Question: Evaluate Starbuck's current performance results in general. Generate and evaluate strategic alternatives January 2017. After sitting through another long executive meeting, Starbucks chairman and CEO

Evaluate Starbuck's current performance results in general.

Evaluate Starbuck's current performance results in general.

Generate and evaluate strategic alternatives

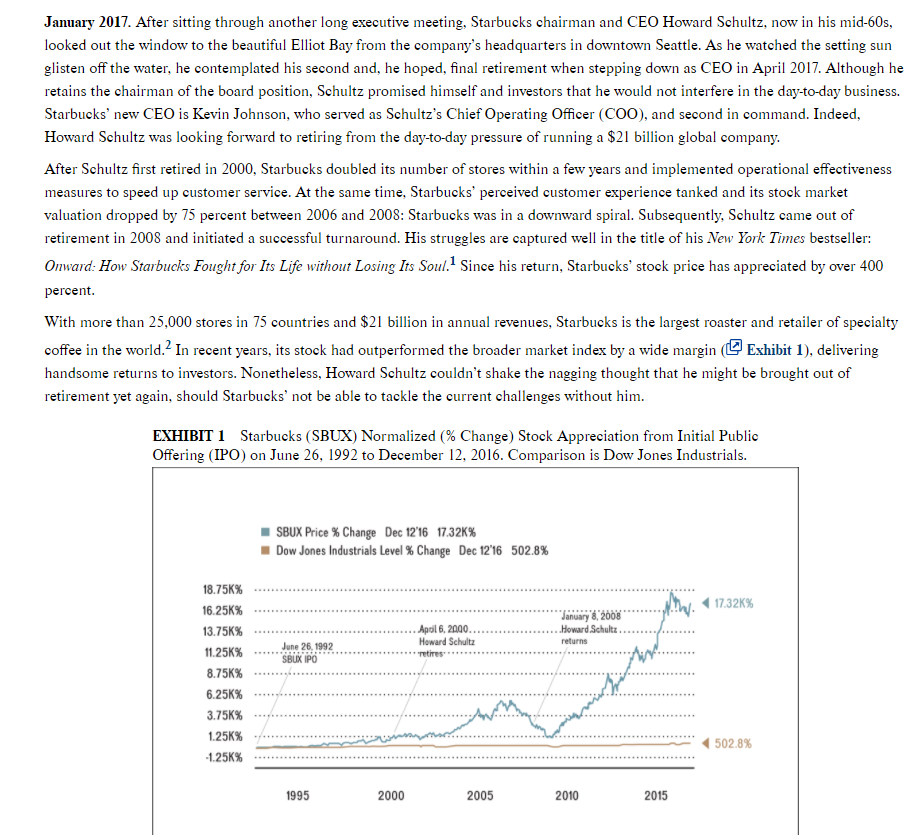

January 2017. After sitting through another long executive meeting, Starbucks chairman and CEO Howard Schultz, now in his mid-60s, looked out the window to the beautiful Elliot Bay from the company's headquarters in downtown Seattle. As he watched the setting sun glisten off the water, he contemplated his second and, he hoped, final retirement when stepping down as CEO in April 2017. Although he retains the chairman of the board position, Schultz promised himself and investors that he would not interfere in the day-to-day business. Starbucks' new CEO is Kevin Johnson, who served as Schultz's Chief Operating Officer (COO), and second in command. Indeed, Howard Schultz was looking forward to retiring from the day-to-day pressure of running a $21 billion global company. After Schultz first retired in 2000, Starbucks doubled its number of stores within a few years and implemented operational effectiveness measures to speed up customer service. At the same time, Starbucks' perceived customer experience tanked and its stock market valuation dropped by 75 percent between 2006 and 2008: Starbucks was in a downward spiral. Subsequently, Schultz came out of retirement in 2008 and initiated a successful turnaround. His struggles are captured well in the title of his New York Times bestseller: Onward: How Starbucks Fought for Its Life without Losing Its Soul. Since his return, Starbucks' stock price has appreciated by over 400 percent With more than 25,000 stores in 75 countries and $21 billion in annual revenues, Starbucks is the largest roaster and retailer of specialty coffee in the world.? In recent years, its stock had outperformed the broader market index by a wide margin (Exhibit 1), delivering handsome returns to investors. Nonetheless, Howard Schultz couldn't shake the nagging thought that he might be brought out of retirement yet again, should Starbucks' not be able to tackle the current challenges without him. EXHIBIT 1 Starbucks (SBUX) Normalized (% Change) Stock Appreciation from Initial Public Offering (IPO) on June 26, 1992 to December 12, 2016. Comparison is Dow Jones Industrials. SBUX Price % Change Dec 12'16 17.32K% Dow Jones Industrials Level % Change Dec 12'16 502.8% 17.32K% January 8, 2008 Howard Schultz returns Apol 6. 2000.. Howard Schultz retires June 26, 1992 SBUX IPO 18.75% 16.25% 13.75% 11.256% 8.75% 6.25% 3.75K% 1.256% -1.25K% we 502.8% 1995 2000 2005 2010 2015Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts