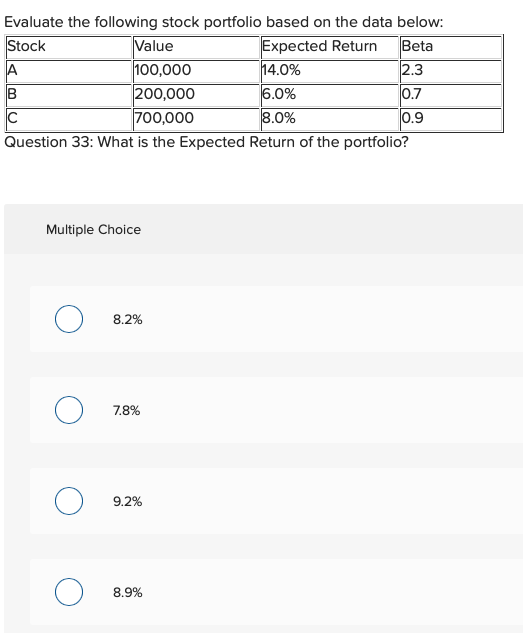

Question: Evaluate the following stock portfolio based on the data below: Stock Value Expected Return Beta A 100,000 14.0% 2.3 B 200,000 6.0% 0.7 700,000 8.0%

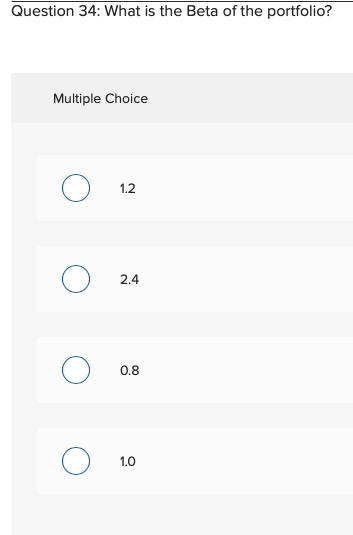

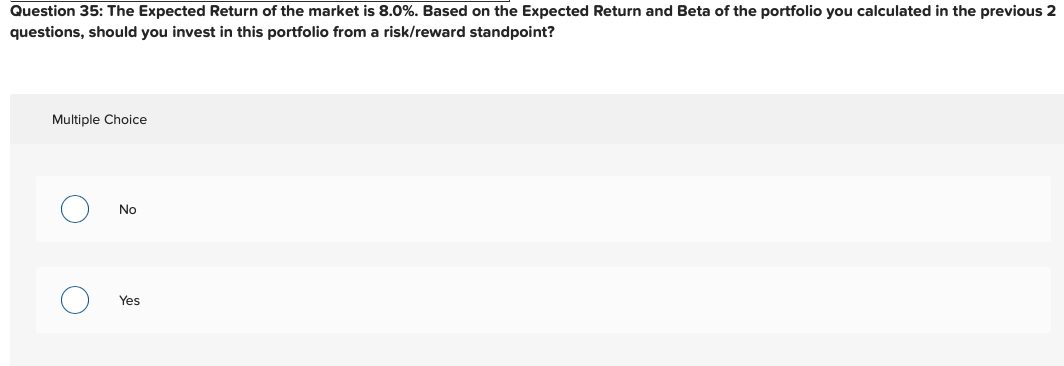

Evaluate the following stock portfolio based on the data below: Stock Value Expected Return Beta A 100,000 14.0% 2.3 B 200,000 6.0% 0.7 700,000 8.0% 0.9 Question 33: What is the Expected Return of the portfolio? Multiple Choice 8.2% 7.8% 9.2% 8.9% Question 34: What is the Beta of the portfolio? Multiple Choice 1.2 2.4 0.8 1.0 Question 35: The Expected Return of the market is 8.0%. Based on the Expected Return and Beta of the portfolio you calculated in the previous 2 questions, should you invest in this portfolio from a risk/reward standpoint? Multiple Choice No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts