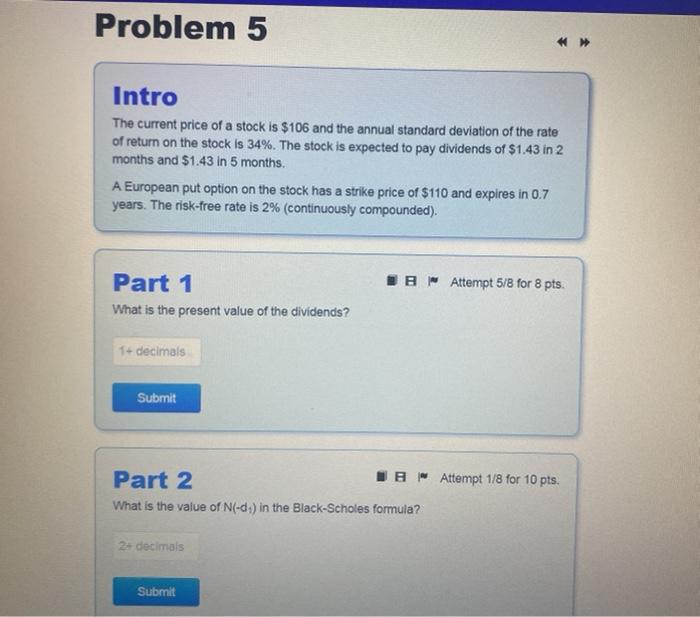

Question: EUROPEAN OPTION USE BLACK-SCHOLES PUT (N(-d)) WITH DIVIDENDS Problem 5 > Intro The current price of a stock is $106 and the annual standard deviation

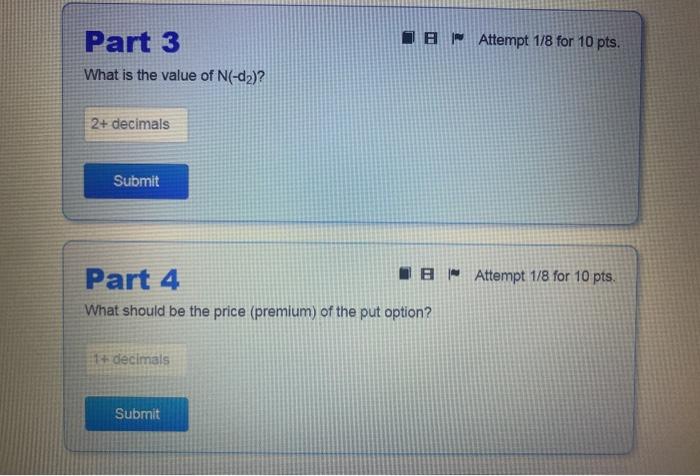

Problem 5 > Intro The current price of a stock is $106 and the annual standard deviation of the rate of return on the stock Is 34%. The stock is expected to pay dividends of $1.43 in 2 months and $1.43 in 5 months. A European put option on the stock has a strike price of $110 and expires in 0.7 years. The risk-free rate is 2% (continuously compounded). IBM Attempt 5/8 for 8 pts. Part 1 What is the present value of the dividends? 1+ decimals Submit Part 2 JE Attempt 1/8 for 10 pts. What is the value of N(-d.) in the Black-Scholes formula? 21 decimals Submit IB Attempt 1/8 for 10 pts. Part 3 What is the value of N(-d2)? 2+ decimals Submit Attempt 1/8 for 10 pts. Part 4 What should be the price (premium) of the put option? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts