Question: Evaluate the financial statements and make a convincing argument for investment in one of the two target companies. Statements of Profit or Loss (SOPL) ALD

Evaluate the financial statements and make a convincing argument for investment in one of the two target companies.

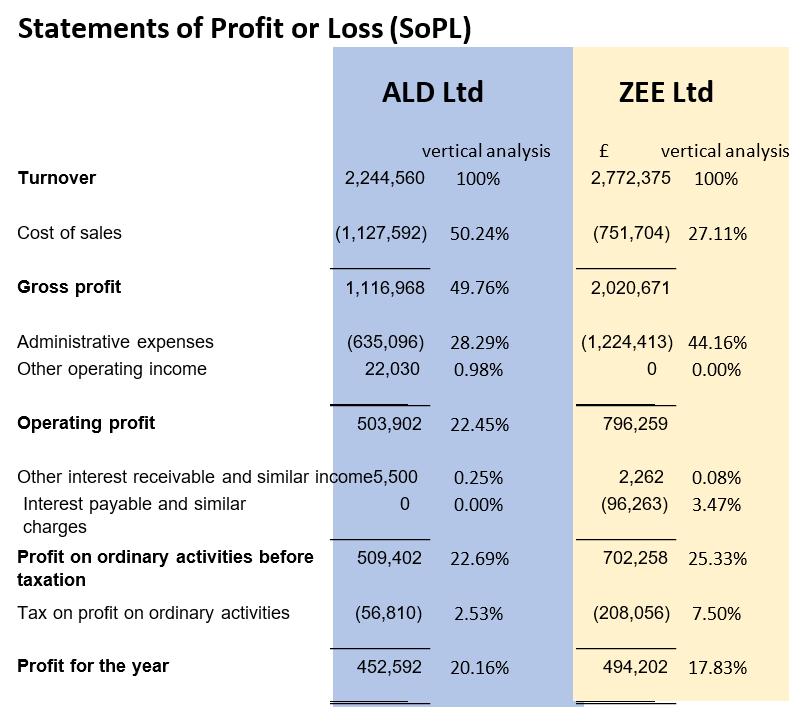

Statements of Profit or Loss (SOPL) ALD Ltd Turnover Cost of sales Gross profit Administrative expenses Other operating income Operating profit Profit on ordinary activities before taxation Tax on profit on ordinary activities Profit for the year 2,244,560 100% vertical analysis (1,127,592) 50.24% 1,116,968 Other interest receivable and similar income5,500 Interest payable and similar charges (635,096) 28.29% 22,030 0.98% 503,902 0 49.76% 22.45% 452,592 0.25% 0.00% 509,402 22.69% (56,810) 2.53% 20.16% ZEE Ltd vertical analysis 2,772,375 100% (751,704) 27.11% 2,020,671 (1,224,413) 44.16% 0 0.00% 796,259 2,262 0.08% (96,263) 3.47% 702,258 25.33% (208,056) 7.50% 494,202 17.83%

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

To evaluate the financial statements and make a convincing argument for investment in one of the two target companies ALD Ltd and ZEE Ltd we need to a... View full answer

Get step-by-step solutions from verified subject matter experts