Question: evaluate Peloton is trading at a discount and whether it is a good time to invest in Peloton. Does the model below make sense? The

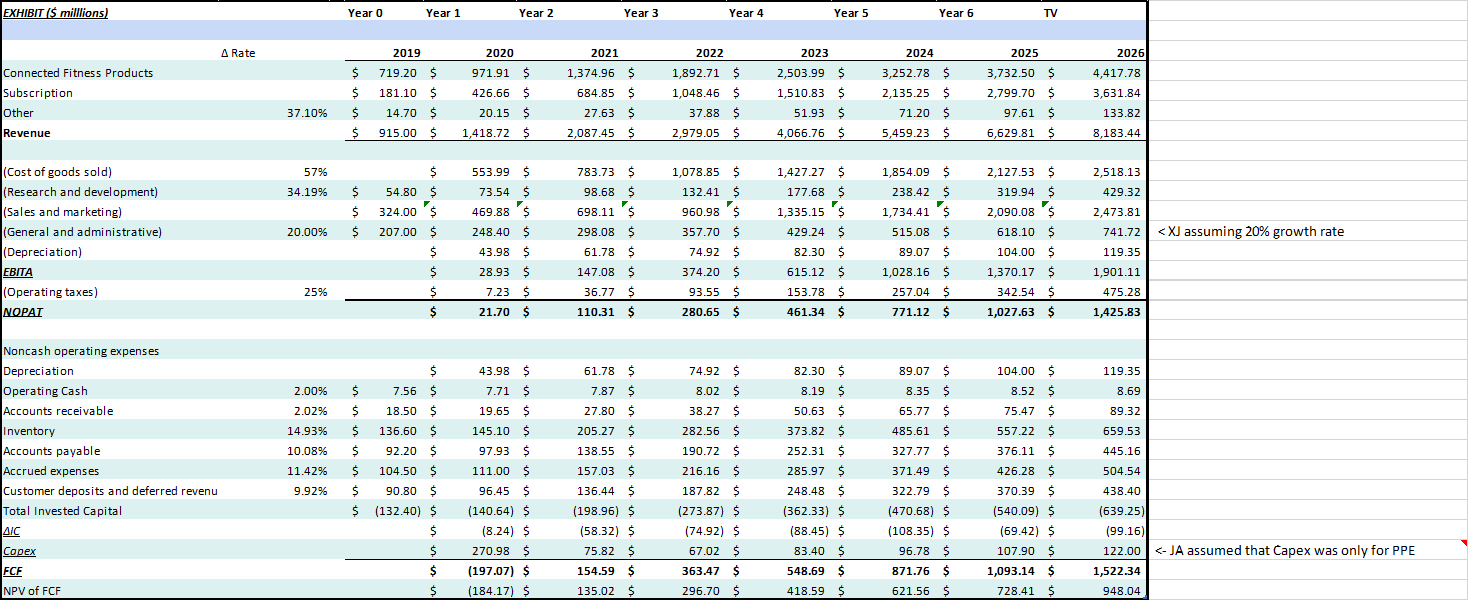

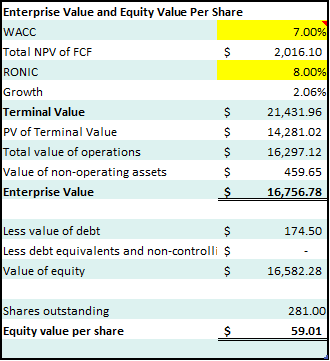

evaluate Peloton is trading at a discount and whether it is a good time to invest in Peloton. Does the model below make sense? The numbers I used for the model is a 2.06 percent growth rate (got this from 30 year inflation rate and not sure if that's correct), a 8 % RONIC and a 7 % WACC. What are your thoughts on using these values as shown in the model below? Additionally, would love to hear thoughts as to whether Peloton is trading at a discount and if it is a good time to invest in them.

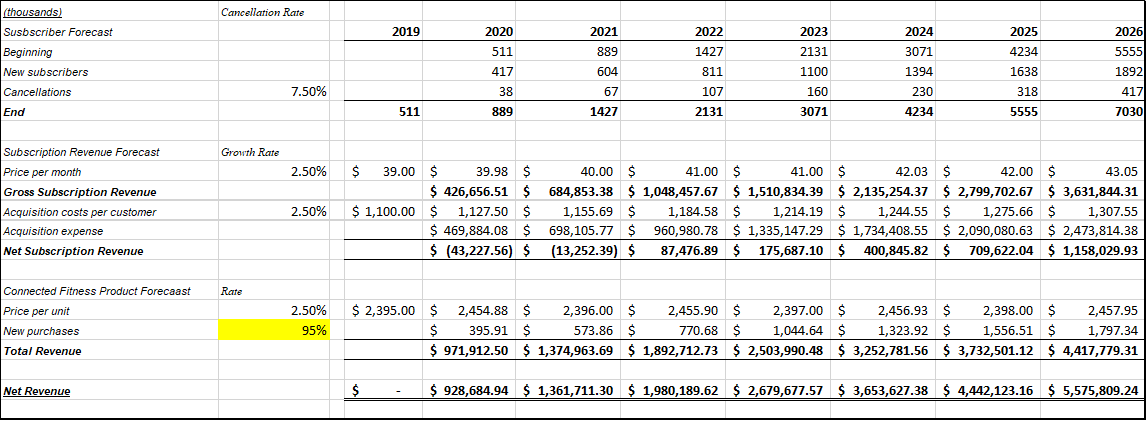

(thousands) Cancellation Rate Susbscriber Forecast 2019 2020 2021 2022 2023 2024 2025 2026 Beginning 511 889 1427 2131 3071 4234 5555 New subscribers 417 604 811 1100 1394 1638 1892 Cancellations 7.50% 38 67 107 160 230 318 417 End 511 889 1427 2131 3071 4234 5555 7030 Subscription Revenue Forecast Price per month Growth Rate 2.50% Gross Subscription Revenue Acquisition costs per customer Acquisition expense 2.50% Net Subscription Revenue $ 39.00 $ 39.98 $ $ 426,656.51 $ $ 1,100.00 $ 1,127.50 $ $ 469,884.08 $ $ (43,227.56) $ 40.00 $ 1,155.69 $ 698,105.77 $ (13,252.39) $ 41.00 $ 41.00 $ 42.03 $ 42.00 $ 43.05 684,853.38 $ 1,048,457.67 $1,510,834.39 $ 2,135,254.37 $2,799,702.67 $ 3,631,844.31 1,184.58 $ 1,214.19 $ 1,244.55 $ 1,275.66 $ 1,307.55 960,980.78 $ 1,335,147.29 $1,734,408.55 $ 2,090,080.63 $2,473,814.38 87,476.89 $ 175,687.10 $ 400,845.82 $ 709,622.04 $ 1,158,029.93 Connected Fitness Product Forecaast Rate Price per unit New purchases 2.50% 95% $ 2,395.00 $ $ 2,454.88 $ 395.91 $ 2,396.00 $ 573.86 $ 2,455.90 $ 2,397.00 $ 2,456.93 $ 770.68 $ 1,044.64 $ 1,323.92 $ 2,398.00 $ 2,457.95 1,556.51 $ Total Revenue Net Revenue $ 1,797.34 $ 971,912.50 $ 1,374,963.69 $ 1,892,712.73 $ 2,503,990.48 $ 3,252,781.56 $3,732,501.12 $ 4,417,779.31 $ 928,684.94 $ 1,361,711.30 $ 1,980,189.62 $ 2,679,677.57 $ 3,653,627.38 $ 4,442,123.16 $ 5,575,809.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts