted Present Value APV of two different projects Project A and Project ... View full answer

Get step-by-step solutions from verified subject matter experts