Question: Evaluate the following techniques for this capital project (suppose that RF=4% , Rm-Rf=10% , beta=1,3 , after cost of debt=12%, D/E=0,25) a)Payback period b)Discounted Payback

Evaluate the following techniques for this capital project (suppose that RF=4% , Rm-Rf=10% , beta=1,3 , after cost of debt=12%, D/E=0,25) a)Payback period b)Discounted Payback period c)Net Present Values

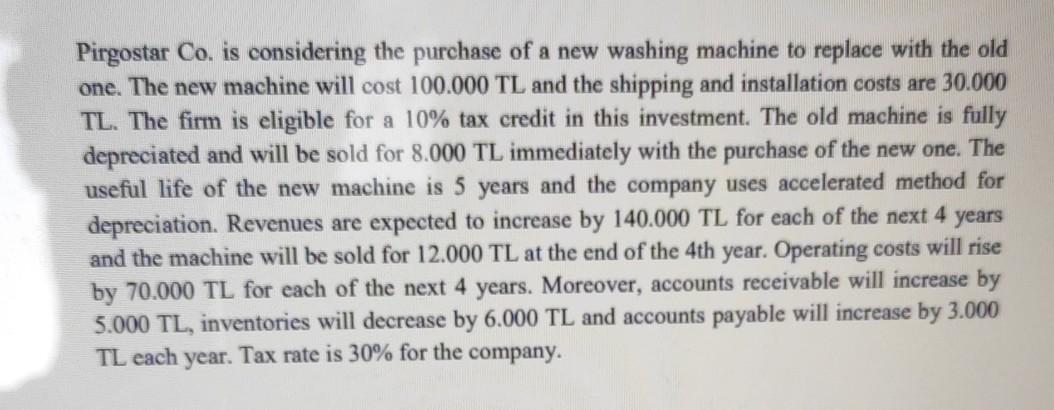

Pirgostar Co. is considering the purchase of a new washing machine to replace with the old one. The new machine will cost 100.000 TL and the shipping and installation costs are 30.000 TL. The firm is eligible for a 10% tax credit in this investment. The old machine is fully depreciated and will be sold for 8.000 TL immediately with the purchase of the new one. The useful life of the new machine is 5 years and the company uses accelerated method for depreciation. Revenues are expected to increase by 140.000 TL for each of the next 4 years and the machine will be sold for 12.000 TL at the end of the 4th year. Operating costs will rise by 70.000 TL for each of the next 4 years. Moreover, accounts receivable will increase by 5.000 TL, inventories will decrease by 6.000 TL and accounts payable will increase by 3.000 TL each year. Tax rate is 30% for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts