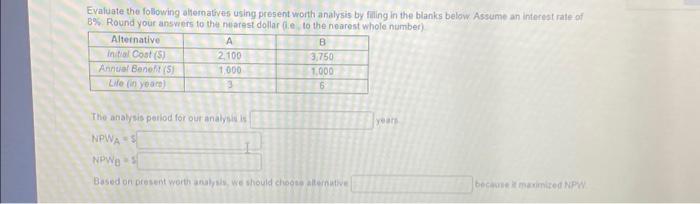

Question: Evaluate the following alternatives using present worth analysis by filling in the blanks below. Assume an interest rate of 8%. Round your answers to the

Evaluate the following alfernatives using present worth analysis by filing in the blanks below Assume an interest rate of B\% Round your answers to the niarest dollar fi.e. to the nearest whole number) Based on present worth analys, we should choose aterostive becant ir maninited NPW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts