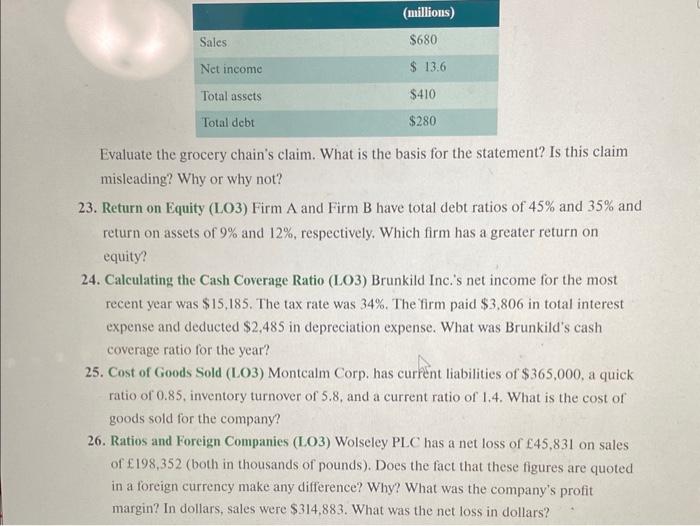

Question: Evaluate the grocery chain's claim. What is the basis for the statement? Is this claim misleading? Why or why not? 23. Return on Equity (LO3)

Evaluate the grocery chain's claim. What is the basis for the statement? Is this claim misleading? Why or why not? 23. Return on Equity (LO3) Firm A and Firm B have total debt ratios of 45% and 35% and return on assets of 9% and 12%, respectively. Which firm has a greater return on equity? 24. Calculating the Cash Coverage Ratio (LO3) Brunkild Inc.'s net income for the most recent year was $15,185. The tax rate was 34%. The firm paid $3,806 in total interest expense and deducted $2,485 in depreciation expense. What was Brunkild's cash coverage ratio for the year? 25. Cost of Goods Sold (LO3) Montcalm Corp. has current liabilities of $365,000, a quick ratio of 0.85 , inventory turnover of 5.8 , and a current ratio of 1.4 . What is the cost of goods sold for the company? 26. Ratios and Foreign Companies (LO3) Wolseley PLC has a net loss of 45,831 on sales of 198,352 (both in thousands of pounds). Does the fact that these figures are quoted in a foreign currency make any difference? Why? What was the company's profit margin? In dollars, sales were $314,883. What was the net loss in dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts