Question: Evaluate case provided INSTRUCTOR'S GUIDE The first issue that students must address in this exercise is to decide on the maximum amount of a merit

Evaluate case provided

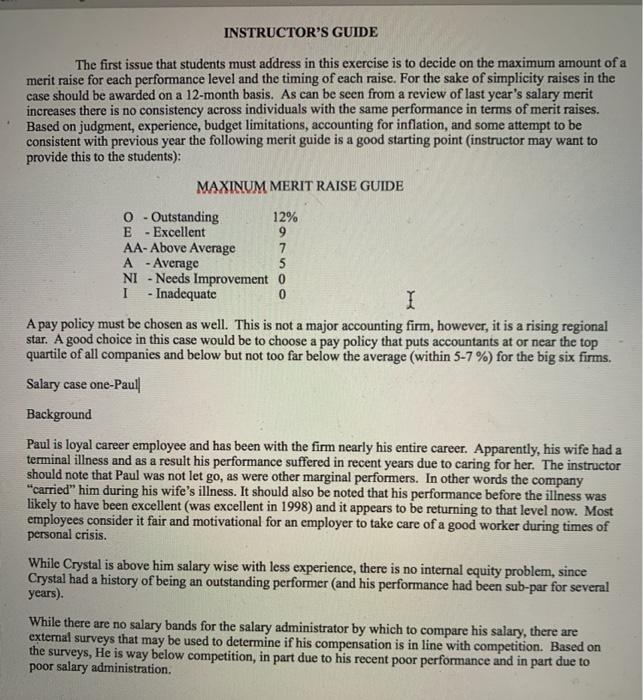

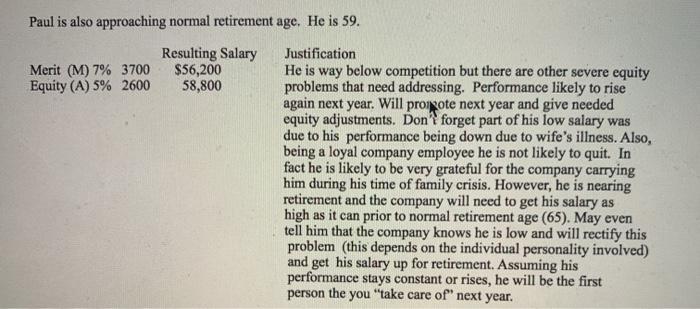

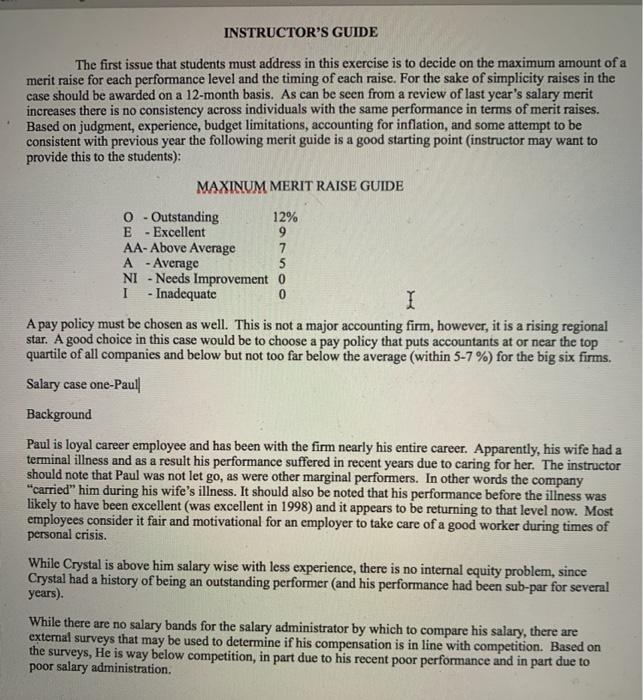

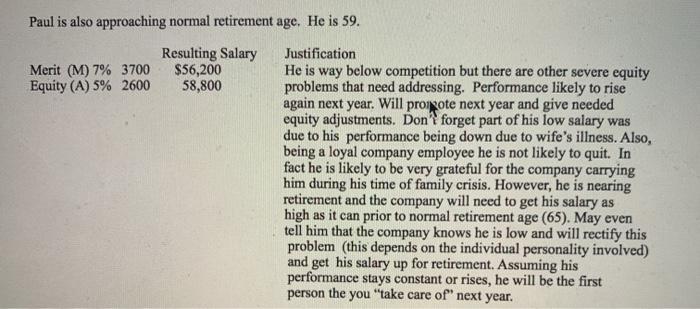

INSTRUCTOR'S GUIDE The first issue that students must address in this exercise is to decide on the maximum amount of a merit raise for each performance level and the timing of each raise. For the sake of simplicity raises in the case should be awarded on a 12-month basis. As can be seen from a review of last year's salary merit increases there is no consistency across individuals with the same performance in terms of merit raises. Based on judgment, experience, budget limitations, accounting for inflation, and some attempt to be consistent with previous year the following merit guide is a good starting point instructor may want to provide this to the students): MAXINUM MERIT RAISE GUIDE 0 - Outstanding 12% E Excellent 9 AA-Above Average 7 A - Average 5 NI - Needs Improvement 0 I - Inadequate I A pay policy must be chosen as well. This is not a major accounting firm, however, it is a rising regional star. A good choice in this case would be to choose a pay policy that puts accountants at or near the top quartile of all companies and below but not too far below the average (within 5-7 %) for the big six firms. Salary case one-Paull Background Paul is loyal career employee and has been with the firm nearly his entire career. Apparently, his wife had a terminal illness and as a result his performance suffered in recent years due to caring for her. The instructor should note that Paul was not let go, as were other marginal performers. In other words the company "carried" him during his wife's illness. It should also be noted that his performance before the illness was likely to have been excellent (was excellent in 1998) and it appears to be returning to that level now. Most employees consider it fair and motivational for an employer to take care of a good worker during times of personal crisis. While Crystal is above him salary wise with less experience, there is no internal equity problem, since Crystal had a history of being an outstanding performer (and his performance had been sub-par for several years). While there are no salary bands for the salary administrator by which to compare his salary, there are external surveys that may be used to determine if his compensation is in line with competition. Based on the surveys, He is way below competition, in part due to his recent poor performance and in part due to poor salary administration. Paul is also approaching normal retirement age. He is 59. Merit (M) 7% 3700 Equity (A) 5% 2600 Resulting Salary $56,200 58,800 Justification He is way below competition but there are other severe equity problems that need addressing. Performance likely to rise again next year. Will promote next year and give needed equity adjustments. Don't forget part of his low salary was due to his performance being down due to wife's illness. Also, being a loyal company employee he is not likely to quit. In fact he is likely to be very grateful for the company carrying him during his time of family crisis. However, he is nearing retirement and the company will need to get his salary as high as it can prior to normal retirement age (65). May even tell him that the company knows he is low and will rectify this problem (this depends on the individual personality involved) and get his salary up for retirement. Assuming his performance stays constant or rises, he will be the first person the you take care of next year. INSTRUCTOR'S GUIDE The first issue that students must address in this exercise is to decide on the maximum amount of a merit raise for each performance level and the timing of each raise. For the sake of simplicity raises in the case should be awarded on a 12-month basis. As can be seen from a review of last year's salary merit increases there is no consistency across individuals with the same performance in terms of merit raises. Based on judgment, experience, budget limitations, accounting for inflation, and some attempt to be consistent with previous year the following merit guide is a good starting point instructor may want to provide this to the students): MAXINUM MERIT RAISE GUIDE 0 - Outstanding 12% E Excellent 9 AA-Above Average 7 A - Average 5 NI - Needs Improvement 0 I - Inadequate I A pay policy must be chosen as well. This is not a major accounting firm, however, it is a rising regional star. A good choice in this case would be to choose a pay policy that puts accountants at or near the top quartile of all companies and below but not too far below the average (within 5-7 %) for the big six firms. Salary case one-Paull Background Paul is loyal career employee and has been with the firm nearly his entire career. Apparently, his wife had a terminal illness and as a result his performance suffered in recent years due to caring for her. The instructor should note that Paul was not let go, as were other marginal performers. In other words the company "carried" him during his wife's illness. It should also be noted that his performance before the illness was likely to have been excellent (was excellent in 1998) and it appears to be returning to that level now. Most employees consider it fair and motivational for an employer to take care of a good worker during times of personal crisis. While Crystal is above him salary wise with less experience, there is no internal equity problem, since Crystal had a history of being an outstanding performer (and his performance had been sub-par for several years). While there are no salary bands for the salary administrator by which to compare his salary, there are external surveys that may be used to determine if his compensation is in line with competition. Based on the surveys, He is way below competition, in part due to his recent poor performance and in part due to poor salary administration. Paul is also approaching normal retirement age. He is 59. Merit (M) 7% 3700 Equity (A) 5% 2600 Resulting Salary $56,200 58,800 Justification He is way below competition but there are other severe equity problems that need addressing. Performance likely to rise again next year. Will promote next year and give needed equity adjustments. Don't forget part of his low salary was due to his performance being down due to wife's illness. Also, being a loyal company employee he is not likely to quit. In fact he is likely to be very grateful for the company carrying him during his time of family crisis. However, he is nearing retirement and the company will need to get his salary as high as it can prior to normal retirement age (65). May even tell him that the company knows he is low and will rectify this problem (this depends on the individual personality involved) and get his salary up for retirement. Assuming his performance stays constant or rises, he will be the first person the you take care of next year