Question: et's continue with our Big Red example. Recall that Big Red is considering aking on a five-year contract with Standard Refining to distribute refined oil

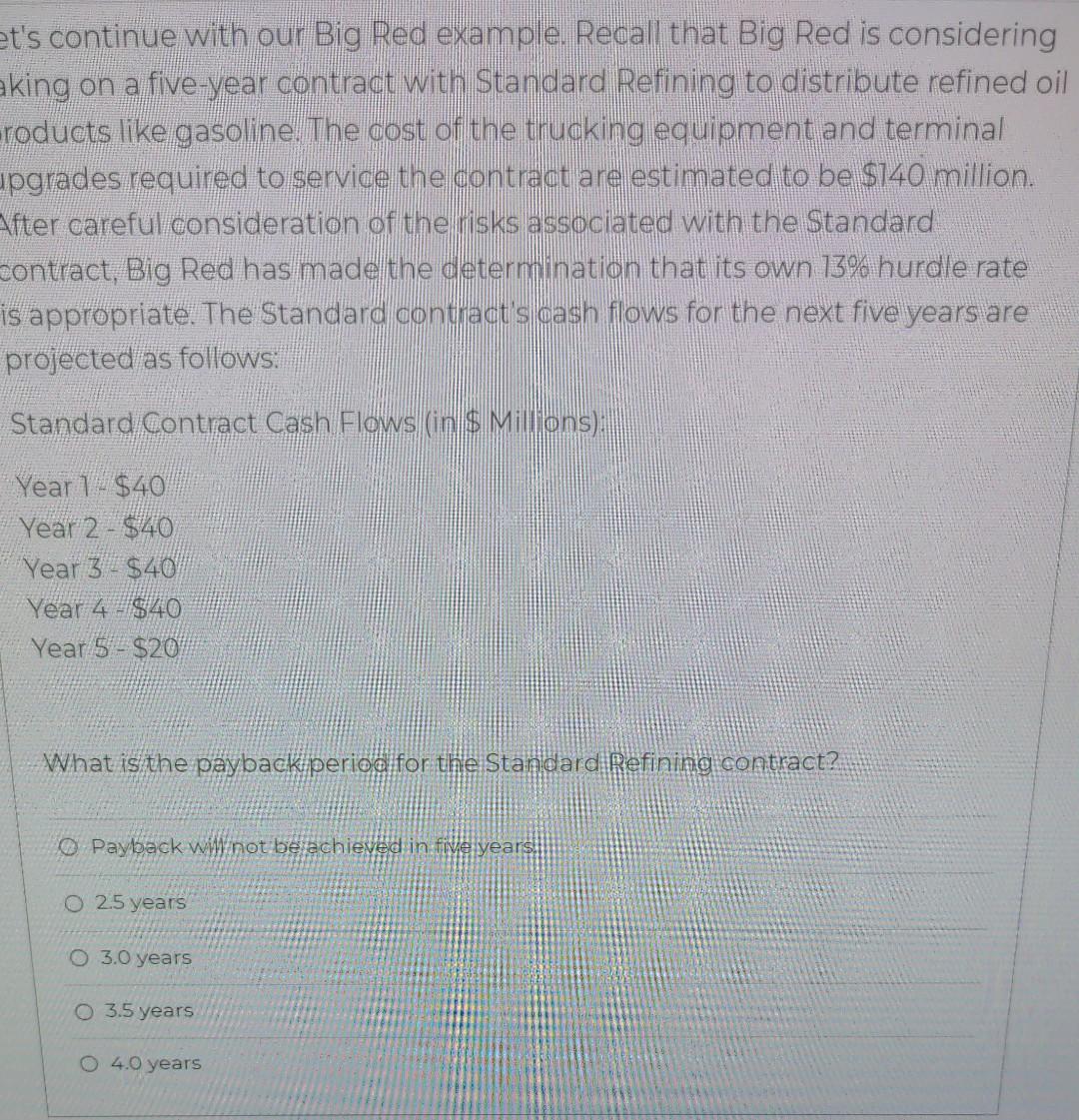

et's continue with our Big Red example. Recall that Big Red is considering aking on a five-year contract with Standard Refining to distribute refined oil roducts like gasoline. The cost of the trucking equipment and terminal upgrades required to service the contract are estimated to be $140 million. After careful consideration of the risks associated with the Standard Contract, Big Red has made the determination that its own 13% hurdle rate is appropriate. The Standard contract's cash flows for the next five years are projected as follows: Standard Contract Cash Flows (in $ Millions). Year 1-$40 Year 2-$40 Year 3-$40 Year 4-$40 Year 5-$20 What is the payback period for the Standard Refining contract? Payback will not be achieved in five years. O 2.5 years O 3.0 years O 3.5 years O 4.0 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts